A Comprehensive Guide to Bitcoin Ownership

Master Bitcoin ownership! This guide tackles security, taxes, and the volatile nature of Bitcoin, empowering you to confidently navigate the crypto world. Learn the ins and outs of responsible Bitcoin ownership today!

Owning Bitcoin presents a unique set of opportunities and challenges. It’s a volatile asset‚ demanding careful consideration of security protocols. Understanding the regulatory landscape‚ particularly concerning taxation‚ is crucial for responsible ownership. This comprehensive guide explores the multifaceted aspects of being a Bitcoin owner‚ aiming to equip you with the knowledge to navigate this dynamic space effectively and safely.

Understanding Bitcoin’s Decentralized Nature

Bitcoin’s decentralized nature is both its strength and its complexity. Unlike traditional currencies controlled by central banks‚ Bitcoin operates on a peer-to-peer network. This means no single entity controls the currency‚ leading to greater transparency but also increased responsibility for the individual owner. Transactions are recorded on a public ledger called the blockchain‚ ensuring immutability and traceability. However‚ this transparency also requires a heightened awareness of security practices to protect your holdings.

Security Best Practices for Bitcoin Owners

Security is paramount when dealing with Bitcoin. The decentralized nature‚ while beneficial‚ also means you are solely responsible for the security of your assets. A single lapse in security can result in irreversible loss. Therefore‚ implementing robust security measures is non-negotiable.

- Use a hardware wallet: Hardware wallets offer the highest level of security by storing your private keys offline‚ shielding them from online threats.

- Enable two-factor authentication (2FA): Adding 2FA to your exchanges and wallets provides an extra layer of protection against unauthorized access.

- Choose strong‚ unique passwords: Avoid using easily guessable passwords and ensure your passwords are different for each platform.

- Regularly update your software: Keeping your wallets and software updated is crucial for patching security vulnerabilities.

- Be wary of phishing scams: Phishing attempts are common in the cryptocurrency world. Never click on suspicious links or provide your private keys to anyone.

Navigating the Regulatory Landscape

The regulatory landscape surrounding Bitcoin is constantly evolving. Different countries have varying regulations‚ and understanding the laws in your jurisdiction is essential. Failure to comply with regulations can lead to significant legal repercussions.

Tax Implications of Bitcoin Ownership

The taxation of Bitcoin varies widely depending on your location and how you use it. In many jurisdictions‚ Bitcoin is treated as a capital asset‚ meaning profits from its sale are subject to capital gains tax. However‚ the specifics can be complex‚ involving considerations like the holding period and the frequency of transactions. Consulting with a tax professional specializing in cryptocurrency is highly recommended.

Legal Considerations and Compliance

Beyond taxation‚ other legal considerations exist. Understanding anti-money laundering (AML) and know-your-customer (KYC) regulations is crucial‚ especially when using exchanges or interacting with regulated financial institutions. Staying informed about evolving legal frameworks is vital for responsible Bitcoin ownership.

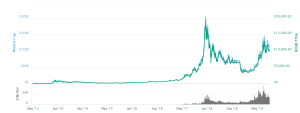

Understanding Bitcoin’s Volatility

Bitcoin’s price is notoriously volatile. It can experience significant fluctuations in a short period‚ presenting both opportunities and risks. Responsible Bitcoin ownership necessitates a thorough understanding of these price swings and their potential impact on your investment.

Risk Management Strategies for Bitcoin Investors

Effective risk management is crucial for navigating Bitcoin’s volatility. Diversification is a key strategy‚ spreading your investments across multiple assets to reduce the impact of any single asset’s price fluctuations. Dollar-cost averaging‚ a method of investing a fixed amount at regular intervals‚ can mitigate the risk of investing a lump sum at a market peak. Setting realistic investment goals and maintaining a long-term perspective can help manage emotional responses to short-term price movements. Never invest more than you can afford to lose.

The Future of Bitcoin and Responsible Ownership

Bitcoin’s future is uncertain‚ but its potential impact on finance and technology is undeniable. Technological advancements‚ regulatory changes‚ and widespread adoption will continue to shape the landscape of Bitcoin ownership. Staying informed about these developments is crucial for navigating this evolving environment.

Adapting to Change in the Cryptocurrency Market

The cryptocurrency market is dynamic and innovative. New technologies‚ such as the Lightning Network‚ are constantly emerging‚ aiming to improve Bitcoin’s scalability and efficiency. Staying updated on these developments and understanding their potential impact on your holdings is crucial for responsible ownership. Continuous learning and adaptation are essential for long-term success in this space.

- Stay informed: Follow reputable news sources and industry experts to stay abreast of developments.

- Engage in the community: Participate in online forums and discussions to learn from others’ experiences.

- Continuously learn: The cryptocurrency landscape is constantly changing‚ requiring ongoing education and adaptation.

- Be critical: Not all information you encounter will be accurate or unbiased. Be critical and evaluate sources carefully.