A Comprehensive Guide to Bitcoin Trading Strategies

Unlock Bitcoin’s potential! Learn winning trading strategies, risk management, and market analysis techniques to navigate the volatile crypto world. Become a savvy Bitcoin trader today!

The allure of Bitcoin, with its potential for significant returns, has drawn countless investors. However, the cryptocurrency market is notoriously volatile, demanding careful planning and a well-defined strategy. Successful Bitcoin trading isn’t about luck; it’s about understanding the market dynamics, employing effective techniques, and diligently managing risk. This comprehensive guide delves into various strategies, providing insights to help you navigate this exciting yet challenging landscape. Remember that any investment carries inherent risk, and Bitcoin trading is no exception. Always conduct thorough research and consider your personal risk tolerance before making any investment decisions.

Understanding the Bitcoin Market

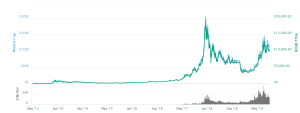

Before diving into specific trading strategies, it’s crucial to grasp the fundamentals of the Bitcoin market. Its price is influenced by a multitude of factors, including technological advancements, regulatory changes, media coverage, and overall market sentiment. Understanding these dynamics is key to predicting price movements and making informed decisions. Technical analysis, focusing on charts and historical data, plays a significant role. Fundamental analysis, which examines the underlying technology and market adoption, is equally important.

Technical Analysis: Charting Your Course

Technical analysis involves studying price charts, identifying trends, and using indicators to predict future price movements. Common tools include moving averages, relative strength index (RSI), and candlestick patterns. These tools help identify potential entry and exit points for trades. However, relying solely on technical analysis can be risky, as it doesn’t consider the underlying fundamentals of the cryptocurrency.

Fundamental Analysis: Assessing the Basics

Fundamental analysis focuses on the intrinsic value of Bitcoin. This involves assessing factors such as the adoption rate, technological advancements, and regulatory landscape. A strong adoption rate and positive regulatory developments generally contribute to price appreciation. Conversely, negative news or regulatory hurdles can lead to price declines. Combining technical and fundamental analysis offers a more holistic approach to trading.

Popular Bitcoin Trading Strategies

Numerous strategies exist for trading Bitcoin, each with its own risk-reward profile. Choosing the right strategy depends on your risk tolerance, trading experience, and investment goals. Let’s explore some popular approaches.

Day Trading: Short-Term Gains

Day trading involves buying and selling Bitcoin within a single trading day, aiming for small, consistent profits. This requires constant market monitoring and quick decision-making. It’s a high-risk, high-reward strategy suitable for experienced traders with a strong understanding of technical analysis.

Swing Trading: Riding the Waves

Swing trading involves holding Bitcoin for several days or weeks, capitalizing on short-term price swings. This strategy requires less constant monitoring than day trading but still demands careful analysis of price charts and market trends. Swing trading allows for capturing significant price movements while mitigating some of the risks associated with day trading.

Long-Term Investing: Hodling for the Future

Long-term investing, often referred to as “hodling,” involves holding Bitcoin for an extended period, typically months or years. This strategy is less focused on short-term price fluctuations and more on the long-term growth potential of Bitcoin. It’s generally considered a lower-risk strategy compared to day or swing trading, but requires patience and confidence in Bitcoin’s future.

Arbitrage Trading: Exploiting Price Differences

Arbitrage trading involves exploiting price discrepancies between different Bitcoin exchanges. If Bitcoin is priced differently on two exchanges, a trader can buy on the cheaper exchange and simultaneously sell on the more expensive one, profiting from the price difference. This requires fast execution and access to multiple exchanges.

Risk Management in Bitcoin Trading

Effective risk management is paramount in Bitcoin trading. The volatile nature of the market necessitates careful planning and discipline. Failing to manage risk can lead to significant losses.

Diversification: Don’t Put All Your Eggs in One Basket

Diversification is a crucial risk management technique. Don’t invest all your capital in Bitcoin. Spread your investments across different assets to reduce the impact of potential losses in any single investment. Consider diversifying into other cryptocurrencies or traditional assets.

Position Sizing: Controlling Your Exposure

Position sizing refers to determining the appropriate amount of capital to allocate to each trade. Never risk more than you can afford to lose. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

Stop-Loss Orders: Protecting Your Profits

Stop-loss orders automatically sell your Bitcoin when the price drops to a predetermined level. This helps limit potential losses if the market moves against you. Setting appropriate stop-loss orders is crucial for protecting your capital.

Take-Profit Orders: Securing Your Gains

Take-profit orders automatically sell your Bitcoin when the price reaches a predetermined level. This helps secure your profits and prevent potential losses due to price reversals. Setting appropriate take-profit orders is essential for maximizing your returns.

Advanced Bitcoin Trading Strategies

Once you have a solid grasp of the fundamentals and basic strategies, you can explore more advanced techniques. These strategies often involve more complex analysis and higher risk.

Scalping: Extremely Short-Term Trading

Scalping is an extremely short-term trading strategy, focusing on capturing small price movements within seconds or minutes. It requires lightning-fast execution and a deep understanding of technical indicators. Scalping is highly risky and is only suitable for experienced traders.

Margin Trading: Leveraging Your Capital

Margin trading allows you to borrow funds from an exchange to increase your trading position size. While it can magnify profits, it also significantly amplifies losses. Margin trading is extremely risky and should only be undertaken by experienced traders with a high risk tolerance.

Futures and Options Trading: Hedging and Speculation

Futures and options contracts offer opportunities for hedging against price risks or speculating on future price movements. These complex instruments require a deep understanding of derivatives trading and carry substantial risk.

Tools and Resources for Bitcoin Trading

Numerous tools and resources can assist you in your Bitcoin trading journey. Choosing the right tools is crucial for making informed decisions and maximizing your success.

- Trading Platforms: Select a reputable and user-friendly exchange with a wide range of trading tools and features.

- Charting Software: Use advanced charting software to analyze price movements and identify potential trading opportunities.

- Technical Indicators: Familiarize yourself with various technical indicators to enhance your analysis.

- News and Analysis Websites: Stay updated on the latest news and market analysis to make informed decisions.

Remember to always prioritize security when choosing your trading platform and tools. Look for platforms with strong security measures and a proven track record.

Staying Informed and Adapting Your Strategy

The Bitcoin market is constantly evolving, so staying informed is crucial. Regularly review market trends, news, and technological developments to adapt your strategy as needed. What worked yesterday might not work today, so continuous learning and adaptability are essential.

- Follow reputable news sources and analysts.

- Participate in online forums and communities.

- Continuously educate yourself on new trading techniques and strategies.

The cryptocurrency market is dynamic and unpredictable. While the potential for high returns is alluring, it’s crucial to approach Bitcoin trading with caution and a well-defined strategy. Thorough research, effective risk management, and continuous learning are essential for success in this challenging yet rewarding field. Never invest more than you can afford to lose, and always remember that past performance is not indicative of future results. Bitcoin trading requires patience, discipline, and a willingness to adapt to the ever-changing market conditions. By understanding the strategies outlined above and consistently applying sound risk management principles, you can significantly increase your chances of success in the world of Bitcoin trading. The journey may be complex, but the potential rewards are significant for those who approach it with knowledge and prudence. Ultimately, informed decision-making is the cornerstone of successful Bitcoin trading.