Bitcoin: A Deep Dive into the Decentralized Digital Currency

Uncover Bitcoin\’s potential and challenges. Explore its real-world impact, from finance to everyday life. Bitcoin explained simply, for everyone!

Bitcoin, a decentralized digital currency, has captivated the world since its inception. Its revolutionary technology, based on blockchain principles, promises a new paradigm for financial transactions. This technology offers the potential for increased financial inclusion and transparency. However, its volatility and regulatory uncertainty remain significant challenges. This in-depth analysis will explore Bitcoin’s real-world applications, its impact on various sectors, and the ongoing debate surrounding its future.

Bitcoin’s Technological Foundation

At its core, Bitcoin is a peer-to-peer electronic cash system. It eliminates the need for intermediaries like banks, relying instead on a distributed ledger technology known as blockchain. This blockchain records all transactions in a secure and transparent manner. Each transaction is cryptographically verified and added to a block, which is then chained to the previous block, creating an immutable record. This decentralized nature enhances security and prevents manipulation by any single entity.

Mining and Transaction Verification

The process of adding new blocks to the blockchain is called mining. Miners use powerful computers to solve complex mathematical problems. The first miner to solve the problem adds the next block to the chain and is rewarded with newly minted bitcoins. This process secures the network and ensures the integrity of transactions. The computational power required for mining makes the system highly resistant to attacks.

Decentralization and Security

Bitcoin’s decentralized nature is a key strength. Unlike traditional financial systems controlled by central authorities, Bitcoin is governed by a global network of nodes. This distributed control makes it extremely resilient to censorship and single points of failure. The cryptographic security ensures the authenticity and integrity of transactions, minimizing the risk of fraud.

Bitcoin’s Real-World Applications

Beyond its theoretical potential, Bitcoin has found practical applications in several sectors. Its use cases are constantly evolving, adapting to the needs of a dynamic global economy.

Remittances and Cross-Border Payments

Bitcoin offers a faster, cheaper, and more transparent alternative to traditional remittance systems. Sending money across borders can be time-consuming and expensive, often involving multiple intermediaries and high fees. Bitcoin can significantly reduce these costs and processing times, making it particularly attractive for migrant workers sending money back home.

E-commerce and Online Transactions

Many online businesses now accept Bitcoin as a form of payment. This provides customers with an alternative to traditional payment methods, offering increased privacy and reduced reliance on centralized payment processors. The growing adoption of Bitcoin in e-commerce reflects its increasing legitimacy and acceptance in the broader marketplace.

Investment and Speculation

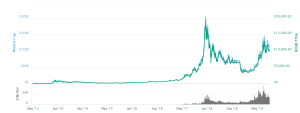

Bitcoin’s price volatility has attracted significant investment and speculation. Its value has fluctuated dramatically since its inception, making it a high-risk, high-reward asset. Many investors view Bitcoin as a hedge against inflation or a store of value, while others see it as a speculative asset with high growth potential. However, investing in Bitcoin should be approached with caution due to its inherent volatility.

Challenges and Concerns

Despite its potential benefits, Bitcoin faces several challenges that hinder its widespread adoption.

Volatility and Price Fluctuations

Bitcoin’s price is notoriously volatile, subject to significant swings driven by market sentiment, regulatory announcements, and technological developments. This volatility can make it a risky investment for those seeking stability. Understanding the factors driving Bitcoin’s price is crucial for any investor.

Regulatory Uncertainty

Governments worldwide are grappling with how to regulate Bitcoin and other cryptocurrencies. The lack of a clear regulatory framework creates uncertainty for businesses and investors. Different jurisdictions have adopted varying approaches, creating a complex and fragmented regulatory landscape.

Scalability and Transaction Speed

Bitcoin’s transaction processing speed can be relatively slow compared to traditional payment systems. This limitation can hinder its adoption for high-volume transactions. Efforts are underway to address scalability issues, including the development of layer-2 solutions.

Environmental Impact

Bitcoin mining consumes significant amounts of energy, raising concerns about its environmental impact. The energy consumption associated with the mining process is a key area of ongoing debate and research; The development of more energy-efficient mining techniques is crucial for addressing this concern.

The Future of Bitcoin

The future of Bitcoin remains uncertain, subject to technological advancements, regulatory developments, and evolving market dynamics. However, several factors suggest its continued relevance and potential for growth.

Technological Innovations

Ongoing developments in blockchain technology and related areas are likely to enhance Bitcoin’s functionality and address some of its current limitations. Innovations such as the Lightning Network aim to improve scalability and transaction speed. These technological advancements could drive broader adoption.

Increased Institutional Adoption

The growing interest from institutional investors, including large corporations and financial institutions, signals increased legitimacy and potential for mainstream adoption. As more institutional players enter the market, Bitcoin’s stability and liquidity may improve.

Global Adoption and Integration

The increasing adoption of Bitcoin in various countries and regions suggests its potential to become a globally recognized and widely used digital currency. As more businesses and individuals embrace Bitcoin, its network effect will strengthen.

- Increased consumer awareness and understanding of Bitcoin’s benefits.

- Improved user experience and accessibility through simpler interfaces.

- Greater integration with existing financial systems.

Bitcoin’s Impact on Different Sectors

Finance

Bitcoin challenges traditional financial systems by offering a decentralized, transparent, and potentially more efficient alternative. Its impact on the financial sector is profound, potentially disrupting traditional banking and payment systems.

Technology

Bitcoin’s underlying blockchain technology has far-reaching implications beyond finance, with applications in supply chain management, digital identity, and other areas. This technology is rapidly evolving, leading to new innovations and use cases.

Politics and Geopolitics

Bitcoin’s decentralized nature has implications for political and geopolitical power structures. Its potential to bypass traditional financial systems and facilitate cross-border transactions can challenge established norms and power dynamics.

- Potential for increased financial inclusion in underserved communities.

- Enhanced transparency and accountability in financial transactions.

- Challenges to existing regulatory frameworks and control mechanisms.