Bitcoin and the United States: A Complex Relationship

Dive into the rollercoaster relationship between Bitcoin and the United States. Explore the regulatory challenges, technological advancements, and the ongoing debate shaping the future of cryptocurrency in America. Bitcoin’s impact is undeniable!

The relationship between Bitcoin and the United States is a multifaceted and constantly evolving landscape. Bitcoin, a decentralized digital currency, presents a unique challenge to traditional financial systems. Its volatility and potential for illicit activities have led to significant regulatory scrutiny. However, its underlying technology, blockchain, has also sparked considerable interest and investment, leading to a complex interplay between innovation and regulation in the US. This article will delve into the intricacies of this relationship, examining its past, present, and potential future implications.

The Rise of Bitcoin in the US

Bitcoin’s introduction to the US market was initially met with a mixture of curiosity and skepticism. Early adopters saw its potential for disrupting traditional finance, while regulators grappled with its decentralized nature and lack of central oversight. The initial years were characterized by a relatively unregulated environment, allowing for rapid growth and experimentation. However, as Bitcoin’s value increased dramatically, attracting wider attention, the need for regulatory clarity became increasingly apparent.

Early Adoption and Growth

The early adoption of Bitcoin in the US was largely driven by tech-savvy individuals and enthusiasts interested in its technological innovation. Online forums and communities played a crucial role in spreading awareness and facilitating transactions. The relative anonymity offered by Bitcoin appealed to those seeking alternative financial solutions, particularly those outside the traditional banking system. This early period saw the emergence of Bitcoin exchanges and businesses accepting Bitcoin as payment, laying the groundwork for its future expansion.

Regulatory Scrutiny and the Shifting Landscape

As Bitcoin’s popularity grew, so did concerns about its potential for illicit activities, including money laundering and tax evasion. This prompted regulators in the US to begin paying closer attention. The Financial Crimes Enforcement Network (FinCEN) issued guidance classifying Bitcoin exchanges as Money Service Businesses (MSBs), requiring them to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. This marked a significant shift, bringing Bitcoin transactions under greater regulatory oversight.

Bitcoin’s Impact on the US Economy

Bitcoin’s influence on the US economy is a topic of ongoing debate. While its direct economic impact remains relatively small compared to traditional financial instruments, its indirect influence is substantial and multifaceted. The rise of Bitcoin has spurred innovation in financial technology, leading to the development of new financial products and services.

Innovation in Fintech

The underlying technology of Bitcoin, blockchain, has captured the attention of numerous industries beyond finance. Its potential for secure and transparent data management has led to its application in supply chain management, healthcare, and voting systems. This ripple effect of innovation has stimulated economic activity and job creation in the US. Many startups and established companies are investing heavily in blockchain technology, seeking to leverage its potential for efficiency and security.

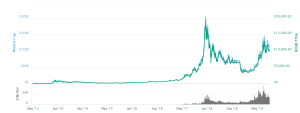

Volatility and Market Risk

Bitcoin’s notorious price volatility presents a significant risk to investors. Its value has fluctuated dramatically, leading to both substantial gains and losses. This inherent volatility can influence broader market sentiment and contribute to overall economic uncertainty. While some view Bitcoin as a hedge against inflation, others caution against its high-risk nature, especially for less experienced investors.

US Regulatory Landscape for Bitcoin

The US regulatory framework surrounding Bitcoin is constantly evolving, reflecting the challenges of regulating a decentralized digital asset. Federal agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), play significant roles in overseeing different aspects of the Bitcoin ecosystem.

SEC’s Role in Regulating Cryptocurrencies

The SEC primarily focuses on regulating the securities aspects of cryptocurrencies. They have taken action against fraudulent initial coin offerings (ICOs) and have clarified their stance on certain cryptocurrencies as securities. This regulatory oversight aims to protect investors from fraudulent schemes and ensure market transparency. The SEC’s approach emphasizes investor protection and market integrity within the cryptocurrency space.

CFTC’s Oversight of Bitcoin Futures

The CFTC, on the other hand, regulates the trading of Bitcoin futures contracts. These contracts allow investors to speculate on the future price of Bitcoin without directly owning the cryptocurrency. The CFTC’s regulatory framework aims to ensure fair and orderly markets for Bitcoin futures trading, mitigating potential risks associated with speculative trading.

The Future of Bitcoin in the US

Predicting the future of Bitcoin in the US is inherently challenging, given its volatility and the evolving regulatory landscape. However, several factors suggest a complex and dynamic future. The increasing adoption of Bitcoin by institutional investors, coupled with technological advancements, could lead to greater mainstream acceptance. Conversely, stricter regulations and concerns about environmental sustainability could impede its growth.

Increased Institutional Adoption

Several large institutional investors have started allocating a portion of their portfolios to Bitcoin, signaling a shift towards greater mainstream acceptance. This institutional investment can bring greater stability and liquidity to the Bitcoin market, potentially reducing its volatility. However, it also introduces new challenges related to regulatory compliance and risk management.

Technological Advancements and Scalability

Ongoing technological advancements aim to improve Bitcoin’s scalability and transaction speed. Layer-2 solutions and other innovations are being developed to address the limitations of the original Bitcoin protocol. These improvements could enhance Bitcoin’s usability and appeal, potentially driving wider adoption.

Environmental Concerns and Sustainability

The energy consumption associated with Bitcoin mining has raised significant environmental concerns. Critics argue that the carbon footprint of Bitcoin mining is unsustainable, particularly given the growing emphasis on climate change mitigation. This concern could lead to stricter regulations or a shift towards more energy-efficient mining methods.

Bitcoin’s Role in Global Finance

Bitcoin’s influence extends beyond the US, impacting the global financial landscape in several ways. Its decentralized nature offers an alternative to traditional financial systems, potentially increasing financial inclusion in underserved regions. However, its volatility and susceptibility to illicit activities present challenges to global financial stability.

Financial Inclusion and Access

In regions with limited access to traditional banking services, Bitcoin can offer a pathway to financial inclusion. Individuals without bank accounts can use Bitcoin to send and receive money, participate in the global economy, and access financial services. This potential for wider financial access is a significant aspect of Bitcoin’s global impact.

Challenges to Global Financial Stability

The volatility of Bitcoin and its potential use in illicit activities pose challenges to global financial stability. Large price swings can trigger market instability, while its anonymity can facilitate illegal activities, requiring international cooperation to mitigate these risks. Global regulatory coordination is crucial to effectively address these challenges.

- Increased regulatory clarity in different jurisdictions.

- Technological advancements enhancing Bitcoin’s scalability and efficiency.

- Growing acceptance by institutional investors.

- Development of sustainable mining practices.

- Continued debate regarding Bitcoin’s classification as a security or a commodity.

- Potential for further regulatory crackdowns in response to illicit activities.

- Uncertainties surrounding Bitcoin’s long-term price stability.

- Ongoing technological competition from alternative cryptocurrencies.