Bitcoin: Genesis Block and Early Adoption

Dive into the history of Bitcoin! Explore the groundbreaking 2009 genesis block and its impact on finance and technology. Uncover the revolutionary potential of decentralized currency and its lasting legacy. Learn about the mysterious Satoshi Nakamoto and the future of crypto.

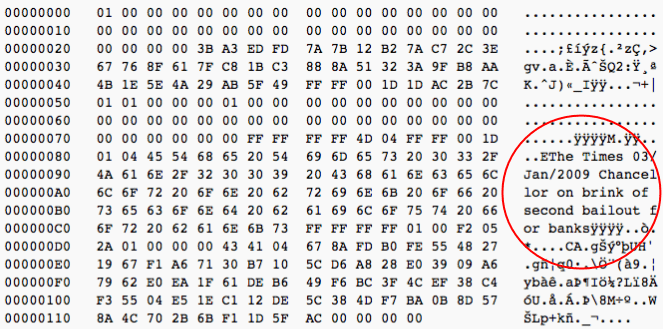

The year 2009 marked a pivotal moment in the history of finance and technology. On January 3rd, the world witnessed the genesis block of Bitcoin, a revolutionary digital currency unlike anything seen before. This event, largely unnoticed at the time, would eventually reshape our understanding of money, transactions, and decentralized systems. The creation of Bitcoin, the brainchild of the pseudonymous Satoshi Nakamoto, laid the foundation for a new era of digital finance, one built on cryptographic security and peer-to-peer interaction.

The Genesis Block and Early Adoption

The genesis block, containing a timestamp and a message referencing a newspaper headline about the financial crisis, marked the official launch of the Bitcoin network. Initially, its adoption was slow and largely confined to a small, technically-savvy community. These early adopters were intrigued by the potential of a decentralized currency, free from the control of governments and banks. They saw in Bitcoin a solution to the problems of centralized financial systems, a vision that would gradually gain traction in the years to come.

The early days of Bitcoin were characterized by experimentation and exploration. Miners, using relatively modest computing power, worked to validate transactions and add new blocks to the blockchain. The reward for this work was, of course, Bitcoin itself, leading to a gradual increase in the circulating supply. These early miners were not driven by immense profit; rather, they were captivated by the underlying technology and the potential of this new paradigm.

Technical Innovations and Challenges

The Bitcoin protocol, as conceived by Nakamoto, incorporated several groundbreaking innovations; The use of cryptography ensured the security and integrity of transactions, while the decentralized nature of the network made it resistant to censorship and single points of failure. However, the early days were not without challenges. Scalability issues, the need for improved user interfaces, and the overall lack of awareness among the general public posed significant hurdles to widespread adoption.

One of the major challenges was the complexity of the technology itself. Understanding the intricacies of blockchain technology, cryptography, and the underlying principles of Bitcoin required a significant technical background. This made it difficult for the average person to engage with and utilize the currency, limiting its initial growth and appeal. Overcoming this hurdle would require the development of more user-friendly interfaces and educational resources.

The Economic Context of 2009

It is crucial to understand the socio-economic climate of 2009 to fully appreciate the emergence of Bitcoin; The global financial crisis was in full swing, triggering widespread distrust in traditional financial institutions. Governments were implementing massive bailout packages, and many individuals felt betrayed by the system. This environment provided fertile ground for an alternative financial system that promised transparency, security, and freedom from centralized control.

The crisis exposed the vulnerabilities of centralized banking systems and the potential for manipulation and fraud. Bitcoin, with its decentralized architecture and cryptographic security, offered a stark contrast. It presented a vision of a financial system that was resistant to manipulation and controlled by its users rather than powerful institutions. This resonated deeply with many who had lost faith in the established order.

The Role of Cypherpunks and Early Communities

The early adoption of Bitcoin was heavily influenced by the cypherpunk movement, a group of activists and technologists who advocated for strong cryptography and privacy rights. These individuals were already familiar with the concepts of decentralized systems and the potential of blockchain technology. They saw in Bitcoin a powerful tool for achieving their goals of enhancing individual privacy and reducing the power of centralized authorities.

Online forums and mailing lists played a vital role in the early development and spread of Bitcoin. These communities provided a space for early adopters to share information, discuss technical challenges, and collaborate on improving the technology. The collaborative spirit and open-source nature of the project were instrumental in its early growth and success. This collaborative ethos remains a hallmark of the Bitcoin community to this day.

Bitcoin’s Limitations in 2009

While Bitcoin showed immense promise in 2009, it also faced significant limitations. The network’s transaction speed was relatively slow compared to traditional payment systems. This slow speed, coupled with the relatively high transaction fees at times, hindered widespread adoption. The limited understanding of the technology among the general public also presented a major obstacle.

Furthermore, the security of Bitcoin, while strong, was not fully understood by everyone. The concept of a decentralized, cryptographic currency was novel and complex, leading to some skepticism and hesitation among potential users. The lack of robust regulatory frameworks also contributed to uncertainties surrounding the legal status and future of Bitcoin.

- Limited scalability: The network struggled to process a large volume of transactions efficiently.

- User experience challenges: The user interface was not very intuitive, making it difficult for non-technical users to interact with the system.

- Security concerns: While secure, the technology was new and not fully understood by many.

- Lack of regulatory clarity: The absence of clear regulatory frameworks created uncertainty.

The Seeds of Future Growth

Despite these initial limitations, the year 2009 laid the groundwork for Bitcoin’s incredible future growth. The core technology was sound, the vision was compelling, and the community was passionate. The early adopters, driven by a belief in decentralization and a desire for financial freedom, provided the essential momentum for Bitcoin’s journey from a niche project to a globally recognized phenomenon.

The genesis block of 2009 was not just the creation of a new currency; it was the birth of a new paradigm in finance. It introduced the concept of a decentralized, transparent, and secure financial system that could potentially disrupt the established order. While the early days were marked by challenges and limitations, the seeds of future growth were clearly sown.

- Technological innovation: The underlying technology proved resilient and adaptable.

- Community engagement: A passionate community contributed to its development and growth.

- Visionary goals: The potential for a decentralized financial system resonated deeply.

The journey of Bitcoin from its humble beginnings in 2009 to its current status as a globally recognized asset is a testament to the power of innovation, community, and a compelling vision. The challenges faced in its early years only served to strengthen its resolve and refine its capabilities. The evolution of Bitcoin continues, constantly adapting to meet the demands of a rapidly changing technological and economic landscape. Its impact on the financial world is undeniable and its future remains full of possibilities, shaping the future of finance in ways we are only beginning to understand. The legacy of that first block, mined on a relatively quiet January day, continues to resonate today, a reminder of the power of disruptive technology and the enduring appeal of a decentralized future. Bitcoin’s evolution continues to unfold, offering a captivating narrative of technological innovation and societal impact. The future holds more developments, refinements, and unexpected turns in this continuously evolving space. The story of Bitcoin in 2009 is not just a historical account; it is a foundation for understanding the digital currency revolution still underway.