Shorting Bitcoin: A Comprehensive Guide

Master the art of shorting Bitcoin. Learn strategies to navigate price swings and potentially profit from market downturns. Unlock advanced crypto trading techniques today!

Bitcoin, the pioneering cryptocurrency, has captivated investors and technologists alike. Its decentralized nature and volatile price movements present unique opportunities and challenges. While many focus on buying and holding Bitcoin (often referred to as “hodling”), a significant portion of the market engages in shorting – betting on a price decline. Understanding how to short Bitcoin, however, requires a nuanced understanding of the market and available instruments. This comprehensive guide delves into the intricacies of shorting Bitcoin, exploring various methods, associated risks, and the evolving landscape of cryptocurrency trading.

Understanding Bitcoin Shorting: A Fundamental Overview

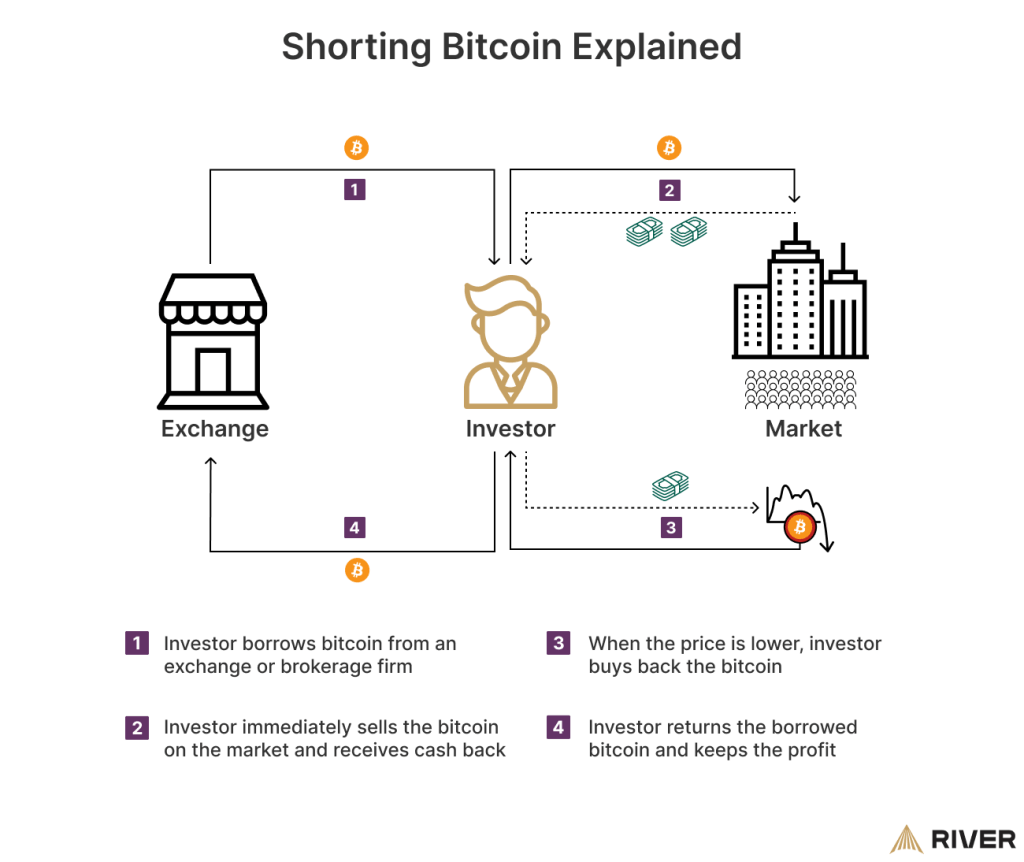

Shorting Bitcoin, in its simplest form, involves borrowing Bitcoin, selling it at the current market price, and hoping the price falls. When the price drops, you buy back the Bitcoin at a lower price, return it to the lender, and profit from the price difference. This is a speculative strategy that can yield substantial profits if the price moves in your favor. However, it carries significant risk, as unlimited losses are theoretically possible if the price rises unexpectedly.

Unlike traditional markets where shorting is relatively straightforward, shorting Bitcoin presents unique complexities. The decentralized nature of Bitcoin, coupled with its volatility, means there are fewer readily available and regulated mechanisms for shorting compared to established stock markets. This makes it crucial to understand the specific methods available and their inherent risks before engaging in any shorting activity.

Key Considerations Before Shorting Bitcoin

- Market Volatility: Bitcoin’s price can fluctuate dramatically in short periods. This extreme volatility amplifies both potential profits and losses.

- Regulatory Landscape: The regulatory environment surrounding cryptocurrencies is constantly evolving and varies significantly across jurisdictions. Understanding the legal and regulatory implications of shorting Bitcoin in your region is essential.

- Platform Selection: Choosing a reputable and secure exchange or platform is critical. Not all platforms offer Bitcoin shorting, and those that do may have varying terms and conditions;

- Risk Management: Implementing robust risk management strategies, including setting stop-loss orders and diversifying your portfolio, is paramount to mitigating potential losses.

- Understanding Leverage: Many platforms allow shorting Bitcoin with leverage, which magnifies both profits and losses. Using leverage inappropriately can lead to significant financial setbacks.

Methods for Shorting Bitcoin

Several methods exist for shorting Bitcoin, each with its own set of advantages and disadvantages. The most common approaches include utilizing futures contracts, CFDs (Contracts for Difference), and borrowing Bitcoin through peer-to-peer lending platforms.

1. Bitcoin Futures Contracts

Futures contracts are agreements to buy or sell Bitcoin at a predetermined price on a specific future date. Shorting Bitcoin using futures involves selling a futures contract, hoping the price of Bitcoin falls below the contract’s strike price by the expiration date. This allows traders to profit from a price decline without actually owning the underlying asset. However, futures contracts require a margin account and expose traders to margin calls if the price moves against their position.

2. Contracts for Difference (CFDs)

CFDs are derivative instruments that allow traders to speculate on the price movement of an asset without actually owning it. Shorting Bitcoin using CFDs involves opening a short position, anticipating a price drop. Profits are realized if the price falls, while losses occur if the price rises. Leverage is often available with CFDs, but it significantly amplifies both potential profits and losses. It’s crucial to fully understand the risks associated with leverage before using CFDs to short Bitcoin.

3. Peer-to-Peer Lending Platforms

Some peer-to-peer lending platforms allow individuals to borrow Bitcoin and then sell it in the market. This approach is less common than futures contracts or CFDs due to the complexities involved in finding a lender and managing the borrowing agreement. Furthermore, the risks of default by the borrower exist, adding another layer of complexity to this method.

Risks Associated with Shorting Bitcoin

Shorting Bitcoin carries significant risks, and it’s crucial to understand these risks before engaging in any shorting activity. The most prominent risks include:

1. Unlimited Loss Potential

Unlike long positions where losses are limited to the initial investment, short positions have theoretically unlimited loss potential. If the price of Bitcoin rises significantly, losses can quickly exceed the initial margin requirement, leading to margin calls and potentially significant financial losses. Effective risk management strategies, such as using stop-loss orders, are critical to mitigating this risk.

2. Market Volatility

Bitcoin’s price is notoriously volatile. Sudden and unpredictable price swings can quickly wipe out short positions, even with robust risk management in place. Traders need to be prepared for significant and rapid price movements.

3. Regulatory Uncertainty

The regulatory environment surrounding cryptocurrencies is constantly evolving and varies across jurisdictions. Changes in regulations can significantly impact the availability and legality of shorting Bitcoin. Staying informed about relevant regulations is crucial.

4. Platform Risk

Using a reputable and secure trading platform is essential. The risk of platform failure, security breaches, or fraudulent activities can lead to significant losses. Thorough due diligence is required before selecting a platform for shorting Bitcoin.

Strategies for Mitigating Risks

While shorting Bitcoin carries inherent risks, several strategies can help mitigate potential losses. These include:

- Utilizing Stop-Loss Orders: Stop-loss orders automatically close a short position when the price reaches a predetermined level, limiting potential losses.

- Employing Position Sizing: Carefully managing the size of your short positions is crucial. Avoid over-leveraging and allocate only a small portion of your portfolio to shorting Bitcoin.

- Diversification: Diversifying your investment portfolio across different asset classes reduces overall risk exposure.

- Thorough Research and Due Diligence: Conduct extensive research on the market, the chosen shorting method, and the selected trading platform before initiating any shorting activity.

- Risk Tolerance Assessment: Honestly assess your risk tolerance before engaging in shorting Bitcoin. Only invest an amount you’re comfortable losing.

The Future of Bitcoin Shorting

The landscape of Bitcoin shorting is constantly evolving. As the cryptocurrency market matures, new and more sophisticated methods for shorting Bitcoin are likely to emerge. Furthermore, regulatory changes will continue to shape the availability and legality of shorting activities. Staying informed about these developments is essential for anyone considering shorting Bitcoin.

The increasing institutional adoption of Bitcoin and the development of more sophisticated trading instruments will likely influence the strategies used for shorting. This could lead to more efficient and regulated mechanisms for short selling, but also potentially greater market complexity.

The future of Bitcoin shorting will depend heavily on technological advancements, regulatory frameworks, and overall market dynamics. Understanding these factors is crucial for navigating the complexities of this evolving market.