Understanding Bitcoin and Converting it to USD

Navigate the wild world of Bitcoin prices! Learn how to accurately convert 100 Bitcoin to USD, understand the factors influencing its value, and make smarter crypto decisions. Unlock the secrets of Bitcoin conversion today!

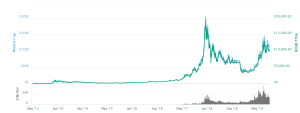

The cryptocurrency market is notoriously volatile․ Bitcoin, the original and most well-known cryptocurrency, experiences price fluctuations daily, hourly, even minute by minute․ Therefore, a simple conversion of 100 Bitcoin to USD requires more than just a quick online calculator․ This guide will delve into the factors influencing Bitcoin’s price, explain how to accurately determine the current conversion rate, and offer insights into the broader implications of owning and trading Bitcoin․ Understanding these nuances is crucial for anyone looking to navigate this dynamic market․

Understanding Bitcoin’s Price Volatility

Bitcoin’s price is influenced by a complex interplay of factors․ Global economic conditions, regulatory changes, media coverage, and even social media trends can significantly impact its value․ For example, positive news about Bitcoin adoption by major corporations can drive prices upward, while negative news or regulatory crackdowns can cause significant drops․ This inherent volatility makes precise long-term predictions challenging, highlighting the need for careful consideration before investing․

Macroeconomic Factors

Broader economic trends play a significant role․ Inflation, interest rate changes, and geopolitical events all influence investor sentiment and, consequently, Bitcoin’s price․ During periods of high inflation, some investors might turn to Bitcoin as a hedge against currency devaluation, pushing demand and price upward․ Conversely, rising interest rates can make other investment options more attractive, potentially leading to decreased Bitcoin demand and lower prices․ These interconnected factors create a dynamic environment that requires continuous monitoring․

Regulatory Landscape

Government regulations around the world significantly impact Bitcoin’s trajectory․ Countries with favorable regulatory frameworks tend to attract more Bitcoin investors and businesses, fostering growth and potentially increasing its price․ Conversely, restrictive regulations can limit adoption and suppress demand, leading to price declines․ The evolving legal landscape is a crucial factor to consider when evaluating Bitcoin’s value;

Market Sentiment and Media Influence

Public perception and media coverage heavily influence Bitcoin’s price․ Positive media portrayals and endorsements from influential figures can boost investor confidence, driving demand and price increases․ Conversely, negative news or critical articles can erode confidence and trigger sell-offs, resulting in price drops․ The power of public opinion and media narratives cannot be underestimated in this market․

Technological Developments

Technological advancements within the Bitcoin network itself can also impact its price․ Upgrades to the network’s infrastructure, the introduction of new features, or improvements in scalability can increase efficiency and attract more users, leading to higher demand and price appreciation․ Conversely, security breaches or technical glitches can erode confidence and lead to price declines․ Staying informed about these advancements is crucial for understanding Bitcoin’s potential․

How to Convert 100 Bitcoin to USD

Converting 100 Bitcoin to USD requires accessing a reliable real-time exchange rate․ Several reputable cryptocurrency exchanges provide this information․ It’s crucial to use multiple sources to get an average, mitigating the risk of relying on potentially inaccurate data from a single exchange․ Remember that the price displayed is a snapshot in time; it can fluctuate constantly․

Many online conversion tools are available․ These tools typically use data from major cryptocurrency exchanges to provide a near real-time conversion․ However, always double-check the time stamp of the rate to ensure accuracy․ The difference between a few minutes can result in a substantial change in the USD equivalent․

- Use multiple exchange websites: Compare the conversion rates offered by several major exchanges (e․g․, Coinbase, Binance, Kraken) to get a more accurate average․

- Check the timestamp: Pay close attention to the time the exchange rate was last updated to ensure accuracy․

- Consider fees: Cryptocurrency exchanges charge transaction fees that can impact the final amount received when converting Bitcoin to USD․ Factor these fees into your calculations․

- Use a reputable source: Stick to well-known and trustworthy platforms to avoid scams and inaccurate information․

Factors Affecting the Conversion

Several factors beyond the current market price can influence the final USD amount received when converting 100 Bitcoin․ Understanding these factors is crucial for accurate calculations and informed decision-making․

Transaction Fees

Cryptocurrency exchanges charge transaction fees, which vary depending on the platform and the trading volume․ These fees can be a significant factor, especially for larger transactions․ Always check the fee schedule of the exchange you’re using before initiating the conversion to avoid unexpected costs․

Exchange Rates

Different exchanges offer slightly different exchange rates due to variations in liquidity and market demand․ Comparing rates across several reputable exchanges is essential to find the most favorable conversion rate․ This simple step can save you a considerable amount of money, especially with a large Bitcoin holding․

Withdrawal Fees

Many exchanges charge additional fees for withdrawing funds to your bank account․ These fees can add up, especially when dealing with substantial amounts of money․ Be sure to factor these fees into your overall cost calculation․

Network Congestion

Network congestion on the Bitcoin blockchain can impact transaction times and fees․ During periods of high network activity, transaction fees can increase significantly, affecting the final amount received after conversion․

Long-Term Implications of Bitcoin Ownership

Owning Bitcoin involves long-term considerations beyond immediate conversion rates․ Understanding the potential risks and rewards is essential for informed investment decisions․

Risk Management

Bitcoin’s volatility presents significant risks․ The price can fluctuate dramatically in short periods, leading to substantial gains or losses․ Diversification and risk management strategies are crucial for mitigating potential losses․ Never invest more than you can afford to lose․

Tax Implications

Capital gains taxes apply to profits from selling Bitcoin․ Tax laws vary by jurisdiction, and it’s essential to understand the relevant tax regulations in your country before engaging in Bitcoin transactions․ Failure to comply with tax laws can result in significant penalties․

Security Considerations

Securing your Bitcoin is paramount․ Use strong passwords, enable two-factor authentication, and consider using hardware wallets for enhanced security․ Losses due to theft or hacking can be devastating․

Future Potential

Bitcoin’s long-term potential is a subject of ongoing debate․ While some believe it will become a dominant form of digital currency, others express concerns about its volatility and scalability․ Thoroughly researching and understanding the potential risks and rewards is critical before investing․

- Diversify your portfolio: Don’t put all your eggs in one basket․ Diversify your investments to mitigate risk․

- Consult a financial advisor: Seek professional advice before making significant investments in cryptocurrencies․

- Stay informed: Keep up-to-date on the latest news and developments in the cryptocurrency market․