Understanding Bitcoin’s All-Time High Price

Dive into the wild ride of Bitcoin! Discover the forces behind its record-high price, explore historical context, and speculate on future trajectories. Uncover the secrets of this digital gold rush!

Bitcoin, the pioneering cryptocurrency, has experienced a volatile yet fascinating journey since its inception. Its value has fluctuated dramatically, reaching astonishing highs and plummeting to unexpected lows. Understanding the factors contributing to the highest Bitcoin price ever recorded is crucial for both seasoned investors and those new to the cryptocurrency world. This comprehensive analysis delves into the historical context, market forces, and potential future trajectories of Bitcoin’s price, aiming to provide a nuanced perspective on this dynamic asset. We will explore various economic, technological, and regulatory influences that have shaped Bitcoin’s price over the years.

Historical Context: Tracing Bitcoin’s Price Peaks

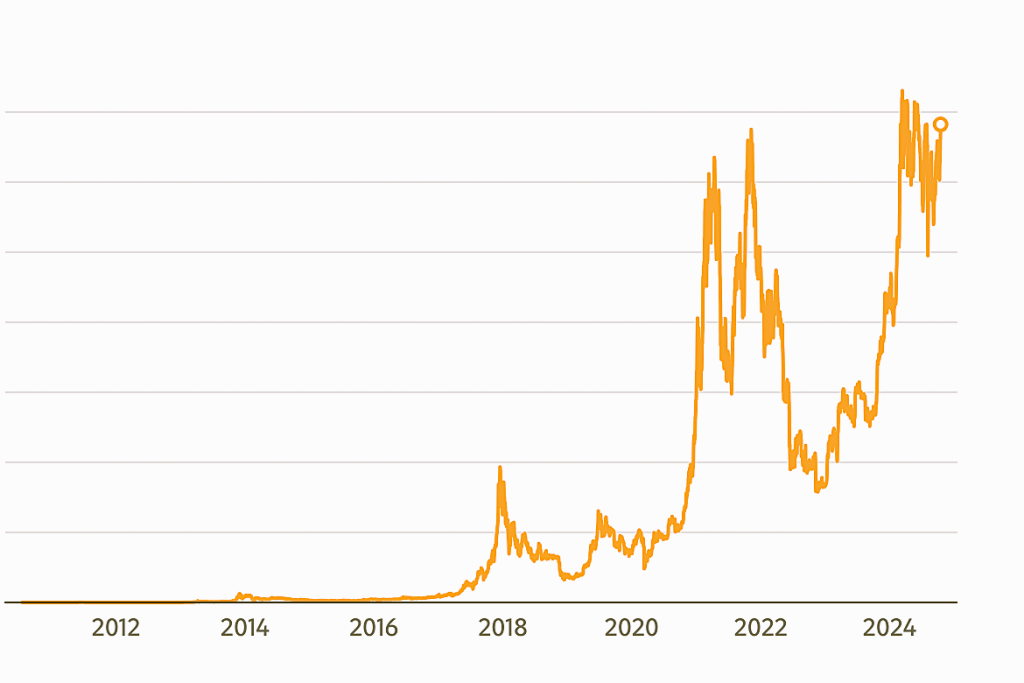

Bitcoin’s price journey has been nothing short of extraordinary. From its humble beginnings, trading at mere pennies, it has witnessed periods of explosive growth interspersed with significant corrections. Analyzing past price peaks helps illuminate the driving forces behind these dramatic shifts. The first major surge occurred in 2013, fueled by increasing mainstream awareness and early adoption. However, subsequent years saw periods of consolidation and even sharp declines. The most notable peak, reaching an all-time high, was driven by a confluence of factors, including institutional investment, increased regulatory clarity in certain jurisdictions, and a growing perception of Bitcoin as a hedge against inflation.

The Role of Media and Public Perception

The media plays a significant role in shaping public perception of Bitcoin. Positive news coverage, such as major institutional adoption or regulatory approvals, can lead to increased demand and price appreciation. Conversely, negative news, like security breaches or regulatory crackdowns, can trigger sell-offs and price declines. The inherent volatility of Bitcoin is often exacerbated by media narratives, highlighting the importance of critical evaluation of information sources. It’s crucial to filter out sensationalism and focus on factual reporting when assessing market trends.

Market Forces: Supply, Demand, and Speculation

Like any asset, Bitcoin’s price is determined by the interplay of supply and demand. The limited supply of Bitcoin, capped at 21 million coins, is a fundamental factor driving its value. As demand increases, particularly from institutional investors and large corporations, the scarcity of Bitcoin pushes its price upwards. However, this demand is often intertwined with speculative trading, which can amplify price swings. Speculative bubbles, while capable of driving prices to unprecedented heights, are inherently unsustainable and often lead to significant corrections.

Institutional Investment and Adoption

The entry of institutional investors, including hedge funds and investment firms, has been a significant catalyst for Bitcoin’s price growth. These large-scale investors bring substantial capital and expertise to the market, contributing to increased liquidity and price stability. Their involvement legitimizes Bitcoin in the eyes of many, fostering greater confidence and attracting further investment. However, institutional participation also introduces new complexities, including the potential for manipulation and the influence of broader macroeconomic factors.

- Increased liquidity in the market.

- Greater price stability (relative to purely retail-driven markets).

- Enhanced legitimacy in the eyes of mainstream investors.

- Potential for increased price volatility due to large-scale trading.

Technological Advancements and Network Effects

Bitcoin’s underlying technology, the blockchain, is constantly evolving. Upgrades and improvements to the network’s scalability, security, and efficiency can have a positive impact on its price. A more robust and efficient network fosters wider adoption and increases confidence in the long-term viability of Bitcoin. The network effect also plays a crucial role; the larger the network of users and transactions, the more valuable Bitcoin becomes as a medium of exchange and store of value.

Regulatory Landscape and Geopolitical Factors

Regulatory frameworks surrounding cryptocurrencies vary significantly across different jurisdictions. Favorable regulatory environments, characterized by clarity and a supportive approach, can boost investor confidence and drive price appreciation. Conversely, restrictive or uncertain regulations can negatively impact Bitcoin’s price. Geopolitical events and macroeconomic conditions also influence Bitcoin’s price, often serving as a safe haven asset during times of economic uncertainty or political instability. The correlation between Bitcoin’s price and global events requires careful consideration.

Predicting the Future: Challenges and Opportunities

Predicting the future price of Bitcoin is inherently challenging due to its volatility and susceptibility to a wide array of influences. While technical analysis and market sentiment can offer insights, they are not foolproof predictors. Long-term price projections require a nuanced understanding of technological advancements, regulatory developments, and macroeconomic trends. Furthermore, unpredictable events, such as unforeseen technological breakthroughs or significant geopolitical shifts, can dramatically alter the trajectory of Bitcoin’s price.

Factors to Consider for Long-Term Price Predictions

Several key factors must be considered when attempting to forecast Bitcoin’s long-term price; These include the rate of adoption by businesses and consumers, the development of new use cases beyond speculation and investment, improvements in the scalability and efficiency of the Bitcoin network, and the overall regulatory landscape for cryptocurrencies. The degree of mainstream acceptance will play a significant role in determining the future value of this digital asset. A greater understanding of the underlying technology and its potential applications will also be crucial.

- Mass adoption by businesses and consumers.

- Development of novel applications beyond speculation.

- Technological advancements improving network scalability and efficiency.

- Favorable regulatory environment across major jurisdictions.

- Global macroeconomic conditions and investor sentiment.

Bitcoin’s journey has been marked by remarkable highs and significant lows. The highest Bitcoin price ever recorded reflects a confluence of factors, including increasing institutional adoption, growing public awareness, and technological advancements. However, predicting future price movements remains highly speculative, highlighting the inherent risks and rewards associated with this volatile asset. Understanding the complex interplay of market forces, technological developments, and regulatory landscapes is crucial for navigating the dynamic world of Bitcoin. Continuous learning and informed decision-making are essential for anyone involved in the cryptocurrency market, whether as an investor or simply an observer of this fascinating technological phenomenon. Long-term success requires a balanced perspective, combining optimism with a realistic assessment of the inherent risks. The future of Bitcoin remains uncertain, but its impact on the financial landscape is undeniable.