Understanding Bitcoin’s Price Volatility

Unravel the mysteries of Bitcoin’s volatile price. Learn about the key factors influencing its dramatic swings, from global economics to tech breakthroughs. Become a Bitcoin price expert!

The price of Bitcoin, a digital currency that has captivated the world, is notoriously volatile. Understanding the forces driving these fluctuations is crucial for both investors and those simply curious about this revolutionary technology. This volatility stems from a complex interplay of factors, ranging from regulatory announcements to technological advancements and macroeconomic trends. Navigating this dynamic landscape requires a keen eye for detail and a thorough understanding of the underlying mechanisms influencing Bitcoin’s value.

Bitcoin’s price is not subject to the same influences as traditional fiat currencies. Unlike the US dollar or the Euro, it’s not backed by a government or central bank. This lack of centralized control contributes significantly to its unpredictable nature. Instead, Bitcoin’s value is determined by supply and demand, shaped by a multitude of interwoven factors. These factors can range from media coverage and investor sentiment to technological developments and geopolitical events.

Supply and Demand Dynamics

The core principle governing Bitcoin’s price is the fundamental economic law of supply and demand. A limited supply of 21 million Bitcoins, coupled with increasing demand, typically drives the price upwards. However, this is not a simple equation. Periods of reduced demand, or an influx of Bitcoin onto the market, can lead to significant price drops. Understanding these shifts is key to predicting – or at least, anticipating – future price movements.

Regulatory Landscape

Government regulations play a significant role in shaping Bitcoin’s price. Positive regulatory announcements from major economies can boost investor confidence, leading to price increases. Conversely, negative news or stricter regulations can trigger sell-offs, causing the price to plummet. The evolving regulatory environment across the globe needs to be carefully monitored for its impact on market sentiment.

Technological Advancements

Technological developments within the Bitcoin ecosystem significantly influence its price. Upgrades to the Bitcoin network, the introduction of new applications built on the blockchain, or breakthroughs in scaling solutions can all impact investor perception and, consequently, price; Conversely, security breaches or technical glitches can cause significant price drops, reflecting concerns about the network’s stability and security.

Macroeconomic Factors

Global macroeconomic conditions exert a considerable influence on Bitcoin’s price. Periods of economic uncertainty or inflation often lead investors to seek alternative assets, driving demand for Bitcoin and pushing its price higher. Conversely, periods of economic stability may cause investors to shift towards more traditional assets, thereby decreasing demand for Bitcoin.

Analyzing Bitcoin Price News

Staying abreast of the latest Bitcoin price news requires a multi-faceted approach. It’s not enough to simply track the price; understanding the underlying reasons for price fluctuations is equally important. This involves analyzing various news sources, evaluating expert opinions, and considering the broader economic context.

Reliable News Sources

Choosing reliable sources of information is crucial for accurate analysis. Reputable financial news outlets, specialized cryptocurrency publications, and reputable blockchain technology blogs are all valuable resources. It’s important to be discerning and avoid websites or social media accounts that promote unsubstantiated claims or manipulative narratives.

Interpreting Market Sentiment

Understanding market sentiment is vital for interpreting Bitcoin price news; Positive sentiment, characterized by widespread optimism and anticipation of price increases, often leads to higher prices. Conversely, negative sentiment, often associated with fear, uncertainty, and doubt, can trigger sell-offs and price drops; Identifying the prevailing market sentiment is a crucial skill for successful Bitcoin price analysis.

Technical Analysis

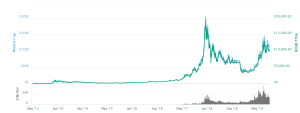

Technical analysis uses charts and graphs to identify patterns in price movements. While not foolproof, technical analysis can help investors predict potential price trends based on historical data. However, it is crucial to remember that technical analysis should be combined with fundamental analysis for a more comprehensive understanding of the market.

Fundamental Analysis

Fundamental analysis focuses on the underlying factors affecting Bitcoin’s value, such as supply and demand, regulatory developments, and technological advancements. This approach provides a more long-term perspective on Bitcoin’s price, complementing the shorter-term insights provided by technical analysis.

Factors Influencing Bitcoin Price Predictions

Predicting Bitcoin’s price is notoriously difficult, if not impossible. The cryptocurrency market is highly speculative and influenced by numerous unpredictable factors; However, by analyzing the factors discussed earlier, investors can improve their understanding of potential price movements.

Adoption Rate

Widespread adoption of Bitcoin as a payment method and store of value will significantly influence its price. Increased adoption leads to higher demand, thereby pushing prices upward. However, predicting the rate of adoption remains a significant challenge.

Institutional Investment

The involvement of institutional investors, such as hedge funds and large corporations, significantly impacts Bitcoin’s price. Institutional investment brings increased liquidity and credibility to the market, typically driving price increases. Monitoring institutional activity provides valuable insights into potential price trends.

Mining Difficulty

The difficulty of mining new Bitcoins affects the rate at which new coins enter circulation. Increased mining difficulty slows down the rate of new Bitcoin creation, potentially leading to price increases due to reduced supply.

Halving Events

Bitcoin’s halving events, which occur approximately every four years, reduce the reward for Bitcoin miners by half. This reduction in supply often leads to a subsequent price increase, as demand remains relatively stable or increases.

Investing in Bitcoin: Risks and Rewards

Investing in Bitcoin carries significant risks, primarily due to its volatility. However, the potential rewards can be substantial for those willing to accept the inherent risks. It is crucial to approach Bitcoin investments with caution and a clear understanding of the risks involved.

Risk Management Strategies

- Diversification: Don’t put all your eggs in one basket. Diversify your investments to mitigate risk.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals, regardless of price fluctuations.

- Only Invest What You Can Afford to Lose: Never invest more than you can comfortably afford to lose.

- Stay Informed: Keep up-to-date with the latest Bitcoin price news and market trends.

Potential Rewards

Despite the risks, Bitcoin offers substantial potential rewards. Its limited supply, growing adoption, and potential as a hedge against inflation make it an attractive investment for some. However, it’s essential to remember that past performance is not indicative of future results.

Staying Updated on Bitcoin Price News

Keeping informed about the latest Bitcoin price news is crucial for making informed investment decisions. This requires a combination of diligent research, careful analysis, and a healthy dose of skepticism. Avoid impulsive decisions based on short-term price fluctuations and focus on long-term strategies.

- Follow reputable news sources.

- Utilize price tracking websites and charts.

- Engage in online communities (with caution).

- Stay informed on regulatory changes.

- Continuously learn and adapt your strategy.