Understanding the Volatility of Bitcoin

Unravel the mysteries of Bitcoin’s volatile price! This guide breaks down the complex factors influencing Bitcoin’s value, from market trends to regulatory changes. Become a Bitcoin price expert – read now!

The price of Bitcoin, a decentralized digital currency, is notoriously volatile. It fluctuates constantly, influenced by a complex interplay of factors. Understanding these influences is crucial for anyone interested in investing in, using, or simply observing this groundbreaking cryptocurrency. This guide will explore the various elements that contribute to Bitcoin’s price, providing a comprehensive overview for both beginners and experienced enthusiasts. We will delve into market forces, technological advancements, regulatory changes, and more, providing you with a clearer understanding of this dynamic market.

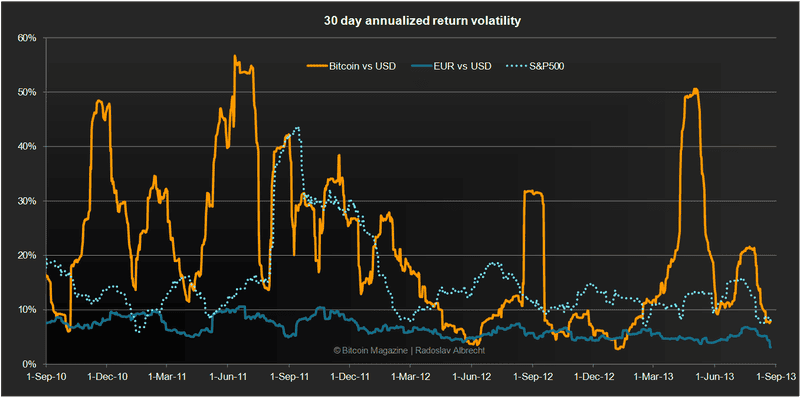

Unlike traditional fiat currencies, Bitcoin’s price isn’t controlled by a central bank or government. This lack of centralized control is a key feature of its decentralized nature, but it also contributes significantly to its volatility. The price is determined solely by supply and demand in the open market, making it susceptible to rapid and sometimes unpredictable swings. This inherent volatility is both a risk and an opportunity for investors.

Factors Influencing Bitcoin’s Price

Numerous factors contribute to the constant fluctuations in Bitcoin’s price. These factors are interconnected and often influence each other, creating a complex and dynamic market environment. Understanding these dynamics allows for a more informed approach to navigating the Bitcoin market.

- Supply and Demand: As with any asset, the fundamental principle of supply and demand plays a crucial role. Increased demand, driven by factors like increased adoption or positive media coverage, typically pushes the price upwards. Conversely, reduced demand can lead to price declines.

- Market Sentiment: The overall sentiment surrounding Bitcoin significantly impacts its price. Positive news, technological breakthroughs, or successful integrations into mainstream financial systems can boost investor confidence and drive up the price. Negative news, regulatory uncertainty, or security breaches can have the opposite effect.

- Regulatory Changes: Governmental regulations and policies regarding cryptocurrencies can dramatically affect Bitcoin’s price. Positive regulatory frameworks can foster investor confidence and increase adoption, while restrictive or unclear regulations can create uncertainty and lead to price drops. The legal landscape is constantly evolving, making it crucial to stay abreast of any changes.

- Technological Advancements: Developments within the Bitcoin network itself can also influence its price. Upgrades to the underlying technology, improvements in scalability, or the implementation of new features can positively impact the price, reflecting increased efficiency and functionality.

- Adoption Rate: The wider adoption of Bitcoin by businesses, institutions, and individuals directly impacts its price. Increased usage and integration into everyday transactions increase demand and often lead to price appreciation. Conversely, slower-than-expected adoption can negatively affect the price.

- Mining Difficulty: The difficulty of mining new Bitcoins influences the supply. As mining difficulty increases, the cost of mining rises, potentially impacting the price. Conversely, a decrease in mining difficulty can lead to an increase in supply and potentially lower prices.

- Macroeconomic Factors: Global economic events, such as inflation, recessionary fears, or geopolitical instability, can influence investor behavior and consequently affect Bitcoin’s price. Investors often view Bitcoin as a hedge against inflation or instability, leading to increased demand during uncertain economic times.

- Media Coverage and Public Perception: Positive or negative media coverage significantly impacts public perception and investor sentiment, influencing demand and ultimately the price. A surge of positive news can create a buying frenzy, while negative news can trigger a sell-off.

Analyzing Bitcoin Price Trends

Analyzing historical price data is crucial for understanding Bitcoin’s price behavior. While past performance doesn’t guarantee future results, studying trends can provide valuable insights into potential future movements. Various technical and fundamental analysis tools can be employed to interpret this data.

Technical Analysis

Technical analysis focuses on chart patterns, indicators, and historical price data to predict future price movements. This approach relies on identifying trends, support levels, and resistance levels to anticipate potential price changes. Various indicators, such as moving averages, relative strength index (RSI), and MACD, are commonly used in technical analysis.

Fundamental Analysis

Fundamental analysis, on the other hand, focuses on the underlying factors that influence Bitcoin’s value. This involves assessing the technological advancements, regulatory landscape, adoption rate, and overall market sentiment. Fundamental analysis aims to determine the intrinsic value of Bitcoin, comparing it to its current market price to identify potential overvaluation or undervaluation.

Where to Find Real-Time Bitcoin Price Information

Numerous reputable sources provide real-time Bitcoin price information. These platforms offer various features, including charts, historical data, and often, trading capabilities. Choosing a reliable source is crucial for accurate and up-to-date information. It’s always recommended to cross-reference information from multiple sources to ensure accuracy.

- Major Cryptocurrency Exchanges: Platforms like Coinbase, Binance, Kraken, and others provide real-time price data alongside trading functionality.

- Financial News Websites: Reputable financial news sources such as Bloomberg, Reuters, and CoinDesk often feature live Bitcoin price trackers and analysis.

- Dedicated Cryptocurrency Data Websites: Sites like CoinMarketCap and CoinGecko offer comprehensive data on Bitcoin and other cryptocurrencies, including historical price charts and market capitalization.

Understanding the Risks of Investing in Bitcoin

Investing in Bitcoin carries significant risks. Its volatility can lead to substantial losses, and the market is subject to unpredictable swings. Before investing, it’s crucial to understand these risks and only invest what you can afford to lose. Conduct thorough research and consider consulting a financial advisor before making any investment decisions.

The cryptocurrency market is constantly evolving, presenting both opportunities and challenges. Understanding the factors that influence Bitcoin’s price, along with the inherent risks involved, is crucial for navigating this dynamic landscape. While the future price of Bitcoin remains uncertain, careful research and a well-informed approach can help individuals make informed decisions about their involvement in this groundbreaking technology. Remember to always prioritize responsible investment practices and diversify your portfolio to mitigate risks. The information provided here is for educational purposes only and should not be considered financial advice. Always conduct your own research and seek professional guidance before making any investment decisions.

Bitcoin’s price is a fascinating and complex subject. Its volatility is a major characteristic, but understanding the underlying factors allows for a more informed approach. The interplay of technological advancements, regulatory changes, and market sentiment creates a dynamic environment. Staying informed is key to navigating this market successfully, whether you’re a seasoned investor or just beginning to explore the world of cryptocurrencies. The future of Bitcoin’s price remains uncertain, but informed participation is crucial for success.

Continuous learning and adaptation are vital in the ever-changing world of cryptocurrencies. This requires staying updated on news, technological advancements, and regulatory changes. By understanding the various forces at play, individuals can develop a more comprehensive understanding of Bitcoin’s price and its potential future trajectory. Remember, responsible investing is key, and seeking professional advice is always a good practice.

Ultimately, the price of Bitcoin is a reflection of its adoption, utility, and the overall confidence in its underlying technology. As its usage increases and its integration into mainstream financial systems progresses, its price will likely continue to be shaped by these factors. By understanding these fundamentals, investors can better position themselves to navigate the inherent volatility of the Bitcoin market.

Therefore, a comprehensive understanding of all these aspects is paramount for anyone aiming to participate effectively in the Bitcoin ecosystem. Informed decision-making, coupled with a thorough risk assessment, is crucial for navigating the complex landscape of Bitcoin’s price dynamics.

The journey of understanding Bitcoin’s price is a continuous one, requiring ongoing learning and adaptation to the ever-changing landscape.