The Coinbase Ventures Investment Thesis: Beyond Financial Returns

Coinbase Ventures invests in groundbreaking blockchain & crypto projects, fueling innovation and building the future of digital assets. Discover their portfolio and impact.

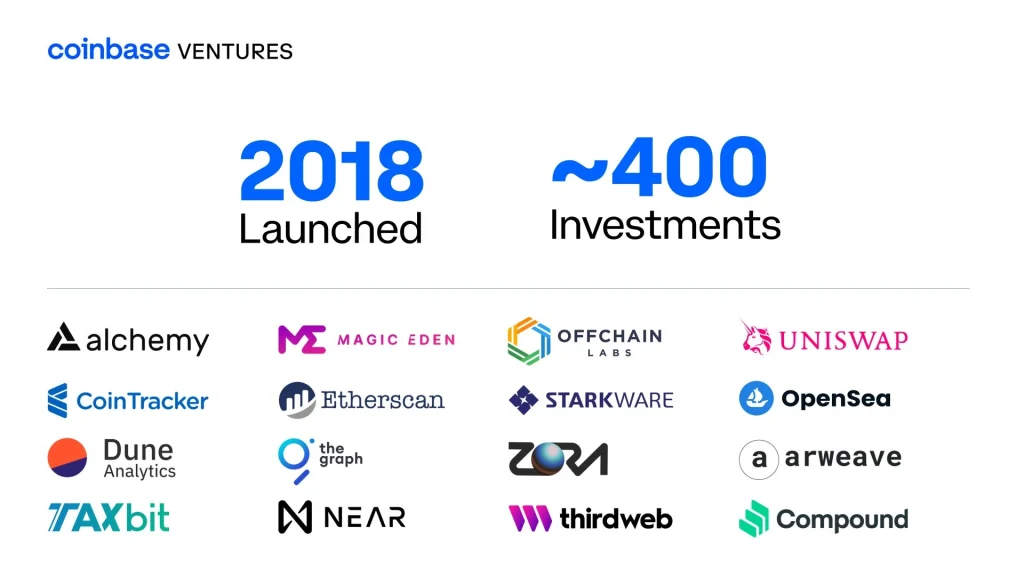

Coinbase Ventures‚ the venture capital arm of the prominent cryptocurrency exchange Coinbase‚ has established itself as a significant player in the blockchain and cryptocurrency investment landscape. Their investments span a wide range of projects‚ reflecting a multifaceted strategy aimed at fostering innovation and growth within the digital asset ecosystem. This strategy isn’t solely focused on financial returns; it also involves nurturing promising startups and shaping the future of the industry. Understanding Coinbase Ventures’ investment philosophy is crucial for anyone interested in the evolution of cryptocurrencies and decentralized technologies.

Coinbase Ventures doesn’t operate with a purely profit-driven approach. While financial returns are undoubtedly a factor‚ their investment strategy prioritizes identifying projects with the potential to reshape the cryptocurrency landscape. This means investing in technologies with transformative capabilities‚ regardless of short-term market fluctuations. Their portfolio reflects a commitment to supporting projects that tackle scalability issues‚ improve user experience‚ and enhance security within the crypto space. This long-term perspective sets them apart from many other venture capital firms.

Focus Areas and Investment Themes

Coinbase Ventures’ investments are not randomly distributed. Instead‚ they are strategically focused on key areas within the crypto ecosystem. These areas often overlap‚ reflecting the interconnected nature of the blockchain technology. For example‚ they frequently invest in projects related to decentralized finance (DeFi)‚ non-fungible tokens (NFTs)‚ and infrastructure solutions. These sectors represent significant growth opportunities‚ and Coinbase Ventures is positioning itself at the forefront of these developments.

- Decentralized Finance (DeFi): Coinbase Ventures has made numerous investments in DeFi protocols‚ aiming to support the growth of decentralized financial applications and services. This includes projects focused on lending‚ borrowing‚ and decentralized exchanges.

- Non-Fungible Tokens (NFTs): Recognizing the growing popularity and potential of NFTs‚ Coinbase Ventures has invested in projects related to NFT marketplaces‚ infrastructure‚ and innovative applications of NFT technology.

- Infrastructure: The foundation of any thriving ecosystem is robust infrastructure. Coinbase Ventures invests heavily in projects improving the scalability‚ security‚ and interoperability of blockchain networks.

- Web3 Development: Coinbase Ventures is deeply involved in supporting the evolution of Web3‚ investing in projects that push the boundaries of decentralized applications and user experiences.

Analyzing Notable Coinbase Ventures Investments

A closer examination of specific Coinbase Ventures investments reveals a pattern of strategic choices. They tend to back teams with strong technical expertise and a clear vision for their project’s long-term impact. The companies they invest in often have a proven track record of innovation or a unique approach to solving challenges within the cryptocurrency space. This meticulous due diligence process is a key component of their investment strategy.

Case Study 1: [Insert Name of a Coinbase Ventures Investment ⸺ Example: Aave]

Aave‚ a decentralized lending and borrowing platform‚ is a prime example of a successful Coinbase Ventures investment. Aave’s innovative approach to lending and its robust security measures have made it a leading player in the DeFi space. This investment underscores Coinbase Ventures’ focus on identifying and supporting projects with significant potential for growth and market disruption.

Case Study 2: [Insert Name of a Coinbase Ventures Investment ー Example: OpenSea]

OpenSea‚ a prominent NFT marketplace‚ showcases Coinbase Ventures’ foresight in recognizing the burgeoning NFT market. Their investment in OpenSea helped solidify the platform’s position as a leader in the NFT space‚ demonstrating their ability to identify promising trends and capitalize on emerging opportunities.

Case Study 3: [Insert Name of a Coinbase Ventures Investment ー Example: Consensys]

Consensys‚ a blockchain software technology company‚ represents Coinbase Ventures’ commitment to supporting infrastructure development. Consensys’ work on improving the scalability and security of Ethereum is crucial for the long-term success of the blockchain ecosystem. This investment highlights the strategic importance of infrastructure in Coinbase Venture’s overall portfolio.

The Impact of Coinbase Ventures Investments

Coinbase Ventures’ investments have a ripple effect throughout the cryptocurrency industry. By providing funding and support to promising projects‚ they help to drive innovation and accelerate the adoption of blockchain technology. Their investments not only contribute to the financial success of the portfolio companies but also foster a more robust and mature cryptocurrency ecosystem. This support extends beyond financial capital‚ including mentorship and networking opportunities.

Furthermore‚ Coinbase Ventures’ involvement often lends credibility and legitimacy to the projects they back. The association with a reputable firm like Coinbase can significantly enhance a startup’s brand reputation and attract further investment. This effect is particularly valuable for emerging projects that are still establishing themselves in the market.

The Future of Coinbase Ventures and its Investments

As the cryptocurrency industry continues to evolve‚ Coinbase Ventures is well-positioned to remain a key player in shaping its future. Their deep understanding of the market‚ combined with their strategic investment approach‚ allows them to identify and support the most promising projects. Their continued focus on innovation and long-term growth suggests that their influence within the crypto space will only continue to grow.

We can expect to see Coinbase Ventures continue to expand its portfolio‚ focusing on emerging technologies and promising startups. Their commitment to fostering a thriving and sustainable cryptocurrency ecosystem ensures their ongoing relevance and influence within the industry. Their strategic investments will undoubtedly shape the landscape of blockchain technology for years to come‚ driving innovation and adoption across various sectors.

The breadth and depth of their portfolio demonstrate a clear vision for the future of decentralized technologies. By strategically selecting and nurturing projects‚ Coinbase Ventures continues to play a critical role in the maturation and expansion of the cryptocurrency ecosystem. The future looks bright for both Coinbase Ventures and the projects they champion.

Their commitment to responsible investment practices and their focus on long-term growth positions them as a leading force in shaping the future of finance and technology. The impact of their investments is undeniable and will continue to be felt across the global cryptocurrency landscape for years to come. Coinbase Ventures is more than just a venture capital firm; it’s a driving force behind the evolution of the digital asset space.

Their impact on the industry is significant and far-reaching‚ influencing the development and adoption of new technologies and shaping the future of finance. Coinbase Ventures plays a crucial role in supporting the growth of a more decentralized and accessible financial system.

- Continued expansion into new sectors within the crypto industry.

- Increased focus on sustainability and responsible investment practices.

- Greater emphasis on supporting projects with a positive social impact.