Understanding and Using Car Payment Loan Calculators

Effortlessly calculate your car loan payments with our easy-to-use calculator. Explore different loan terms and interest rates to find the perfect fit for your budget. Get pre-approved and drive off happy!

Choosing a car is an exciting experience, but the financing aspect can often feel overwhelming. Navigating interest rates, loan terms, and monthly payments requires careful consideration. Fortunately, a car payment loan calculator can significantly simplify this process. These handy tools allow you to quickly estimate your monthly payments based on various loan parameters. Understanding how to use a car payment loan calculator empowers you to make informed decisions and secure the best possible financing for your new or used vehicle. Let’s delve into the intricacies of car loan calculations and how to leverage these valuable tools.

Understanding the Components of a Car Payment Loan Calculator

Before diving into specific examples, it’s crucial to understand the key components that influence your monthly car payments. These calculators typically require you to input several pieces of information. The accuracy of your estimate directly correlates with the precision of your input data. Let’s break down the essential elements:

Loan Amount

This represents the total amount you’re borrowing to purchase the vehicle. It’s calculated by subtracting any down payment or trade-in value from the vehicle’s price. A larger down payment will naturally result in a lower loan amount and subsequently lower monthly payments.

Interest Rate

The interest rate is the cost of borrowing money, expressed as a percentage. This rate is typically determined by your credit score, the lender, and the prevailing market conditions. A higher credit score usually translates into a lower interest rate, resulting in lower overall payments. Shopping around for lenders is crucial to securing the most favorable interest rate.

Loan Term

The loan term is the length of time you have to repay the loan, typically expressed in months. Common loan terms range from 36 to 72 months. Longer loan terms result in lower monthly payments but increase the total interest paid over the life of the loan; Shorter loan terms mean higher monthly payments but significantly reduce the total interest paid.

How to Use a Car Payment Loan Calculator

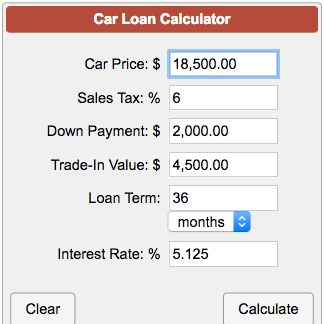

Most online car payment loan calculators share a similar interface. You will typically find fields for the loan amount, interest rate, and loan term. Simply enter the relevant information, and the calculator will instantly provide an estimate of your monthly payment. However, some advanced calculators offer additional features.

Advanced Calculator Features

Some sophisticated calculators offer additional features that provide a more comprehensive view of your financing options. These features might include:

- Amortization Schedule: This detailed breakdown shows the principal and interest portions of each monthly payment throughout the loan term.

- Total Interest Paid: This feature calculates the total amount of interest you’ll pay over the loan’s lifespan.

- Multiple Loan Term Options: Allows you to compare monthly payments across different loan terms simultaneously.

- Sensitivity Analysis: Some calculators allow you to adjust various input parameters to see how changes affect the monthly payment and total interest.

Factors Affecting Your Car Loan Approval

While the calculator provides an estimate, your actual loan approval depends on several factors beyond the figures you input. Lenders assess your financial stability to determine your creditworthiness. They consider your credit history, income, debt-to-income ratio, and employment history. A strong credit history significantly improves your chances of securing favorable loan terms.

Credit Score’s Influence

Your credit score is a critical factor in determining your eligibility for a car loan and the interest rate you’ll receive. A higher credit score indicates lower risk to the lender, resulting in better loan terms. Improving your credit score before applying for a car loan can save you considerable money over the life of the loan. Consistent on-time payments, managing credit utilization, and avoiding new credit applications are all positive steps towards improving your credit score.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio is the percentage of your monthly income dedicated to debt repayment. Lenders use this metric to gauge your ability to manage additional debt. A lower DTI demonstrates a greater capacity to handle monthly car payments, improving your chances of loan approval and potentially securing a better interest rate. Reducing existing debt before applying for a car loan can positively impact your DTI.

Income and Employment History

Stable employment and a consistent income are essential for loan approval. Lenders require proof of income to verify your ability to meet your monthly payment obligations. A stable job history demonstrates financial responsibility and reduces the risk for the lender. Providing comprehensive documentation of your income and employment history strengthens your application.

Choosing the Right Loan Term

Selecting the appropriate loan term is a crucial decision with significant financial implications. A shorter loan term leads to higher monthly payments, but it saves you money on interest in the long run. Conversely, a longer loan term results in lower monthly payments, but it increases the total interest paid over the loan’s lifetime. The best option depends on your individual financial circumstances and priorities.

Balancing Monthly Payments and Total Interest

The decision often involves balancing affordability with long-term cost savings. If you can comfortably afford higher monthly payments, a shorter loan term is usually the more financially advantageous option. However, if minimizing monthly payments is paramount, a longer loan term might be necessary. Careful consideration of both short-term and long-term financial impacts is crucial.

Considering Future Financial Goals

Your future financial goals should also inform your loan term choice. If you anticipate significant income increases or plan to pay off the loan early, a longer term might be acceptable. Conversely, if you’re aiming for rapid debt reduction and financial freedom, a shorter term might be preferable. A thorough assessment of your financial goals allows for a more informed and strategic decision.

Beyond the Calculator: Exploring Other Financing Options

While a car payment loan calculator is an invaluable tool, it’s crucial to explore other financing options beyond traditional auto loans. Different lenders offer various programs, and understanding these alternatives can lead to more favorable terms. Shopping around and comparing offers from multiple lenders is essential for securing the best possible financing package.

- Dealer Financing: Many dealerships offer their own financing options, often with attractive initial rates. However, it’s crucial to compare these offers with rates from external lenders.

- Bank Loans: Banks and credit unions often provide competitive auto loan rates, particularly for borrowers with strong credit scores.

- Online Lenders: Numerous online lenders offer convenient and streamlined auto loan applications, sometimes with flexible repayment options.

- Lease Financing: Leasing a car offers lower monthly payments than purchasing, but it comes with restrictions and doesn’t build equity.

Utilizing a car payment loan calculator is a crucial first step in the car-buying process. It provides a clear picture of potential monthly payments and helps in informed decision-making. Remember, however, that the calculator’s estimate is just one piece of the puzzle. Thorough research, comparison shopping, and a realistic assessment of your financial situation are essential for securing the best car loan deal. By combining the insights from a car payment loan calculator with careful planning, you can make a smart and informed decision about your auto financing needs, ensuring a financially sound purchase.

Careful consideration of your credit score, debt-to-income ratio, and future financial goals will guide you towards the most suitable loan term. Don’t hesitate to seek professional financial advice if needed; this can provide valuable insights and personalized guidance tailored to your unique circumstances. Remember, understanding your financing options and leveraging the power of a car payment loan calculator is key to navigating the car-buying experience with confidence and financial prudence. A well-informed decision will leave you feeling secure and satisfied with your new vehicle.

Ultimately, responsible financial planning and a thorough understanding of your financing options are paramount. By combining smart use of online tools with diligent research and realistic financial planning, you can confidently purchase your next vehicle. Remember that this purchase is a significant financial commitment, so careful consideration ensures a positive and stress-free experience.

The right approach will ensure you find a car that suits your needs and a financing plan that aligns with your budget and financial goals. Remember, informed decision-making is the cornerstone of successful car ownership.

Take your time, do your research, and enjoy the process of finding the perfect vehicle for you!