Understanding Car Loan Interest Calculations

Unlock the secrets of car loan interest calculations! Avoid hidden costs & make informed decisions with our easy-to-understand guide. Learn smart borrowing strategies today!

Securing a car loan is a significant financial commitment․ Understanding the intricacies of interest calculations is crucial for responsible borrowing․ This comprehensive guide will demystify the process, equipping you with the knowledge to make informed decisions and avoid unexpected costs․ We will explore various methods of calculation, common pitfalls, and strategies for minimizing your overall interest payments․

Understanding the Basics of Car Loan Interest

Before diving into complex calculations, let’s establish a foundational understanding of car loan interest․ Simply put, interest is the cost of borrowing money․ Lenders charge interest as compensation for the risk they assume when lending you funds․ The interest rate, expressed as a percentage, determines the amount of interest you’ll pay over the loan’s term․ This rate can vary significantly depending on factors like your credit score, the loan amount, and the loan term itself․ A higher credit score typically translates to a lower interest rate, making your monthly payments more manageable․ Conversely, a lower credit score may result in a higher interest rate, increasing the total cost of borrowing․

Types of Interest Rates

Car loans typically employ either a fixed or variable interest rate․ A fixed interest rate remains constant throughout the loan’s duration, providing predictability in your monthly payments․ This stability allows for better budgeting and financial planning․ In contrast, a variable interest rate fluctuates based on market conditions․ While a variable rate might start lower than a fixed rate, it carries the risk of increasing over time, potentially leading to higher monthly payments and a greater overall cost․ Understanding the implications of each type is critical for choosing the right loan․

Methods for Calculating Car Loan Interest

Several methods exist for calculating the interest on a car loan․ The simplest method involves using a basic formula, while more complex calculations may require specialized tools or software․ Let’s explore some of the most common approaches․

The Simple Interest Formula

The simple interest formula, while straightforward, doesn’t accurately reflect the interest calculations used in most car loans․ The formula is: Interest = Principal x Rate x Time․ Here, the principal is the loan amount, the rate is the annual interest rate (expressed as a decimal), and the time is the loan term in years․ This formula only calculates the interest accrued on the original principal amount, ignoring the compounding effect seen in most car loan agreements․ While useful for basic understanding, it’s not suitable for precise car loan interest calculations․

The Compound Interest Formula

Compound interest, the most prevalent method in car loans, calculates interest not only on the principal but also on accumulated interest․ This means that interest earned in each period is added to the principal, and subsequent interest calculations are based on this larger amount․ The formula for compound interest is more complex and often involves iterative calculations or financial calculators․ This method accurately reflects the total interest paid over the loan’s lifetime․ Understanding compound interest is vital for grasping the true cost of your car loan․

Using Online Calculators and Software

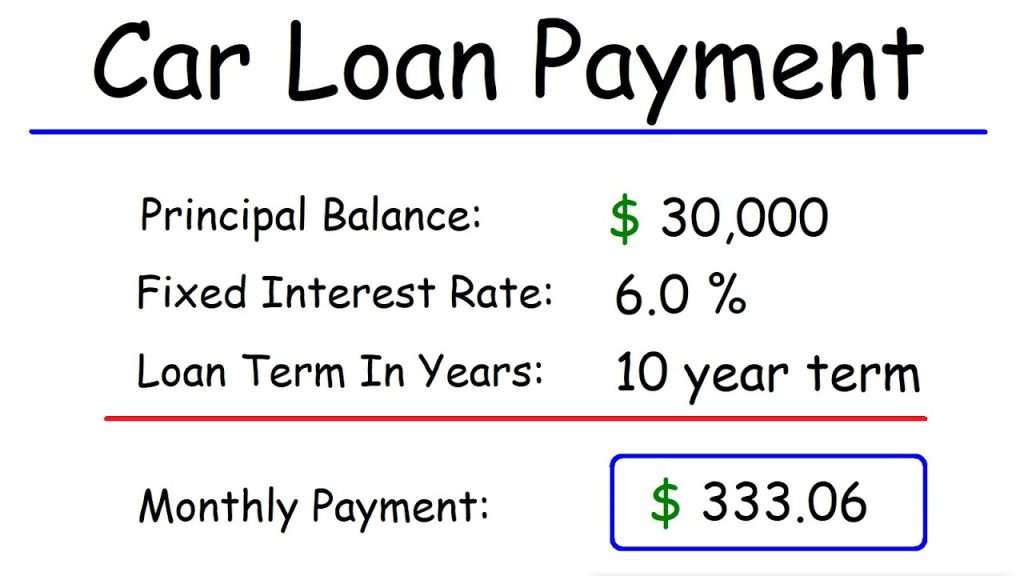

Many online car loan calculators and financial software programs provide convenient tools for accurate interest calculations․ These tools often require inputting the loan amount, interest rate, and loan term․ They then automatically compute the monthly payment, total interest paid, and the amortization schedule, which details the principal and interest portions of each payment over the loan’s life․ Utilizing these resources eliminates the need for manual calculations, saving time and minimizing the risk of errors․

Factors Affecting Car Loan Interest Rates

Several factors play a crucial role in determining the interest rate you’ll receive on your car loan․ Understanding these factors can help you negotiate a better rate and potentially save thousands of dollars over the life of the loan․ Let’s delve into some key influencers․

Credit Score

Your credit score is arguably the most significant factor affecting your interest rate․ A higher credit score signifies lower risk to the lender, leading to more favorable interest rates․ Conversely, a lower credit score indicates higher risk, resulting in higher interest rates․ Improving your credit score before applying for a car loan can substantially reduce the overall cost of borrowing․

Loan Amount and Term

The amount you borrow and the loan’s length also influence the interest rate․ Larger loan amounts often come with slightly higher rates, reflecting a greater risk for the lender․ Similarly, longer loan terms generally result in higher interest rates because the lender is exposed to the risk for a more extended period․ Shorter loan terms, while leading to higher monthly payments, usually result in lower overall interest paid․

Type of Loan

Different types of car loans carry different interest rates․ For instance, loans offered through dealerships may have varying rates compared to those from banks or credit unions․ Shopping around and comparing offers from multiple lenders is crucial for securing the best interest rate․ Dealerships may offer incentives, but it’s essential to compare those against the rates of independent financial institutions․ Understanding the fine print of each loan offer is key to making an informed decision․

Market Conditions

Interest rates are also influenced by prevailing economic conditions․ During periods of economic uncertainty, interest rates may rise, while during periods of stability, they might fall․ Keeping abreast of current interest rate trends can help you time your loan application strategically․

Minimizing Your Interest Payments

Several strategies can help minimize the amount of interest you pay on your car loan․ Let’s explore some effective approaches․

Negotiate the Interest Rate

Don’t hesitate to negotiate the interest rate with lenders․ Shop around for the best offers, and use competing offers as leverage to secure a lower rate․ A seemingly small difference in the interest rate can translate to significant savings over the loan’s term․ Be prepared to justify your request with a strong credit history and responsible financial behavior․

Make Larger Payments

Making larger than required monthly payments can significantly reduce the total interest paid․ Even small extra payments can accelerate the loan’s payoff, saving you money in the long run․ This strategy is especially effective during the early stages of the loan, where the majority of payments go towards interest․

Consider Refinancing

If interest rates fall after you’ve taken out a car loan, refinancing can help you secure a lower rate and reduce your monthly payments․ Refinancing involves obtaining a new loan to pay off the existing one, usually with more favorable terms․ However, be mindful of any refinancing fees before making a decision․

Improve Your Credit Score

Before applying for a car loan, work on improving your credit score․ Paying bills on time, keeping credit utilization low, and avoiding new credit applications can all contribute to a better credit score, leading to lower interest rates․

- Pay all bills on time and in full․

- Keep credit card balances low (ideally under 30% of your credit limit)․

- Avoid opening multiple new credit accounts in a short period․

- Check your credit report regularly for errors․

Understanding Your Amortization Schedule

An amortization schedule provides a detailed breakdown of each payment, showing how much goes towards principal and how much towards interest․ Reviewing this schedule is crucial for understanding the loan’s progression and ensuring accuracy․ This schedule allows for precise tracking of the loan’s repayment and helps visualize the impact of extra payments on the overall interest paid․ Most lenders provide this schedule digitally or in printed form․

Common Pitfalls to Avoid

Several pitfalls can lead to overpaying on your car loan․ Avoiding these traps is essential for responsible borrowing․ Let’s highlight some common mistakes to watch out for․

- Ignoring the fine print: Carefully review all loan documents before signing․ Understand the interest rate, fees, and repayment terms․

- Not shopping around: Compare offers from multiple lenders to secure the best interest rate․

- Taking on too much debt: Borrow only what you can comfortably afford to repay․

- Missing payments: Late payments can damage your credit score and lead to increased interest charges․

Calculating interest on a car loan can seem daunting, but with a clear understanding of the principles and available tools, the process becomes significantly more manageable․ By carefully considering the factors affecting interest rates, employing effective strategies to minimize costs, and avoiding common pitfalls, you can navigate the car loan process successfully and make responsible financial decisions․ Remember, thorough research and informed choices are paramount to securing a favorable loan and achieving your financial goals․

Careful planning and diligent monitoring of your loan’s progress are key to responsible borrowing․ Remember that the figures presented here are for illustrative purposes․ Always consult with a financial professional for personalized guidance․ By proactively managing your loan, you can ensure a positive financial outcome and build a strong credit history for future endeavors․ Ultimately, understanding the intricacies of car loan interest empowers you to make sound financial choices and achieve your goals with confidence․ Taking proactive steps to manage your debt responsibly will significantly improve your long-term financial health․