Understanding Car Loan Lengths: Factors and Implications

Unlock the secrets to car loan terms! Learn how loan length impacts monthly payments and total cost. Find the perfect repayment plan for your budget and goals. Explore all the factors that influence your car loan term today!

The length of a car loan, or its term, is a crucial factor influencing your monthly payments and overall cost. It’s not a one-size-fits-all answer; the duration varies significantly based on several interconnected factors. Understanding these factors empowers you to make informed decisions and choose a repayment plan that aligns with your financial capabilities and long-term goals. Let’s delve into the intricacies of car loan terms and explore what determines their length.

Factors Influencing Car Loan Length

The duration of your car loan isn’t arbitrarily determined. Several key elements play a significant role in shaping the repayment schedule. These factors interact to create a personalized loan structure tailored to your individual circumstances. Let’s examine these influential factors in detail.

Credit Score: A Cornerstone of Loan Approval

Your credit score is arguably the most significant factor impacting your car loan term. A higher credit score typically translates to more favorable loan terms, including potentially shorter loan lengths and lower interest rates. Lenders view individuals with excellent credit histories as less risky borrowers, thus offering them more attractive options. Conversely, a poor credit score might restrict you to longer loan terms and higher interest rates, increasing the overall cost of borrowing.

Loan Amount: The Size of Your Borrowed Capital

The amount you borrow directly correlates with the loan’s length. Larger loan amounts often necessitate longer repayment periods to keep monthly payments manageable. While a shorter loan term might seem desirable, it often results in significantly higher monthly installments. Balancing the loan amount with your repayment capacity is essential to avoid financial strain.

Interest Rate: The Cost of Borrowing

Interest rates are a critical component of car loan costs. Lower interest rates enable you to repay the loan faster, even with the same monthly payment. Conversely, higher interest rates extend the repayment period, potentially increasing the total interest paid over the loan’s life. Negotiating a favorable interest rate can significantly reduce the overall cost and potentially shorten the loan term.

Down Payment: Reducing the Loan Amount

A substantial down payment reduces the principal loan amount, allowing for a shorter loan term. By putting more money upfront, you effectively lessen the burden of repayment, giving you more flexibility to choose a shorter repayment period. This strategy can ultimately save you money on interest payments in the long run.

Vehicle Type and Age: Assessing Risk and Value

The type and age of the vehicle also affect the loan term. Newer vehicles generally command shorter loan terms due to their higher value and lower depreciation risk. Used cars, especially older models, might be associated with longer loan terms due to increased depreciation and potential maintenance costs.

Understanding Different Loan Terms

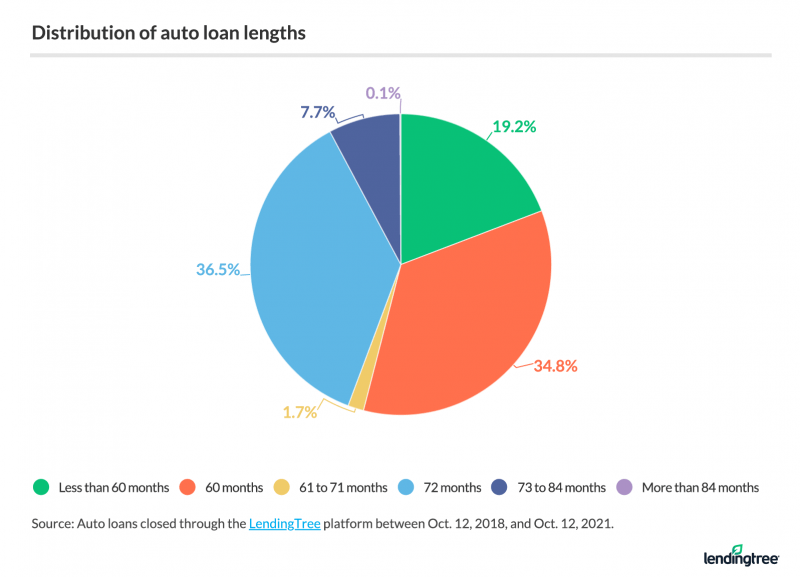

Car loans typically range from 24 months to 84 months, although some lenders might offer longer terms in specific circumstances. Each term length presents its own advantages and disadvantages, impacting your monthly payments and the overall cost of the loan.

Shorter Loan Terms (24-48 Months): Advantages and Disadvantages

Shorter loan terms result in higher monthly payments but significantly reduce the total interest paid over the life of the loan. This approach allows you to own the vehicle outright sooner, but it requires a higher level of financial discipline and a larger disposable income.

- Advantage: Lower total interest paid.

- Advantage: Faster ownership.

- Disadvantage: Higher monthly payments.

- Disadvantage: Requires greater financial flexibility.

Longer Loan Terms (60-84 Months): Advantages and Disadvantages

Longer loan terms result in lower monthly payments, making the loan more manageable for individuals with tighter budgets. However, this approach comes at the cost of paying significantly more interest over the loan’s duration. The extended repayment period means you’ll be paying for the vehicle for a considerably longer time.

- Advantage: Lower monthly payments.

- Advantage: Increased affordability.

- Disadvantage: Higher total interest paid.

- Disadvantage: Longer ownership period.

Calculating Your Monthly Payments

Understanding how your monthly payment is calculated is crucial for making informed decisions about your car loan. Numerous online calculators are available to estimate your monthly payment based on the loan amount, interest rate, and loan term. These calculators provide a valuable tool for comparing different loan options and making the best choice for your financial situation.

Factors Affecting Monthly Payments

Several factors influence your monthly payment, including the loan amount, interest rate, loan term, and any applicable fees. A higher loan amount, higher interest rate, and longer loan term will all lead to higher monthly payments. Conversely, a lower loan amount, lower interest rate, and shorter loan term will result in lower monthly payments. It’s important to consider these factors in relation to your budget and financial goals.

Negotiating Your Car Loan

Negotiating your car loan is a crucial step in securing the best possible terms. This involves comparing offers from multiple lenders to find the most favorable interest rate and loan term. Your credit score significantly impacts your negotiating power; a higher score opens doors to more competitive offers. Don’t hesitate to shop around and compare various options before committing to a specific loan.

Tips for Successful Negotiation

Thoroughly research different lenders and compare their interest rates, fees, and loan terms. Pre-qualify for a loan to understand your borrowing power before visiting dealerships. Having a pre-approved loan offer in hand strengthens your negotiating position. Don’t be afraid to walk away if the terms aren’t favorable. Remember, you’re in control of the negotiation process.

Beyond the Basics: Refinancing and Other Options

Refinancing your car loan might be a viable option if you secure a lower interest rate after initially taking out a loan. This can potentially lower your monthly payments or shorten the loan term. Explore all available options and compare them carefully to determine the most cost-effective approach.

Other financing options, such as leasing, offer alternative ways to acquire a vehicle. Leasing often involves lower monthly payments but doesn’t lead to vehicle ownership at the end of the term. Understanding the pros and cons of leasing versus buying is critical in making the right choice for your individual needs and preferences.

The decision to purchase a vehicle is a significant financial commitment, and understanding the intricacies of car loans is crucial for responsible financial management. Careful planning and consideration of various factors will ensure that you secure a loan that aligns with your financial capabilities and long-term goals.

Choosing the right car loan is a multifaceted process. Careful consideration of your credit score, loan amount, interest rate, and desired loan term is vital. Remember to shop around, compare offers, and negotiate to secure the most favorable terms possible. Ultimately, the length of your car loan is a decision that should be made with a clear understanding of your financial situation and future plans. Taking the time to understand all the factors involved will lead to a more informed decision and a more manageable repayment schedule. By making a well-informed choice, you can confidently drive off into the sunset, knowing you’ve secured a car loan that works for you. The process might seem daunting, but with careful planning and a thorough understanding of the available options, you can confidently navigate the complexities of car financing. This ensures a financially sound and fulfilling ownership experience.