Understanding Chase New Car Loan Rates

Unlock the secrets to securing the best Chase new car loan rates! Navigate the financing maze with ease and drive off in your dream car. Compare options, understand interest rates, and make a smart financial decision. Get started now!

Buying a new car is a significant financial decision. It’s an exciting time, filled with the thrill of choosing your dream vehicle. However, securing financing can often feel overwhelming. Understanding the intricacies of car loans, particularly Chase new car loan rates, is crucial to making a smart and informed purchase. This comprehensive guide will walk you through everything you need to know, from understanding interest rates to comparing different loan options and ultimately, securing the best deal for your needs.

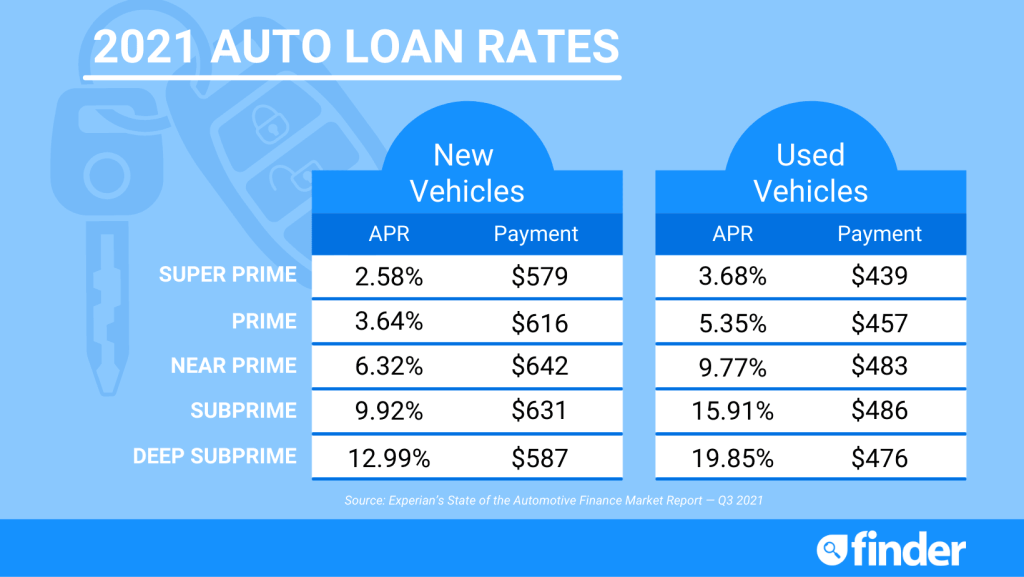

Chase, a major financial institution, offers a range of auto loan products. Their new car loan rates are competitive, but they vary depending on several key factors. These factors include your credit score, the type of vehicle you’re purchasing, the loan term, and the down payment amount. A higher credit score generally translates to lower interest rates, as lenders perceive you as a lower-risk borrower. Similarly, a larger down payment can also reduce your interest rate and the overall cost of the loan.

The loan term, or the length of time you have to repay the loan, also significantly impacts your monthly payments and the total interest paid. A shorter loan term means higher monthly payments but lower overall interest costs. Conversely, a longer loan term results in lower monthly payments but higher total interest costs. It’s a delicate balance to strike, and understanding this trade-off is paramount.

Factors Influencing Your Interest Rate

- Credit Score: Your credit score is the most significant factor determining your interest rate. A higher score (700 or above) typically qualifies you for the lowest rates.

- Loan Term: Shorter loan terms generally come with lower interest rates but higher monthly payments.

- Down Payment: A larger down payment reduces the loan amount, leading to lower interest rates and monthly payments.

- Vehicle Type: The type of vehicle you’re financing can influence the interest rate. Luxury vehicles may command higher rates than more economical options.

- Income and Debt-to-Income Ratio: Lenders assess your income and debt to determine your ability to repay the loan. A lower debt-to-income ratio improves your chances of securing a favorable rate.

How to Get the Best Chase New Car Loan Rates

Securing the best Chase new car loan rates requires proactive preparation and strategic planning. Before you even step foot in a dealership, take steps to improve your creditworthiness. This might involve paying down existing debts, correcting errors on your credit report, and maintaining a consistent payment history. A strong credit score is your most powerful negotiating tool.

Shop around and compare offers from various lenders. Don’t limit yourself to just Chase; explore other banks, credit unions, and online lenders. This allows you to compare rates and terms to find the most favorable option. Remember, the lowest interest rate isn’t always the best deal; consider the total cost of the loan over its lifespan.

Tips for Negotiating Favorable Rates

- Negotiate the price of the car first: Secure the best possible price before discussing financing to avoid overpaying for the vehicle.

- Shop around for pre-approval: Obtain pre-approval from multiple lenders to leverage competitive offers and strengthen your negotiating position.

- Consider a shorter loan term: While monthly payments might be higher, you’ll pay significantly less interest in the long run.

- Make a substantial down payment: A larger down payment reduces the loan amount, potentially lowering your interest rate.

- Maintain a good credit score: A high credit score is crucial for securing the best possible rates and terms.

Understanding the Loan Application Process

Applying for a Chase new car loan involves several steps. Typically, you’ll start by pre-qualifying online, providing basic information to receive an estimated interest rate. This doesn’t commit you to anything, but it gives you a good idea of what you might qualify for. Once you’ve found a vehicle, you’ll complete a formal application, providing more detailed financial information, including income, employment history, and debt obligations.

Chase will then review your application and assess your creditworthiness. The approval process can take a few days or even a week. Once approved, you’ll receive a loan agreement outlining the terms and conditions. Carefully review the document before signing to ensure you understand everything. Don’t hesitate to ask questions if anything is unclear.

Required Documentation

Be prepared to provide documentation to support your application. This typically includes proof of income (pay stubs, tax returns), identification (driver’s license, passport), and proof of residence (utility bill, bank statement). The specific documents required may vary, so it’s always best to contact Chase directly to confirm.

Alternatives to Chase New Car Loans

While Chase offers competitive rates, it’s always wise to explore alternative financing options. Credit unions often provide lower rates than banks, particularly for members. Online lenders also offer a convenient and streamlined application process, often with competitive rates. Comparing offers from multiple sources ensures you get the best possible deal.

Consider the overall cost of the loan, including interest rates, fees, and any potential penalties. Some lenders may have hidden fees or less favorable terms than others. Thoroughly research and compare offers to make an informed decision. Don’t rush the process; take your time to understand all the details before committing to a loan.

Protecting Yourself from Predatory Lending Practices

Be aware of predatory lending practices, which target vulnerable borrowers with high-interest rates and unfavorable terms. These practices can trap borrowers in a cycle of debt. Always read the fine print carefully, and don’t hesitate to ask questions if anything seems unclear or unfair. If a lender pressures you into accepting a loan you’re uncomfortable with, walk away;

Understand your rights as a borrower. Federal and state laws protect consumers from unfair lending practices. If you believe you’ve been a victim of predatory lending, contact your state’s attorney general’s office or the Consumer Financial Protection Bureau (CFPB) for assistance.