Determining Your Ideal Mortgage Percentage: A Comprehensive Guide

Unlock financial freedom! Discover the ideal percentage of your income to allocate for mortgage payments. We’ll help you navigate the complexities and find a comfortable balance for your unique financial situation. Don’t overextend yourself – plan smart!

The question of how much of your income should be dedicated to mortgage payments is a crucial one, influencing financial stability and overall well-being․ There’s no single magic number applicable to everyone; the ideal percentage depends on numerous personal factors․ Careful consideration of your individual financial situation, including debts, savings, and future aspirations, is paramount․ Understanding these factors allows for informed decision-making and a path towards comfortable homeownership․

The 28/36 Rule: A Common Guideline

A widely used benchmark is the 28/36 rule, a guideline established by lenders to assess a borrower’s ability to manage debt․ This rule suggests that your total monthly housing expenses (including mortgage principal, interest, taxes, and insurance – often abbreviated as PITI) should not exceed 28% of your gross monthly income․ Furthermore, your total debt payments (including credit cards, student loans, and car loans, in addition to your housing costs) shouldn’t exceed 36% of your gross monthly income․ While this rule isn’t a strict requirement for loan approval, it provides a solid framework for responsible borrowing․

Understanding the 28/36 Rule’s Limitations

While the 28/36 rule offers a helpful starting point, it’s crucial to recognize its limitations․ It’s a broad guideline, not a personalized financial plan․ It doesn’t account for unexpected expenses, savings goals, or variations in individual spending habits․ Someone with substantial savings might comfortably afford a higher percentage of their income dedicated to housing, while someone with significant other debts might need to allocate a smaller percentage․ Therefore, the 28/36 rule should be viewed as a general guideline, not an absolute truth․

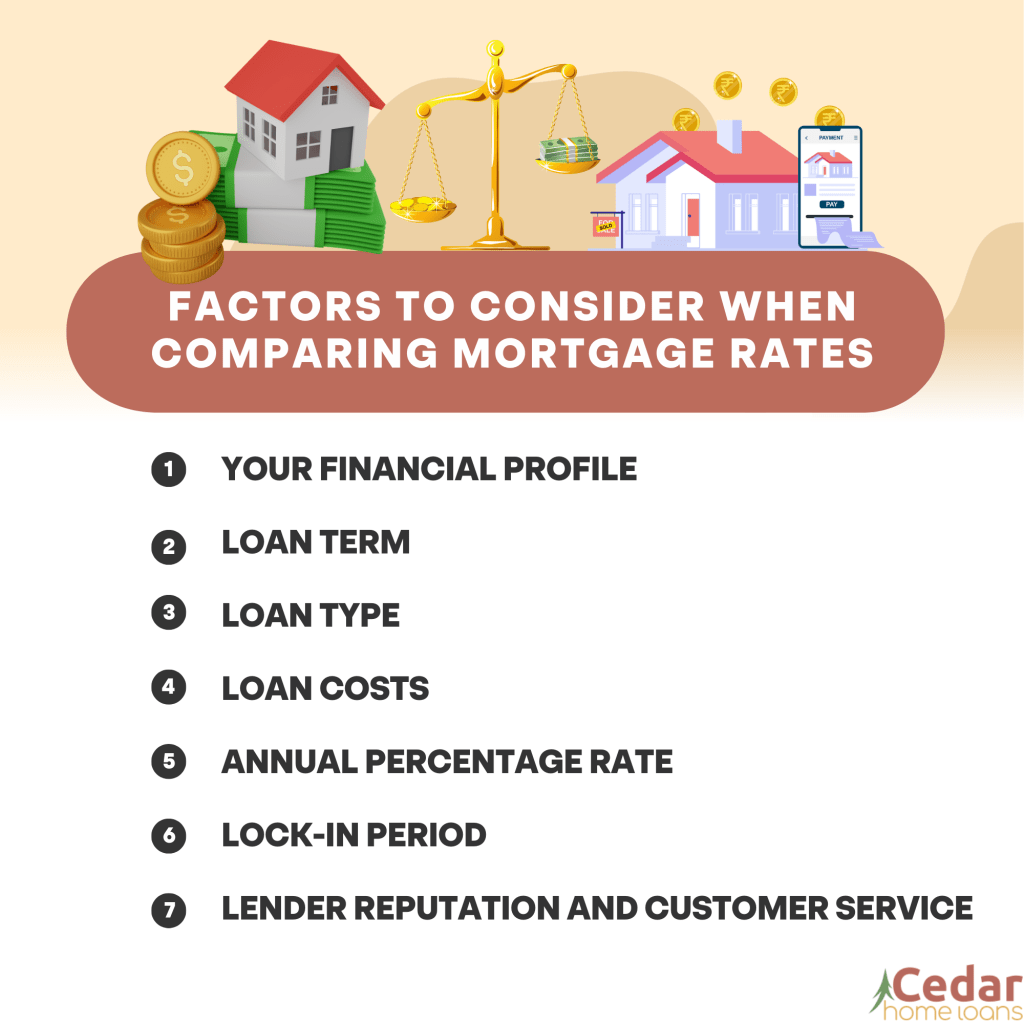

Factors Influencing Your Ideal Mortgage Percentage

Determining the right mortgage percentage for you requires a deeper dive into your personal finances․ Several key factors play a critical role in this decision:

- Gross Monthly Income: Your pre-tax income forms the foundation for calculating affordable mortgage payments․ A higher income generally allows for larger mortgage payments․

- Existing Debt: Outstanding loans and credit card balances significantly impact your debt-to-income ratio․ Higher debt limits your ability to take on a larger mortgage․

- Savings and Emergency Fund: A robust emergency fund provides a financial cushion against unexpected events․ Having sufficient savings allows for greater flexibility in mortgage payments․

- Future Financial Goals: Consider your long-term financial aspirations․ Do you plan to save for retirement, your children’s education, or other significant expenses? This influences how much you can comfortably allocate towards your mortgage․

- Interest Rates: Current mortgage interest rates directly affect your monthly payments․ Lower rates enable higher mortgage amounts for the same monthly payment․

- Lifestyle and Spending Habits: Your typical spending habits influence how much remains for mortgage payments after meeting essential living expenses․

- Down Payment: A larger down payment reduces the loan amount and consequently lowers monthly payments․

- Loan Term: Longer loan terms lead to lower monthly payments but result in higher overall interest paid․

Beyond the Numbers: A Holistic Approach

While numbers provide a framework, it’s vital to consider the bigger picture․ Think about your lifestyle and long-term aspirations․ Do you envision frequent travel? Are you planning to expand your family? These factors can impact your ability to manage a higher mortgage payment․ A comfortable mortgage payment should leave you with enough disposable income for unforeseen circumstances and personal enjoyment․ Financial stress from an overly ambitious mortgage can negatively impact your overall well-being․

Stress Testing Your Budget

Before committing to a mortgage, conduct a thorough budget analysis․ Track your expenses for a few months to gain a clear understanding of your spending habits․ Consider potential future expenses like home maintenance, property taxes, and potential interest rate increases․ This exercise helps you determine the maximum affordable monthly mortgage payment without compromising your financial stability․ It’s better to err on the side of caution and choose a mortgage that leaves room for unexpected expenses and financial flexibility․

Utilizing Online Mortgage Calculators

Several online mortgage calculators can assist you in determining your affordable mortgage payment․ These calculators typically require inputting your income, debt, desired down payment, interest rate, and loan term․ They then calculate estimated monthly payments, helping you gauge the potential impact on your budget․ Remember that these calculators provide estimates, and your actual payments might vary slightly depending on lender-specific fees and closing costs․

Seeking Professional Financial Advice

Consulting a financial advisor is highly recommended, particularly if you’re uncertain about your financial capacity for a mortgage․ A financial advisor can provide personalized guidance based on your specific circumstances, goals, and risk tolerance․ They can help you create a comprehensive financial plan that incorporates your mortgage within a larger framework of financial stability․ Their expertise can prevent costly mistakes and ensure you make informed decisions․

The Importance of Responsible Homeownership

Owning a home is a significant financial commitment․ Responsible homeownership involves more than just making monthly payments․ It requires diligent budgeting, proactive planning for home maintenance, and a commitment to long-term financial health․ Prioritizing responsible homeownership ensures you enjoy the benefits of homeownership without succumbing to financial strain․ Regularly reviewing your financial situation and adapting your budget as needed is key to managing your mortgage effectively․

- Regularly Review Your Budget: Life changes, and so do your finances․ Regular budget reviews help you adjust your spending and ensure your mortgage remains manageable․

- Plan for Home Maintenance: Unexpected repairs can strain your finances․ Setting aside a dedicated fund for home maintenance mitigates this risk․

- Explore Refinancing Options: If interest rates drop significantly, refinancing can lower your monthly payments․

- Consider Additional Income Streams: Supplementing your income can provide a buffer against financial uncertainties․

Ultimately, the percentage of your income dedicated to your mortgage is a personal decision․ There’s no one-size-fits-all answer․ By carefully considering the factors discussed above, utilizing available resources, and seeking professional guidance when needed, you can make an informed choice that aligns with your financial goals and ensures a secure and comfortable path to homeownership․ The process requires diligence, planning, and a commitment to responsible financial management․ Remember that responsible borrowing and prudent financial planning are key to long-term success in homeownership․ Prioritizing your financial well-being will pave the way for a stress-free and enjoyable homeownership experience․ Careful planning and a realistic approach to budgeting will undoubtedly contribute to a successful and rewarding journey․