Understanding and Calculating Your Mortgage Payment

Master mortgage calculations! Learn the secrets to understanding your monthly payments and budgeting effectively for your dream home. Unlock financial freedom today!

Buying a home is a significant financial undertaking. Understanding how to calculate a mortgage payment is crucial for budgeting and ensuring financial stability. This process involves several key factors, each playing a vital role in determining your monthly expenses. Let’s delve into the specifics and equip you with the knowledge to confidently navigate the mortgage calculation process.

Understanding the Key Components

Before diving into the calculations, it’s essential to grasp the core elements influencing your mortgage payment. These include the loan amount, interest rate, loan term, and property taxes and insurance (often bundled into your monthly payment).

Loan Amount (Principal)

This is the total amount you borrow from the lender to purchase the property. It’s usually the price of the house minus your down payment. A larger down payment reduces the loan amount and consequently, your monthly payment.

Interest Rate

The interest rate is the annual cost of borrowing money, expressed as a percentage. Lenders determine your interest rate based on various factors, including your credit score, the type of loan, and prevailing market conditions. A lower interest rate translates to lower monthly payments.

Loan Term

This is the length of time you have to repay the loan, typically expressed in years (e.g., 15 years, 30 years). Shorter loan terms result in higher monthly payments but significantly less interest paid over the life of the loan. Conversely, longer loan terms have lower monthly payments but accrue more interest overall.

Property Taxes and Homeowners Insurance

These costs are often included in your monthly mortgage payment through a process called escrow. Property taxes vary by location and are assessed based on the property’s value. Homeowners insurance protects your investment from damage or loss. These additional costs significantly impact your total monthly expense.

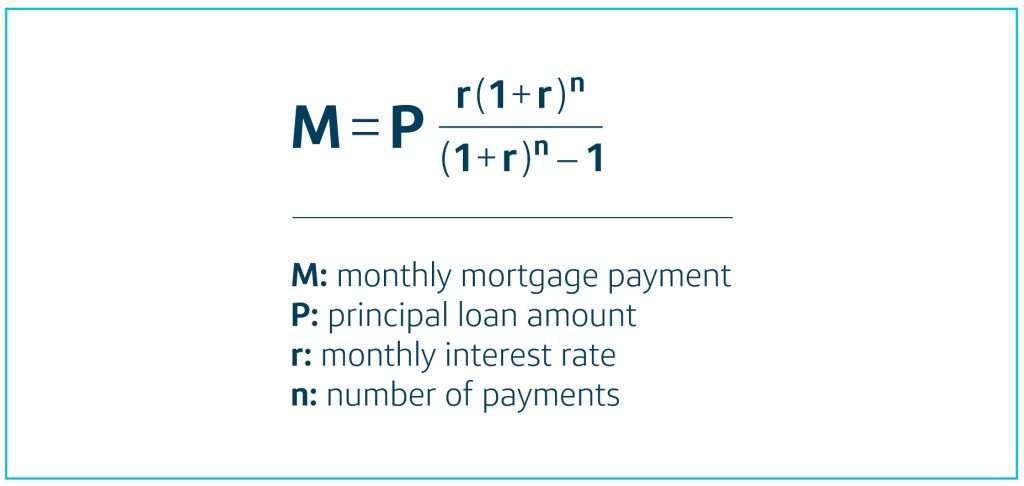

The Mortgage Payment Formula

While several online calculators simplify the process, understanding the underlying formula empowers you to make informed decisions. The most common formula used to calculate a monthly mortgage payment is based on the concept of amortization. This formula takes into account the principal, interest, loan term, and the number of payments per year. The formula is as follows:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly mortgage payment

- P = Principal loan amount

- i = Monthly interest rate (Annual interest rate divided by 12)

- n = Total number of payments (Loan term in years multiplied by 12)

This formula might seem daunting at first glance, but let’s break it down with an example.

Example Calculation

Let’s assume you’re buying a house for $300,000 with a 20% down payment, a 30-year mortgage at a 6% annual interest rate. First, calculate the principal:

Down payment: $300,000 * 0.20 = $60,000

Principal loan amount (P): $300,000 ⎯ $60,000 = $240,000

Next, we determine the monthly interest rate (i) and the total number of payments (n):

Monthly interest rate (i): 6% / 12 = 0.005

Total number of payments (n): 30 years * 12 months/year = 360

Now, we can plug these values into the formula:

M = $240,000 [ 0.005 (1 + 0.005)^360 ] / [ (1 + 0.005)^360 – 1]

Solving this equation (using a calculator or spreadsheet software) will provide the monthly mortgage payment (M). This calculation will give you only the principal and interest portion of your monthly payment.

Adding Property Taxes and Insurance

Remember, your actual monthly payment will be higher than the principal and interest calculation. You’ll need to factor in property taxes and homeowners insurance, which are usually included in your monthly payment through escrow. Obtain estimates for these costs from your lender or local tax assessor’s office. Add these monthly costs to the principal and interest payment to get your total monthly mortgage payment.

Using Online Mortgage Calculators

While understanding the formula is beneficial, numerous online mortgage calculators simplify the process. These tools allow you to input the loan amount, interest rate, loan term, and other factors to quickly calculate your estimated monthly payment. Several reputable websites offer free mortgage calculators. However, it’s crucial to compare results from multiple calculators to ensure accuracy.

Factors Affecting Your Mortgage Rate

Your credit score is a major determinant of your interest rate. A higher credit score often qualifies you for lower interest rates, resulting in lower monthly payments. Other factors influencing your interest rate include your debt-to-income ratio, the type of mortgage loan you choose (e.g., fixed-rate, adjustable-rate), and the prevailing economic conditions.

- Credit Score: A higher score usually means a better rate.

- Debt-to-Income Ratio: Lower ratios generally lead to better rates.

- Loan Type: Fixed-rate mortgages typically offer more stability.

- Market Conditions: Interest rates fluctuate based on economic factors.

Shopping for the Best Mortgage

It’s essential to shop around and compare offers from multiple lenders. Don’t settle for the first offer you receive. Compare interest rates, fees, and the overall terms of the loan to find the most favorable option. Consider factors like closing costs and any potential prepayment penalties.

Understanding how to calculate a mortgage is a pivotal step in the home-buying process. By grasping the key components and utilizing available resources, you can confidently assess your affordability and make informed financial decisions. Remember that this guide provides a general overview; consulting with a financial advisor is always recommended for personalized guidance.

Accurate mortgage calculations are essential for responsible homeownership. By leveraging the formula and available online tools, you’ll gain a clear picture of your financial obligations. Proper planning and understanding of the mortgage calculation process will pave the way for a smoother and more secure home-buying experience. Remember to account for all associated costs and explore various mortgage options before making a final decision. This thorough approach will ensure you find the best mortgage that suits your individual financial circumstances and long-term goals.