Understanding Mortgage Pre-Approval: Lifespan, Factors, and Renewal

Unlock your dream home! Get a mortgage pre-approval & confidently navigate the competitive market. Learn how long your pre-approval lasts and make your offer shine. Secure your future today!

Securing a mortgage pre-approval is a crucial first step in the home-buying process. It provides you with a clear picture of how much you can borrow‚ boosting your confidence when making offers. This pre-approval demonstrates to sellers that you’re a serious buyer‚ increasing your competitiveness in a potentially fast-paced market. However‚ the validity of your pre-approval isn’t indefinite. Understanding its lifespan is critical for navigating the home-buying journey successfully. This comprehensive guide will explore the typical duration‚ influencing factors‚ and strategies to maximize the usefulness of your pre-approval.

The Typical Lifespan of a Mortgage Pre-Approval

Generally‚ a mortgage pre-approval letter is valid for anywhere between 30 and 90 days. This timeframe can vary significantly depending on the lender and the specific circumstances of your application. Some lenders might offer a shorter validity period‚ while others may extend it for a longer duration. Always clarify the expiration date with your lender to avoid any last-minute surprises. It’s vital to remember this isn’t a guarantee of a loan; it’s simply an indication that you’ve met the lender’s preliminary requirements.

Factors Affecting Pre-Approval Validity

Several factors can influence how long your mortgage pre-approval remains active. These factors often interact‚ creating a complex picture of pre-approval duration. Understanding these influences allows you to better manage your home-buying timeline.

- Lender Policies: Each lender has its own internal policies regarding the validity of pre-approvals. Some lenders are more conservative‚ offering shorter periods‚ while others are more flexible.

- Credit Score Changes: Significant changes to your credit score after receiving your pre-approval can impact its validity. A drop in your score might necessitate a re-evaluation of your application.

- Changes in Employment or Income: A change in employment status or a significant decrease in income could invalidate your pre-approval. Lenders need to confirm your financial stability throughout the process.

- Property Appraisal: The actual appraisal of the property you intend to purchase plays a role. If the appraisal comes in lower than the purchase price‚ your loan amount might need to be adjusted‚ potentially affecting the pre-approval.

- Loan Program Type: Different loan programs‚ such as FHA‚ VA‚ or conventional loans‚ might have varying pre-approval validity periods.

- Market Conditions: Fluctuations in the housing market‚ including interest rate changes‚ can influence lender policies and the duration of pre-approvals.

Renewing or Extending Your Mortgage Pre-Approval

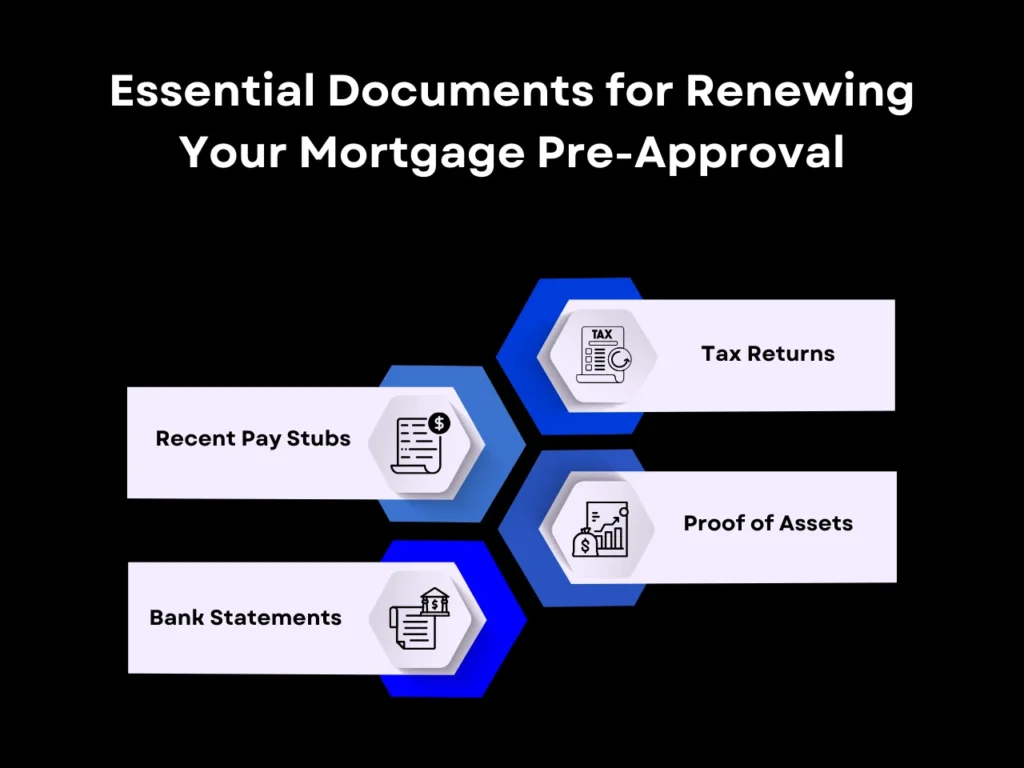

If your pre-approval is about to expire before you’ve successfully closed on a home‚ don’t panic. Most lenders offer the possibility of renewal or extension. Contact your lender well in advance of the expiration date to discuss your options. They will likely require an update on your financial situation‚ such as recent pay stubs and bank statements. Be prepared to answer any questions they might have regarding changes in your circumstances since your initial application.

Understanding the Difference Between Pre-qualification and Pre-approval

It’s important to distinguish between pre-qualification and pre-approval. Pre-qualification involves providing basic financial information to a lender‚ who then gives a rough estimate of how much you might be able to borrow. This is a less formal process and doesn’t involve a thorough credit check. In contrast‚ pre-approval entails a more in-depth review of your finances‚ including a credit report and verification of income and assets. A pre-approval letter is a much stronger indicator of your borrowing capacity and is highly valued by sellers.

Maximizing the Effectiveness of Your Mortgage Pre-Approval

To maximize the benefit of your mortgage pre-approval‚ stay organized and proactive. Keep meticulous records of your financial documents and promptly address any queries from your lender. Understanding the intricacies of the process will ensure you navigate it smoothly. Maintaining a strong credit score is essential‚ as it directly impacts your eligibility for a mortgage.

- Maintain a Strong Credit Score: Avoid opening new credit accounts or making large purchases that could negatively impact your credit score during the pre-approval period.

- Keep Financial Information Updated: Inform your lender of any changes in your employment‚ income‚ or significant financial transactions.

- Shop Around for the Best Rates: While you can receive a pre-approval from one lender‚ it’s beneficial to shop around and compare offers from multiple lenders to secure the most favorable interest rate and terms.

- Communicate Regularly with Your Lender: Keep open communication with your lender and promptly respond to any requests for additional information.

- Understand the Fine Print: Carefully review all documents provided by your lender and ask clarifying questions if anything is unclear.

Addressing Common Concerns About Mortgage Pre-Approvals

Many homebuyers have questions about the process of obtaining and maintaining a mortgage pre-approval. Let’s address some of the most frequently asked questions.

What happens if my circumstances change after pre-approval?

Significant changes in your financial situation‚ such as job loss or a large decrease in income‚ can affect your pre-approval. It’s crucial to immediately inform your lender of any such changes. They may require an updated application or potentially withdraw the pre-approval.

Can I get pre-approved with bad credit?

While it’s more challenging‚ it’s not impossible to get pre-approved with less-than-perfect credit. You might need to work with a lender specializing in subprime mortgages‚ and you may qualify for higher interest rates. Improving your credit score before applying is highly recommended.

How does a pre-approval affect my credit score?

The impact on your credit score is generally minimal. Most lenders perform a “soft pull” of your credit‚ which doesn’t affect your credit score significantly. However‚ a “hard pull” might occur during the formal loan application process‚ which can have a small‚ temporary impact.

What if the appraisal comes in lower than the purchase price?

If the property appraisal is lower than the agreed-upon purchase price‚ you may need to renegotiate the purchase price with the seller‚ increase your down payment‚ or explore alternative financing options. Your lender will guide you through these options.

Is a pre-approval a guarantee of a loan?

No‚ a pre-approval is not a guarantee that you will receive a mortgage. It simply indicates that you meet the lender’s preliminary requirements. The final loan approval is contingent on several factors‚ including a satisfactory appraisal and verification of all financial information.