Understanding Mortgage Prequalification: What It Is and Why It Matters

Buying a home? Pre-approval gives you the power to shop confidently, knowing your budget. Avoid disappointment and find your perfect place faster with mortgage pre-approval. Start your homeownership journey now!

Buying a home is a significant financial undertaking. It’s a process filled with excitement, anticipation, and, let’s be honest, a fair amount of stress. One of the crucial first steps in this journey is getting prequalified for a mortgage. This process provides you with a realistic understanding of your borrowing power, allowing you to shop for homes within your financial reach, saving you time and preventing potential disappointment later on.

Mortgage prequalification is a preliminary assessment of your ability to secure a home loan. Unlike a full mortgage application, prequalification doesn’t involve a deep dive into your credit history or a formal appraisal of the property. Instead, it provides a general estimate of how much you can borrow based on the information you provide to the lender. This estimate, often expressed as a loan amount range, gives you a clear picture of your budget before you start house hunting. Knowing your prequalification amount prevents you from falling in love with a house that is financially unattainable.

The benefits of prequalification are numerous. It strengthens your negotiating position when making an offer on a home, demonstrating to sellers that you are a serious buyer with the financial capacity to close the deal. It also helps you refine your home search, focusing your efforts on properties within your comfortable borrowing limit. Furthermore, prequalification allows you to explore different mortgage options and compare interest rates from various lenders, potentially saving you thousands of dollars over the life of the loan.

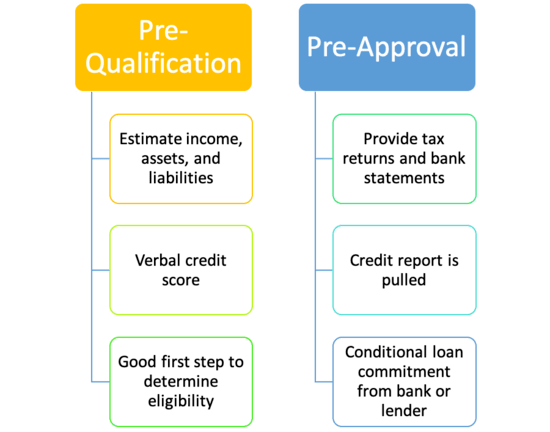

The Difference Between Prequalification and Preapproval

It’s essential to understand the difference between prequalification and preapproval. Prequalification is a quicker, less intensive process based on the information you provide. Preapproval, on the other hand, involves a more thorough review of your financial documents, including credit reports and bank statements. Preapproval provides a more concrete picture of your borrowing capacity and significantly strengthens your offer when purchasing a home. While prequalification gives you a general idea, preapproval is a more formal commitment from the lender.

Step-by-Step Guide to Getting Prequalified for a Mortgage

The process of getting prequalified is relatively straightforward. However, gathering the necessary documents beforehand will streamline the process considerably. Here’s a step-by-step guide to help you navigate this important phase of home buying.

1. Gather Your Financial Documents

Before contacting a lender, gather the following documents. Having these ready will expedite the prequalification process significantly. The documents typically include your income tax returns (for the past two years), pay stubs (from the past two months), bank statements (for the past six months), and any other relevant documentation showcasing your income and assets. This also includes information about any outstanding debts such as credit card balances and student loans.

2. Choose a Lender

Research different lenders – banks, credit unions, and mortgage brokers – to find the best fit for your needs. Compare interest rates, fees, and customer service reviews. Consider factors such as the lender’s reputation, the types of loans they offer, and their responsiveness to your inquiries. Don’t hesitate to contact multiple lenders to compare their offerings. A little research can save you significant money in the long run.

3. Complete the Prequalification Application

Once you’ve chosen a lender, you’ll need to complete their prequalification application. This typically involves providing basic personal information, employment details, and an overview of your financial situation. Be honest and accurate when completing the application; any discrepancies could delay or even jeopardize the process. The lender will use this information to provide you with a preliminary estimate of your borrowing power.

4. Review Your Prequalification Letter

After completing the application, the lender will provide you with a prequalification letter. This letter outlines the estimated loan amount you can borrow, the interest rate you might qualify for, and any other relevant conditions. Carefully review this letter to ensure the information is accurate and aligns with your expectations. Keep this letter handy; it will be a valuable tool when making offers on properties.

5. Shop Around and Compare

Don’t stop with just one lender. Use your prequalification letter to compare offers from multiple lenders. Different lenders may offer varying interest rates and loan terms. Comparing these offers allows you to secure the most favorable financing terms for your home purchase. Remember, even small differences in interest rates can significantly impact the total cost of your mortgage over time.

Factors Affecting Mortgage Prequalification

Several factors influence your mortgage prequalification. Understanding these factors allows you to better prepare and improve your chances of securing a favorable loan.

- Credit Score: Your credit score is a critical factor. A higher credit score typically translates to better interest rates and loan terms.

- Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI generally improves your chances of prequalification.

- Income Stability: Lenders prefer borrowers with stable income sources. Consistent employment history strengthens your application.

- Down Payment: A larger down payment typically results in more favorable loan terms and potentially lower interest rates.

- Type of Mortgage: Different mortgage types (e.g., conventional, FHA, VA) have varying eligibility requirements.

Improving Your Chances of Prequalification

If you’re aiming for a successful prequalification, focus on improving your financial standing. This includes paying down existing debts, improving your credit score, and ensuring stable income. These steps can significantly enhance your chances of securing a favorable mortgage.

Consider reviewing your credit report for any errors. Dispute any inaccuracies with the credit bureaus to improve your score. Paying off high-interest debt, such as credit card balances, reduces your DTI, making you a more attractive borrower. Maintaining a stable employment history showcases your financial responsibility to potential lenders;

Understanding the Fine Print: Fees and Closing Costs

While prequalification focuses on your borrowing capacity, remember to factor in closing costs and other fees associated with purchasing a home. These costs can significantly add to the overall expense, so ensure you budget accordingly. These costs vary depending on the location, the lender and the type of mortgage.

The Importance of Professional Advice

Navigating the mortgage prequalification process can be complex. Seeking advice from a qualified financial advisor or mortgage broker can prove invaluable. These professionals can provide personalized guidance based on your specific financial situation and help you make informed decisions. They can also help you understand the nuances of different mortgage products and assist you in finding the best financing options for your needs.

- Financial Advisor: Offers comprehensive financial planning, including guidance on mortgages.

- Mortgage Broker: Acts as an intermediary, connecting you with multiple lenders.

- Real Estate Agent: Provides insights into the local housing market and connects you with lenders.

Getting prequalified for a mortgage is a crucial first step in the home-buying process. It empowers you with knowledge, allowing you to confidently navigate the complexities of securing a home loan. By understanding the process, gathering the necessary documents, and seeking professional advice when needed, you’ll be well-equipped to embark on your homeownership journey with confidence and peace of mind. Remember, thorough preparation is key to a smooth and successful home-buying experience. Take your time, do your research, and don’t hesitate to ask questions. The entire process can seem daunting, but with careful planning, you’ll be one step closer to owning your dream home. The rewards of homeownership are immense, making the effort well worth it. Your new home awaits!