Understanding PennyMac Mortgage Investment Trust

Unlock the secrets of PennyMac Mortgage Investment Trust! Find the stock symbol, understand its investment strategies, and navigate the financial markets with confidence. Learn more now!

PennyMac Mortgage Investment Trust, a prominent player in the mortgage-backed securities market, operates under a specific stock symbol. Understanding this symbol is crucial for investors seeking to track its performance and participate in its offerings. This comprehensive guide will delve into the intricacies of PennyMac’s symbol, its operational structure, and the significance of its presence within the financial landscape. We will explore the company’s investment strategies, risk factors, and provide a concise overview of its position within the broader mortgage market. The information provided here is for educational purposes and should not be considered financial advice.

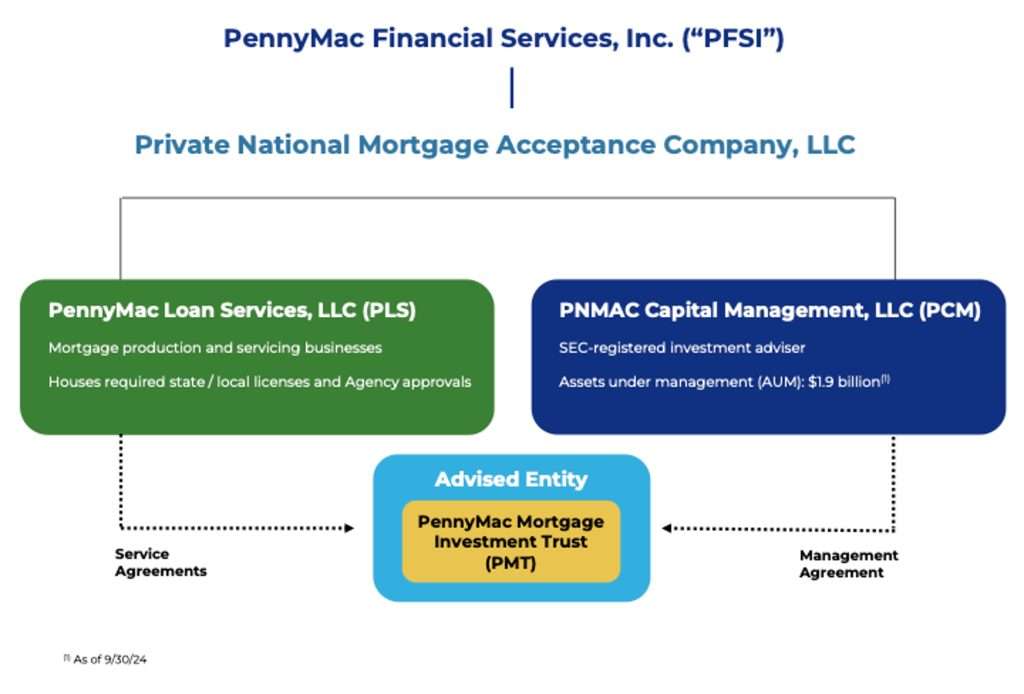

PennyMac Mortgage Investment Trust (PMT) is a real estate investment trust (REIT) that primarily invests in mortgage-related assets. These assets range from residential mortgage-backed securities to other mortgage-related investments. The company’s core business model revolves around acquiring, managing, and ultimately profiting from these mortgage-backed securities. This involves careful analysis of market trends, risk assessment, and strategic portfolio management to maximize returns for shareholders. Their expertise lies in navigating the complexities of the mortgage market, identifying opportunities for growth, and mitigating potential risks.

Investment Strategies and Portfolio Management

PennyMac employs a diversified investment strategy, carefully balancing risk and return across its portfolio. This means they don’t put all their eggs in one basket, but rather spread investments across various mortgage-backed securities and other related assets. This diversification helps to mitigate the impact of losses in any single investment. Their portfolio management team conducts thorough due diligence on each potential investment, assessing its risk profile and projected returns before committing capital. This meticulous approach is integral to their long-term success and stability.

The company’s expertise in analyzing mortgage-backed securities allows them to identify undervalued opportunities and capitalize on market inefficiencies. They leverage advanced analytical models and a deep understanding of market dynamics to make informed investment decisions. Their success hinges on accurately predicting market trends and adapting their portfolio accordingly to maintain optimal performance. This requires a highly skilled team capable of reacting swiftly to changing market conditions.

Risk Management and Regulatory Compliance

Operating within the highly regulated financial industry, PennyMac prioritizes robust risk management practices. This includes implementing comprehensive internal controls and complying with all relevant regulatory requirements. They employ a dedicated risk management team responsible for identifying, assessing, and mitigating potential risks across all aspects of their operations. This rigorous approach ensures the long-term viability and stability of the company, fostering confidence among investors.

Compliance with regulatory standards is paramount for PennyMac. They adhere strictly to all applicable laws and regulations, ensuring transparency and accountability in their operations. This commitment to ethical conduct and compliance builds trust with investors, regulators, and other stakeholders. Regular audits and internal reviews further reinforce their dedication to maintaining the highest standards of corporate governance.

The Significance of the Stock Symbol

The stock symbol for PennyMac Mortgage Investment Trust is PMT. This simple three-letter code represents the company’s publicly traded stock on the New York Stock Exchange (NYSE). This symbol is essential for investors wishing to buy, sell, or track the performance of PennyMac’s stock. It serves as a concise identifier, simplifying the process of accessing real-time market data and executing trades.

Understanding the symbol is crucial for investors seeking to add PennyMac to their portfolios. It allows them to easily locate the company’s stock information on various financial platforms, including brokerage websites and financial news sources. This accessibility is vital for informed decision-making and effective portfolio management. Without the symbol, locating and tracking the company’s stock performance would be significantly more challenging.

Accessing Information Using the Stock Symbol

The symbol “PMT” is the key to unlocking a wealth of information about PennyMac Mortgage Investment Trust. Investors can utilize this symbol to access real-time stock quotes, historical price data, company news, financial statements, and analyst ratings through various online resources. This information is invaluable for making informed investment choices and monitoring the performance of their investment in PennyMac.

- Brokerage Platforms: Most online brokerage accounts allow you to search for stocks using their symbols. Simply enter “PMT” to view real-time quotes, charts, and other relevant information.

- Financial News Websites: Major financial news websites use stock symbols to display stock prices, news headlines, and analysis related to specific companies. Searching for “PMT” will provide up-to-date information on PennyMac.

- Company Website: PennyMac’s investor relations section on their official website will often provide access to financial reports, press releases, and other important information for shareholders;

Investing in PennyMac: Considerations and Risks

While PennyMac offers potential for significant returns, investing in any stock involves inherent risks. It’s essential to conduct thorough research and understand the factors that can influence the company’s performance before making any investment decisions. These factors include broader economic conditions, interest rate changes, and fluctuations in the housing market.

Interest rate fluctuations, for instance, can have a substantial impact on the value of mortgage-backed securities. Rising interest rates can lead to lower demand for these securities, potentially affecting PennyMac’s profitability. Conversely, falling interest rates can stimulate demand and boost its performance. Therefore, investors should consider the potential impact of interest rate changes on PennyMac’s investment portfolio.

Fluctuations in the broader housing market also play a crucial role. A strong housing market generally supports higher demand for mortgages and mortgage-backed securities, benefiting PennyMac. Conversely, a downturn in the housing market can negatively impact the value of their assets and reduce profitability. Therefore, monitoring the overall health of the housing market is a necessary component of investing in PennyMac.

Diversification and Risk Mitigation

As with any investment, diversification is key to mitigating risk. Investors should not concentrate all their assets in a single stock, including PennyMac. A well-diversified portfolio reduces the impact of losses in any single investment. Spreading investments across various asset classes and sectors helps to cushion against market volatility and reduce overall portfolio risk.

Before investing in PennyMac or any other company, it is strongly recommended to consult with a qualified financial advisor. They can provide personalized advice based on your individual financial situation, risk tolerance, and investment goals. Their expertise can help you make informed decisions and create a portfolio aligned with your long-term financial objectives. Never invest more than you can afford to lose.

- Thoroughly research the company’s financial performance and future prospects.

- Consider your own risk tolerance before making any investment decisions.

- Diversify your investments to minimize risk.

- Consult with a qualified financial advisor for personalized advice.

PennyMac Mortgage Investment Trust, with its stock symbol PMT, occupies a significant position in the mortgage-backed securities market. Understanding its investment strategies, risk factors, and the accessibility of information through its stock symbol is crucial for potential investors. The company’s performance is intrinsically linked to broader market conditions, highlighting the importance of thorough research and diversification in any investment strategy. Remember, responsible investing requires careful consideration and a clear understanding of both the opportunities and the potential risks involved. Careful planning and consultation with financial professionals are highly recommended before embarking on any investment journey. The information provided herein is for educational purposes only and does not constitute financial advice. Always conduct your own due diligence before making any investment decisions.