Understanding Today’s Mortgage Interest Rates

Unlock the secrets to navigating today’s mortgage interest rates. Find the perfect loan, understand the factors influencing rates, and secure the best deal for your dream home. Start your journey to homeownership now!

Navigating the world of mortgages can feel overwhelming‚ particularly when faced with the ever-shifting landscape of interest rates. Understanding today’s rates is paramount for prospective homebuyers. This guide will delve into the complexities of current mortgage interest rates‚ exploring the factors that influence them and offering insights into securing the most favorable terms. We’ll also discuss various mortgage types and strategies for finding the best deal for your individual circumstances.

Understanding the Current Mortgage Interest Rate Landscape

Mortgage interest rates are a dynamic element of the financial market‚ influenced by a multitude of economic factors. The Federal Reserve’s monetary policy plays a significant role‚ with interest rate hikes generally leading to higher mortgage rates. Inflation also exerts considerable pressure‚ as higher inflation often prompts the Federal Reserve to increase interest rates to cool down the economy. These adjustments impact the cost of borrowing‚ directly affecting what you’ll pay on your mortgage.

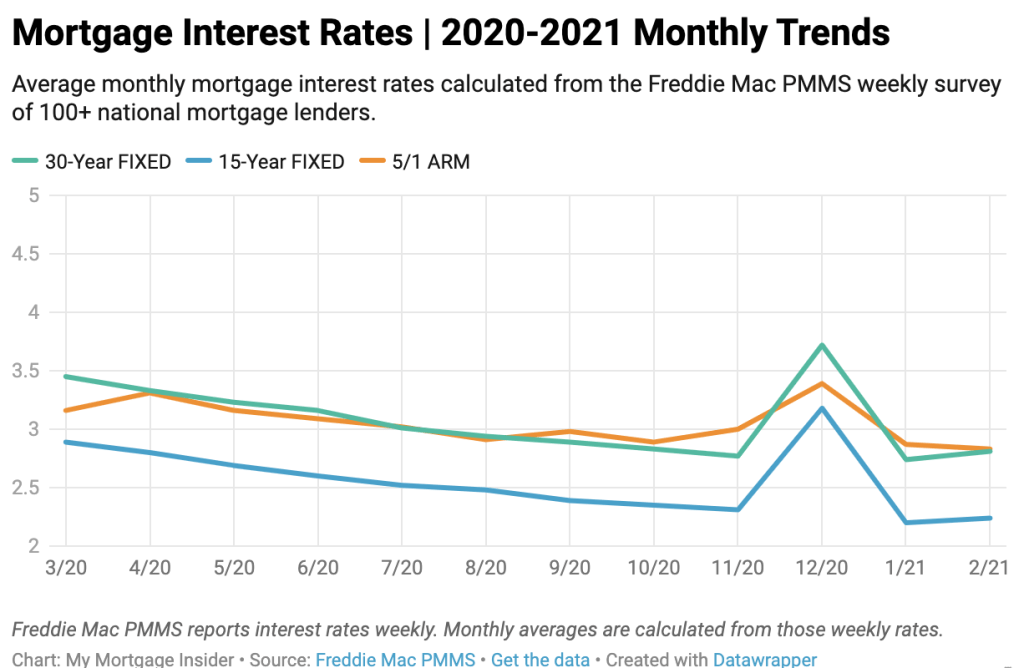

Beyond these macroeconomic factors‚ individual lender policies and your personal creditworthiness significantly influence the interest rate you’ll receive. Lenders assess your credit score‚ debt-to-income ratio‚ and the down payment you can offer. A higher credit score and a lower debt-to-income ratio typically translate to a lower interest rate‚ while a larger down payment might also secure a better rate. The type of mortgage you choose – a 30-year fixed-rate mortgage‚ a 15-year fixed-rate mortgage‚ an adjustable-rate mortgage (ARM)‚ or something else – will also affect the interest rate.

Factors Influencing Mortgage Rates

- Federal Reserve Policy: The Federal Reserve’s actions directly impact interest rates.

- Inflation: High inflation generally leads to higher interest rates.

- Economic Growth: Strong economic growth can sometimes lead to higher rates.

- Credit Score: A higher credit score usually results in a lower interest rate.

- Debt-to-Income Ratio: A lower debt-to-income ratio is preferred by lenders.

- Loan-to-Value Ratio (LTV): A higher down payment (lower LTV) often secures a better rate.

- Mortgage Type: Different mortgage types carry different interest rates.

- Market Conditions: Overall market conditions and investor sentiment play a role.

Types of Mortgages and Their Associated Rates

The mortgage market offers a variety of options‚ each with its unique features and interest rate implications. Fixed-rate mortgages provide stability with predictable monthly payments‚ while adjustable-rate mortgages (ARMs) offer potentially lower initial rates but carry the risk of rate fluctuations. Understanding the differences is crucial for making an informed decision.

Fixed-Rate Mortgages

Fixed-rate mortgages‚ as the name suggests‚ maintain a consistent interest rate throughout the loan term. This predictability makes budgeting easier‚ and it eliminates the uncertainty associated with fluctuating rates. However‚ the initial interest rate might be slightly higher than that of an ARM at the outset.

Adjustable-Rate Mortgages (ARMs)

ARMs offer an initial interest rate that’s often lower than that of a fixed-rate mortgage. However‚ this rate can adjust periodically based on market conditions. While this can lead to lower payments initially‚ it also introduces uncertainty as your payments could increase over time. ARMs are generally riskier but can be advantageous for those who plan to sell their home within a shorter timeframe.

Other Mortgage Types

Beyond fixed-rate and adjustable-rate mortgages‚ there are other specialized options such as FHA loans (Federal Housing Administration)‚ VA loans (Department of Veterans Affairs)‚ and USDA loans (United States Department of Agriculture). These programs often cater to specific borrowers and may have different eligibility criteria and interest rate structures. Researching these options is essential to identify the best fit for your financial profile.

Finding the Best Mortgage Interest Rate

Securing a favorable mortgage interest rate requires diligent research and strategic planning. Comparison shopping is critical‚ involving contacting multiple lenders to compare their offerings. Pre-qualifying for a mortgage beforehand gives you a clearer picture of what you can afford and strengthens your negotiating position. Consider factors such as closing costs and any associated fees when comparing overall costs.

Improving your credit score before applying for a mortgage can significantly impact the interest rate you receive. Paying down existing debt and maintaining a responsible credit history are crucial steps. A strong credit score demonstrates financial responsibility to lenders‚ leading to more favorable terms.

Finally‚ consider working with a mortgage broker. A broker can access a wide range of lenders and negotiate on your behalf‚ potentially securing a better rate than you could obtain independently. They can also guide you through the complex process and help you understand all the associated costs.

Tips for Securing a Favorable Mortgage Rate

- Shop Around: Compare offers from multiple lenders.

- Improve Your Credit Score: A higher score means better rates.

- Increase Your Down Payment: A larger down payment often leads to lower rates.

- Consider a Shorter Loan Term: Shorter terms usually mean lower rates.

- Pre-qualify for a Mortgage: Understand your borrowing power before you start shopping.

- Work with a Mortgage Broker: A broker can help you find the best options.

- Negotiate: Don’t be afraid to negotiate with lenders.

The Importance of Understanding Your Mortgage Costs

Beyond the interest rate itself‚ it’s crucial to understand all associated costs. Closing costs‚ which are fees paid at the closing of the mortgage‚ can significantly impact the overall cost of your home purchase. These costs can include appraisal fees‚ title insurance‚ and loan origination fees. It is vital to factor these additional costs into your budget when planning your home purchase.

Furthermore‚ private mortgage insurance (PMI) may be required if your down payment is less than 20% of the home’s purchase price. PMI protects the lender in case of default and adds to your monthly mortgage payments. Understanding these additional costs helps ensure you have a realistic budget for homeownership.