Bitcoin Price 2014: A Year of Volatility and Transformation

Remember 2014? The bitcoin price 2014 went CRAZY! Discover the drama, the crashes, and what it all means for crypto today. Get the inside scoop!

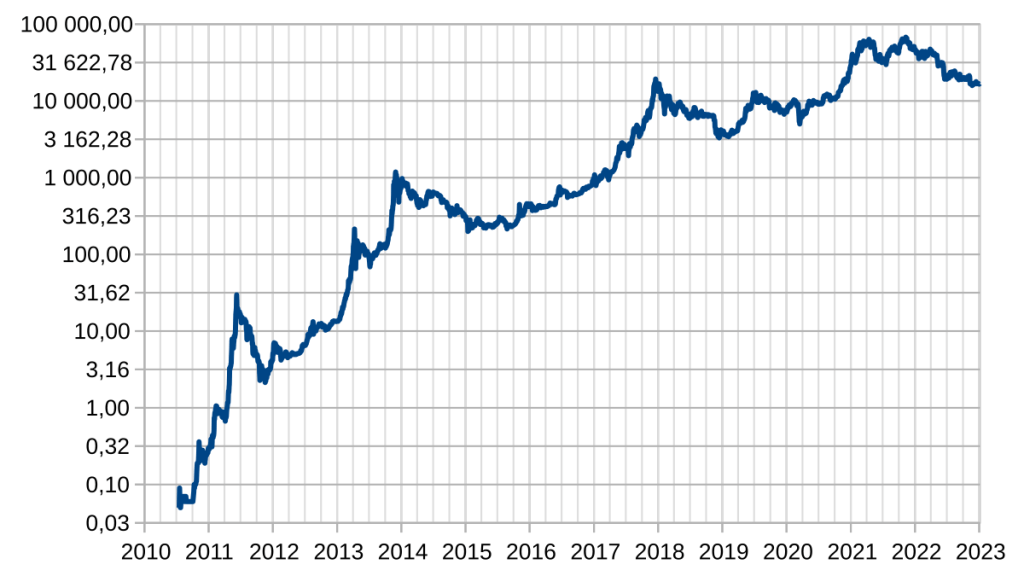

The year 2014 was a turbulent one for Bitcoin, marked by significant price swings, evolving regulatory landscapes, and growing mainstream awareness. The bitcoin price 2014 experienced a rollercoaster ride, beginning with cautious optimism and ultimately leading to a substantial correction from its late 2013 peak. This period was pivotal in shaping the narrative around Bitcoin and its long-term potential. Understanding the factors influencing the bitcoin price 2014 is crucial for grasping the cryptocurrency’s subsequent development and its place in the global financial ecosystem.

Key Events Influencing the Bitcoin Price in 2014

- Mt. Gox Collapse: The infamous collapse of Mt; Gox, one of the largest Bitcoin exchanges at the time, sent shockwaves through the community. The loss of hundreds of thousands of bitcoins significantly eroded investor confidence and contributed to a sharp decline in price.

- Increased Regulatory Scrutiny: Governments worldwide began to pay closer attention to Bitcoin, leading to increased regulatory scrutiny. While some welcomed regulation as a sign of legitimacy, others feared it would stifle innovation and limit Bitcoin’s potential.

- Growing Institutional Interest: Despite the challenges, 2014 also saw growing interest in Bitcoin from institutional investors. This interest, though nascent, signaled a potential shift towards greater mainstream adoption.

The Impact of Mt. Gox

The Mt. Gox collapse was arguably the most significant event affecting the Bitcoin price 2014. The exchange’s failure not only resulted in substantial financial losses for users but also exposed vulnerabilities in the nascent Bitcoin infrastructure. The lack of regulation and security measures at Mt. Gox highlighted the risks associated with early cryptocurrency exchanges and prompted calls for greater oversight.

Price Fluctuations and Market Sentiment

Throughout 2014, the Bitcoin price experienced significant fluctuations. Early in the year, the price continued its correction from the late 2013 peak. While there were periods of relative stability and even minor rallies, the overall trend was downward. Market sentiment was often driven by news related to Mt. Gox, regulatory developments, and general uncertainty surrounding Bitcoin’s future.

The market was highly sensitive to news and events. Any negative news, such as regulatory crackdowns or security breaches, could trigger immediate sell-offs. Conversely, positive news, such as announcements of institutional investment or acceptance by major retailers, could lead to temporary price increases.

A Turning Point?

Despite the challenges and price declines, 2014 was also a year of transformation for Bitcoin. The collapse of Mt. Gox forced the industry to address security and regulatory concerns. The growing interest from institutional investors, even in its early stages, suggested a long-term potential for Bitcoin beyond its use as a niche currency. This was the period where Bitcoin started to evolve into something more than just a digital currency.

Looking back, it’s clear that 2014 was a crucial year in Bitcoin’s history. It was a year of volatility, uncertainty, and ultimately, resilience. The lessons learned during this period helped shape the industry’s development and laid the groundwork for its subsequent growth. That’s why the bitcoin price 2014 is so important to understand.

LONG-TERM IMPLICATIONS AND LESSONS LEARNED

The tumultuous journey of Bitcoin in 2014 provided invaluable lessons for the cryptocurrency industry. The need for robust security measures, transparent exchange practices, and clear regulatory frameworks became undeniably apparent. The events of that year spurred the development of more secure wallets, more reliable exchanges, and a greater emphasis on compliance.

– Improved Security: The vulnerabilities exposed by Mt. Gox led to significant advancements in Bitcoin security, including multi-signature wallets and cold storage solutions;

– Enhanced Exchange Practices: New exchanges emerged with a focus on transparency, security audits, and regulatory compliance.

– Greater Regulatory Clarity: Governments around the world began to develop more comprehensive regulatory frameworks for cryptocurrencies, providing greater legal certainty for businesses and investors.

THE EVOLUTION OF THE BITCOIN NARRATIVE

The narrative surrounding Bitcoin also evolved significantly in 2014. While initially viewed by some as a get-rich-quick scheme or a tool for illicit activities, Bitcoin began to be recognized as a potentially transformative technology with broader applications. The focus shifted from short-term price speculation to long-term value creation and the potential of blockchain technology to revolutionize various industries.

This evolution was driven by several factors, including the growing awareness of Bitcoin’s underlying technology, the increasing number of real-world use cases, and the growing interest from institutional investors. The narrative also benefited from the efforts of Bitcoin advocates who worked to educate the public and policymakers about the technology’s potential benefits.

LOOKING AHEAD: FROM 2014 TO THE PRESENT

The lessons learned from the 2014 Bitcoin experience continue to shape the cryptocurrency landscape today. The industry has become more mature, more regulated, and more secure. While volatility remains a characteristic of the Bitcoin market, the underlying technology and the ecosystem surrounding it have become significantly more robust.

The foundations laid in 2014 paved the way for the subsequent growth and adoption of Bitcoin and other cryptocurrencies. The challenges and setbacks experienced during that year ultimately strengthened the industry and helped to build a more sustainable and resilient ecosystem. As we reflect on the bitcoin price 2014, it serves as a reminder of the importance of innovation, regulation, and responsible investment in the ever-evolving world of cryptocurrency.