Chase Used Car Loan Rates: A Comprehensive Guide

Thinking about a used car loan with Chase? Let’s decode those Chase used car loan rates, compare options, and get you cruising toward the best deal! Don’t get stuck with a lemon!

Securing a used car loan can feel like navigating a complex maze, especially when trying to understand the intricacies of interest rates and loan terms․ For many, Chase is a familiar name in the world of finance, prompting the question: are Chase used car loan rates competitive and right for you? Understanding the factors influencing these rates, comparing them with alternative options, and knowing how to prepare your application are crucial steps in making an informed decision․ This exploration will delve into the nuances of securing a Chase used car loan and provide guidance to help you drive away with a deal that fits your budget and financial goals․

Understanding Chase Used Car Loan Rates

Chase, as a major financial institution, offers used car loans with rates influenced by several key factors․ These factors typically include:

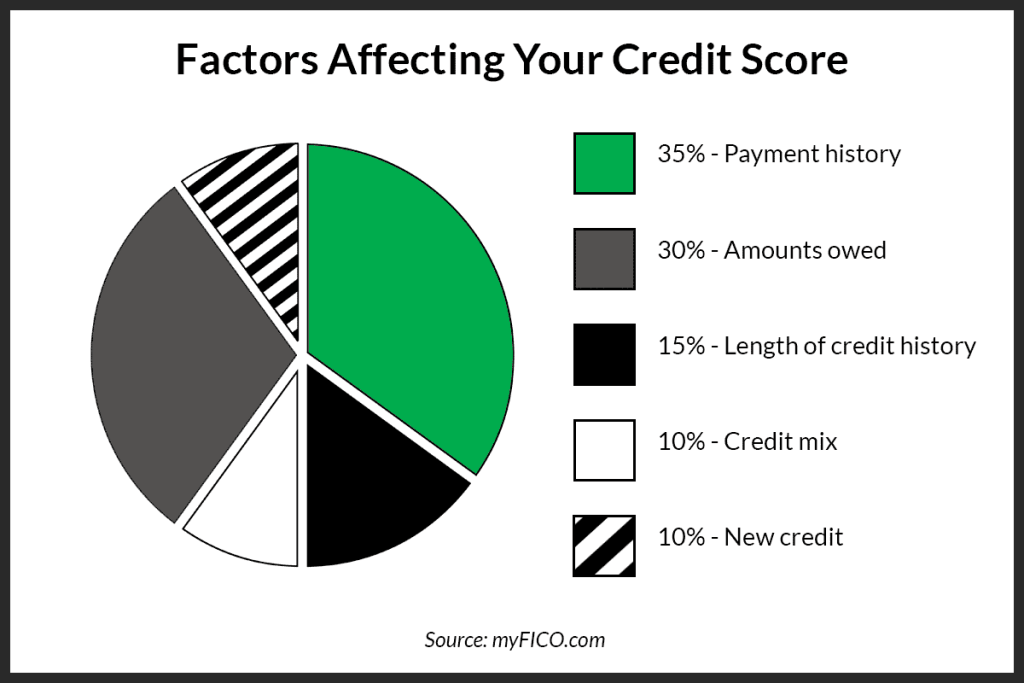

- Credit Score: A higher credit score usually translates to lower interest rates․ Lenders see borrowers with good credit as less risky․

- Loan Term: Shorter loan terms often come with lower interest rates, but higher monthly payments․ Longer terms offer lower monthly payments but accrue more interest over time․

- Vehicle Age and Mileage: Older vehicles or those with high mileage may be considered riskier to finance, potentially leading to higher rates․

- Down Payment: A larger down payment can reduce the loan amount, potentially lowering your interest rate․

Comparing Chase with Other Lenders

Before settling on a Chase used car loan, it’s wise to compare their rates with those offered by other lenders․ This comparison should include:

- Banks: Local and national banks often offer competitive rates․

- Credit Unions: Credit unions are known for potentially offering lower interest rates to their members․

- Online Lenders: Numerous online lenders specialize in auto loans and can provide quick quotes․

Example Comparison Table

| Lender | APR Range (Estimated) | Loan Term Options |

|---|---|---|

| Chase | 6․0% ౼ 15․0% | 24 ౼ 72 months |

| Credit Union A | 5․5% ⎻ 14․5% | 24 ౼ 84 months |

| Online Lender B | 6․5% ౼ 16․0% | 36 ⎻ 60 months |

Preparing Your Application

To improve your chances of securing a favorable rate on a used car loan, preparation is key․ Here’s what you can do:

- Check Your Credit Report: Review your credit report for any errors and address them before applying․

- Gather Financial Documents: Collect proof of income, such as pay stubs and bank statements․

- Determine Your Budget: Calculate how much you can realistically afford each month;

- Shop Around: Get pre-approved by multiple lenders to compare offers․

Negotiating Your Loan

Don’t be afraid to negotiate! Once you have pre-approval offers, use them as leverage to negotiate with the lender offering the most attractive vehicle you are seeking․ Point out any areas where competitors offer better terms․ Lenders are often willing to work with you to secure your business․

Ultimately, finding the best Chase used car loan rates requires research, comparison, and careful preparation․ Take the time to explore your options and ensure you understand the terms of your loan before committing․

Securing the best possible rate not only saves you money in the long run but also provides peace of mind knowing you’ve made a financially sound decision․ Remember to consider the overall cost of the loan, including interest, fees, and the total repayment amount, not just the monthly payment․

THE LONG-TERM IMPACT OF INTEREST RATES

It’s easy to get caught up in the excitement of buying a used car, but it’s crucial to remember that the interest rate on your loan has a significant impact on the total amount you’ll pay over the life of the loan․ Even a small difference in interest rate can translate into hundreds or even thousands of dollars in savings or extra expenses․ Consider these points:

– Total Interest Paid: Calculate the total interest you’ll pay over the loan term for different interest rates and loan durations․

– Impact on Budget: Understand how higher monthly payments will affect your monthly budget and ability to save for other goals․

– Early Repayment Options: Check if the loan allows for early repayment without penalty, which can help you save on interest in the long run․

EXAMPLE: IMPACT OF INTEREST RATE ON TOTAL LOAN COST

Loan Amount

Interest Rate

Loan Term

Monthly Payment

Total Interest Paid

$15,000

6%

60 months

$290․00

$2,400․00

$15,000

8%

60 months

$304․16

$3,249․60

Note: This table demonstrates the difference in total interest paid based on different interest rates for the same loan amount and term․

BEYOND THE INTEREST RATE: OTHER LOAN CONSIDERATIONS

While the interest rate is a primary factor, don’t overlook other aspects of the loan that can impact your overall cost and experience:

– Fees: Inquire about any origination fees, prepayment penalties, or other charges associated with the loan․

– Loan Terms: Understand the loan’s terms and conditions, including repayment schedules, late payment policies, and options for deferment or forbearance․

– Customer Service: Consider the lender’s reputation for customer service and responsiveness to borrower inquiries․

By considering all these factors, you can make a well-informed decision and secure a used car loan that fits your needs and budget․ Remember to always read the fine print and ask questions if anything is unclear․ With careful research and planning, you can navigate the world of used car loans and drive away with confidence․ Finally, be certain to review the terms carefully, to ensure you receive the best possible deal and low Chase used car loan rates․

Beyond securing the loan itself, protecting your investment with appropriate insurance is also vital․ Liability coverage is a legal requirement, but consider collision and comprehensive coverage to safeguard against damage or theft․ Bundling your auto insurance with your existing homeowner’s or renter’s insurance can sometimes lead to discounts, so it’s worth exploring your options with your insurance provider․

NAVIGATING THE DEALERSHIP

Once you’ve secured pre-approval for your loan and found the perfect used car, the next step is negotiating the final price with the dealership․ Remember that the advertised price is often negotiable, so don’t hesitate to haggle․ Research the car’s market value using online resources like Kelley Blue Book or Edmunds to ensure you’re getting a fair deal․ Be prepared to walk away if the dealership is unwilling to meet your price or provide you with the terms you’re comfortable with․ Dealerships often offer their own financing options, but don’t feel pressured to accept them without comparing them to your pre-approved loan․ Compare the interest rates, loan terms, and any associated fees to determine which option is truly the most advantageous for you․

RED FLAGS TO WATCH OUT FOR

While most dealerships are reputable, it’s essential to be aware of potential red flags that could indicate a dishonest or predatory practice:

– High-Pressure Sales Tactics: Be wary of salespeople who pressure you to make a decision quickly without giving you time to consider your options․

– Hidden Fees: Always review the loan agreement carefully for any hidden fees or charges that were not disclosed upfront․

– Upselling Unnecessary Add-ons: Resist the urge to purchase add-ons like extended warranties or paint protection if you don’t truly need them․

– Spot Delivery Scams: Avoid signing a contract that is contingent on the dealership securing financing after you’ve already driven the car off the lot․

THE LONG-TERM BENEFITS OF A SMART LOAN

Securing a used car loan with favorable terms can have long-term benefits beyond just saving money on interest․ A responsible approach to financing your car can improve your credit score, making it easier to qualify for future loans and credit cards․ Additionally, owning a reliable vehicle can improve your quality of life by providing reliable transportation to work, school, and other important activities․ Remember, a used car is a significant investment, so take the time to make informed decisions and protect your financial well-being․

By following these guidelines, you can confidently navigate the process of securing Chase used car loan rates or those from another lender, and drive away with a vehicle that meets your needs and fits your budget․ Always prioritize research, comparison, and careful consideration to ensure you’re making the best possible financial decision for your situation․