Decoding Bitcoin Price: Understanding Volatility and Investment Strategies

Wondering how much for a Bitcoin? Get the real deal on today’s volatile prices, market trends, and what’s driving the crypto craze! Don’t get left behind!

The question of “how much for a bitcoin” is a deceptively simple one. The price of Bitcoin is not fixed and fluctuates constantly, determined by the ever-shifting dynamics of supply and demand within the cryptocurrency market. Understanding the forces that drive these fluctuations is crucial for anyone considering investing in, or simply curious about, this digital asset. Therefore, pinpointing an exact cost for “how much for a bitcoin” requires real-time monitoring of exchanges and market trends, but let’s delve into the factors that influence its volatile value.

Decoding the Bitcoin Price Volatility

Bitcoin’s price journey is known for its dramatic highs and lows. Several interconnected factors contribute to this volatility:

- Market Sentiment: News events, regulatory announcements, and even social media buzz can significantly impact investor confidence and, consequently, the price. Positive news often leads to buying pressure, pushing the price up, while negative news can trigger sell-offs.

- Supply and Demand: Bitcoin’s supply is capped at 21 million coins, creating inherent scarcity. Increased demand, driven by adoption or investment interest, can lead to price appreciation. Conversely, decreased demand can result in a price decline.

- Regulatory Landscape: Government regulations regarding Bitcoin and other cryptocurrencies vary widely across the globe. Favorable regulations can boost adoption and price, while restrictive regulations can have the opposite effect.

- Technological Developments: Advances in Bitcoin’s underlying technology, such as improvements to scalability or security, can positively influence its perceived value.

Comparing Bitcoin to Traditional Assets

Unlike traditional assets like stocks or bonds, Bitcoin is not backed by a central bank or government. This decentralization is a core feature that attracts many investors, but it also contributes to its volatility. Here’s a brief comparison:

| Asset | Backing | Volatility | Liquidity |

|---|---|---|---|

| Bitcoin | Decentralized, Limited Supply | High | Varies by Exchange |

| Stocks | Company Performance, Market Conditions | Moderate | Generally High |

| Bonds | Government or Corporate Debt | Low to Moderate | Generally High |

The Role of Cryptocurrency Exchanges

Cryptocurrency exchanges act as marketplaces where buyers and sellers can trade Bitcoin and other digital currencies. The prices listed on these exchanges reflect the current supply and demand dynamics. However, different exchanges may display slightly different prices due to variations in trading volume and fees.

Looking Ahead: The Future of Bitcoin’s Price

Predicting the future price of Bitcoin with absolute certainty is impossible. Numerous factors, both known and unknown, can influence its trajectory. The continued evolution of the cryptocurrency market, regulatory developments, and technological advancements will all play a role. Ultimately, understanding these underlying factors is key to making informed decisions about investing in, or simply following the story of, Bitcoin. As we consider future investments, the initial question of “how much for a bitcoin” remains a crucial starting point for informed decision making.

STRATEGIES FOR NAVIGATING BITCOIN’S PRICE FLUCTUATIONS

Given the inherent volatility, adopting sound strategies is vital for anyone venturing into the Bitcoin market. Here are a few approaches to consider:

– Dollar-Cost Averaging (DCA): This involves investing a fixed amount of money at regular intervals, regardless of the price. This can help mitigate the impact of short-term price swings.

– Diversification: Don’t put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can reduce overall risk.

– Due Diligence: Thoroughly research Bitcoin, the technology behind it, and the factors that influence its price before investing. Understand the risks involved.

– Long-Term Perspective: Bitcoin can be a long-term investment, so be prepared to ride out periods of volatility.

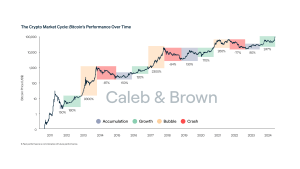

UNDERSTANDING MARKET CYCLES

Like traditional markets, Bitcoin experiences cycles of bull markets (periods of rising prices) and bear markets (periods of falling prices). Recognizing these cycles can help you make more informed decisions about when to buy or sell. However, predicting the exact timing of these cycles is challenging.

THE IMPACT OF INSTITUTIONAL INVESTMENT

The increasing involvement of institutional investors, such as hedge funds and corporations, is having a significant impact on the Bitcoin market. These large-scale investors bring substantial capital and sophistication, which can lead to increased price stability and adoption. However, their actions can also exacerbate price swings.

THE BITCOIN HALVING EVENTS

Bitcoin’s protocol includes a mechanism called “halving,” which occurs approximately every four years. During a halving, the reward for mining new Bitcoin blocks is reduced by half. This reduces the rate at which new Bitcoins enter circulation, potentially leading to increased scarcity and price appreciation. These events are closely watched by the Bitcoin community.

BEYOND PRICE: EXPLORING BITCOIN’S UTILITY

While the price of Bitcoin often dominates headlines, it’s important to remember that Bitcoin is more than just a speculative asset. It has potential applications in areas such as cross-border payments, secure data storage, and decentralized finance (DeFi). Exploring these use cases can provide a more comprehensive understanding of Bitcoin’s long-term value proposition.

Ultimately, the perceived value and, therefore, “how much for a bitcoin” is worth is subjective and subject to change. Staying informed, adopting sound investment strategies, and understanding the technology behind Bitcoin are key to navigating this dynamic market.