How Long to Pay Off Mortgage Factors and Strategies

Wondering how long to pay off your mortgage? It’s not just 15 or 30 years! Discover the hidden factors and smart strategies to become mortgage-free faster. Let’s crush that debt!

The question‚ “how long to pay off mortgage?” is a common one‚ often answered with standard terms like 30 or 15 years. However‚ the true answer is far more nuanced and dependent on a multitude of individual factors that extend beyond the initial loan agreement. Understanding these factors can empower you to take control of your mortgage and potentially significantly shorten the repayment period. Exploring alternative strategies and considering your financial priorities is key to determining the ideal timeframe for you to eliminate this significant debt. Therefore‚ the duration to pay off mortgage depends greatly on your actions.

Factors Influencing Mortgage Payoff Time

Several elements play a crucial role in determining how quickly you can become mortgage-free. These factors can be broadly categorized as follows:

- Initial Loan Amount: Naturally‚ a larger mortgage will generally take longer to pay off than a smaller one‚ assuming all other factors remain constant.

- Interest Rate: A higher interest rate means more of your monthly payment goes towards interest‚ slowing down the principal repayment and extending the loan term.

- Loan Term: The agreed-upon loan term (e.g.‚ 30 years‚ 15 years) directly impacts the scheduled repayment timeline.

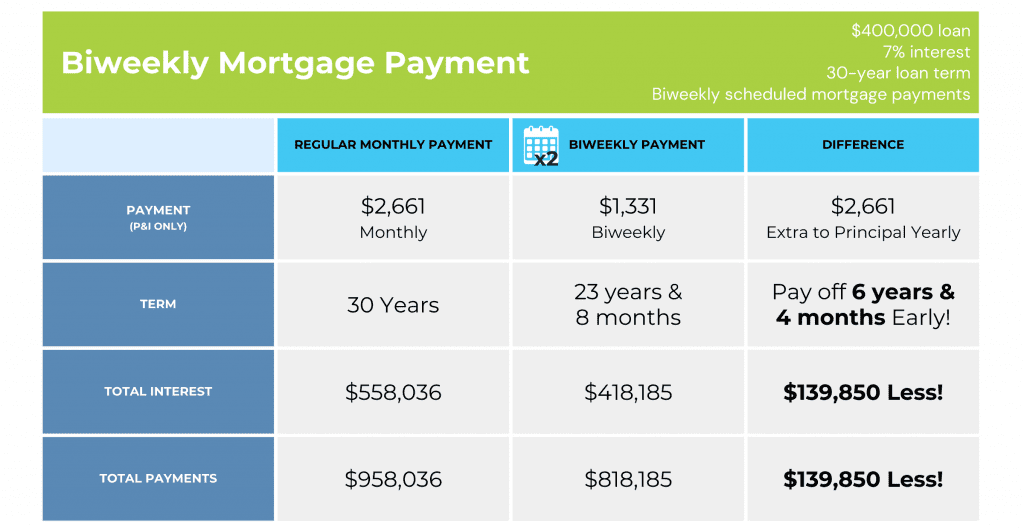

- Payment Frequency: Making bi-weekly payments instead of monthly payments can significantly reduce the payoff time.

- Additional Principal Payments: Contributing extra funds towards the principal balance accelerates the repayment process.

- Refinancing: Refinancing to a shorter term or lower interest rate can dramatically shorten the mortgage term.

Strategies to Accelerate Mortgage Payoff

Beyond the standard payment schedule‚ there are several proactive strategies you can employ to become mortgage-free sooner:

Making Extra Principal Payments

Even a small extra payment each month can make a big difference over the long run. Consider rounding up your monthly payment or making a lump-sum payment whenever you receive a bonus or tax refund.

Bi-Weekly Payments

By making half of your monthly payment every two weeks‚ you effectively make one extra monthly payment per year. This simple strategy can shave years off your mortgage.

Refinancing

If interest rates have dropped‚ refinancing to a lower rate can save you money and shorten your loan term. Carefully consider the costs associated with refinancing to ensure it’s a worthwhile investment.

Downsizing or Generating Extra Income

Selling your current home and downsizing to a less expensive property can free up cash to pay off your mortgage. Alternatively‚ exploring side hustles or income-generating investments can provide extra funds to accelerate your repayment.

Comparison of Mortgage Payoff Scenarios

| Scenario | Initial Loan Amount | Interest Rate | Loan Term | Monthly Payment | Estimated Payoff Time |

|---|---|---|---|---|---|

| Standard 30-Year | $300‚000 | 6% | 30 years | $1‚798.65 | 30 years |

| 15-Year | $300‚000 | 6% | 15 years | $2‚531.54 | 15 years |

| 30-Year with Extra $200/month | $300‚000 | 6% | 30 years | $1‚798.65 + $200 | ~24 years |

Ultimately‚ determining how long to pay off your mortgage is a personal decision based on your individual financial circumstances and goals. With careful planning‚ proactive strategies‚ and consistent effort‚ you can significantly reduce your mortgage term and achieve financial freedom sooner than you might think.

THE PSYCHOLOGICAL BENEFITS OF EARLY MORTGAGE PAYOFF

Beyond the purely financial advantages‚ paying off your mortgage early offers significant psychological benefits. The sense of security and freedom that comes with owning your home outright can be invaluable. This can lead to reduced stress‚ increased peace of mind‚ and a greater ability to pursue other life goals.

– Reduced Financial Stress: A mortgage is often the largest debt most people carry. Eliminating this debt can dramatically reduce financial anxiety and stress.

– Increased Financial Flexibility: Once your mortgage is paid off‚ you free up a significant portion of your monthly income. This newfound flexibility can be used for savings‚ investments‚ travel‚ or other personal pursuits.

– Enhanced Peace of Mind: Knowing that you own your home outright provides a sense of security and stability‚ especially during uncertain economic times.

CONSIDERING OPPORTUNITY COSTS

While paying off your mortgage early is generally a sound financial decision‚ it’s important to consider the opportunity cost. Before aggressively paying down your mortgage‚ evaluate other potential investment opportunities; Could you earn a higher return by investing in stocks‚ bonds‚ or real estate? Weigh the potential benefits of early mortgage payoff against the potential returns from other investments to make an informed decision. Remember to consider your risk tolerance and time horizon when evaluating investment options.

LONG-TERM FINANCIAL PLANNING AND YOUR MORTGAGE

Your mortgage should be viewed as an integral part of your overall long-term financial plan. Consider how your mortgage repayment strategy aligns with your retirement goals‚ investment strategy‚ and other financial priorities. It’s a good idea to consult with a financial advisor to create a comprehensive plan that takes all these factors into account. They can help you determine the optimal balance between paying down your mortgage‚ saving for retirement‚ and achieving other financial objectives. For example‚ if your retirement savings are behind schedule‚ prioritizing contributions to your 401k might be more beneficial than aggressively paying down your mortgage.

Ultimately‚ the best approach to “how long to pay off mortgage?” involves a holistic assessment of your financial situation‚ risk tolerance‚ and long-term goals. While accelerating your mortgage payoff can be a worthwhile endeavor‚ it’s crucial to ensure that it aligns with your broader financial objectives and doesn’t come at the expense of other important priorities. The key is to develop a strategy that allows you to achieve financial security and peace of mind while living a fulfilling life. Therefore‚ understanding your options will make the best of the situation to pay off mortgage.