How to Get Pre-Approved for a Mortgage A Comprehensive Guide

Ready to buy? Learn the *mortgage pre-approval* secrets that get you ahead! Find out how much you can borrow and shop with confidence. Your dream home awaits!

Embarking on the journey of homeownership can feel like navigating a complex maze, but understanding the steps to get pre-approved for a mortgage is crucial to a smooth experience․ Securing pre-approval provides you with a clear understanding of your borrowing power and strengthens your position as a serious buyer in a competitive market; Knowing how much you can realistically borrow empowers you to search for homes within your budget, preventing disappointment later on․ Ultimately, understanding the process of how do you get pre approved for a mortgage is essential for anyone looking to buy a home․

Understanding Mortgage Pre-Approval

Mortgage pre-approval is more than just a quick estimate․ It’s a lender’s conditional commitment to lend you a specific amount of money, based on their thorough review of your financial situation․ This process involves verifying your income, credit history, assets, and debts․ Think of it as a dress rehearsal for the full mortgage application, giving you a significant advantage when you find your dream home․

Steps to Getting Pre-Approved

1․ Gather Your Financial Documents

Lenders will require various documents to assess your creditworthiness․ Having these readily available will expedite the pre-approval process:

- Proof of Income: Pay stubs (usually the most recent 30 days), W-2 forms (for the past two years), and tax returns (for the past two years if self-employed)․

- Bank Statements: Statements for all your bank accounts (checking, savings, and money market accounts)․

- Asset Documentation: Statements for investment accounts (stocks, bonds, retirement accounts)․

- Debt Information: Information on all outstanding debts, including credit cards, student loans, and auto loans․

- Identification: A valid government-issued photo ID․

2․ Check Your Credit Score

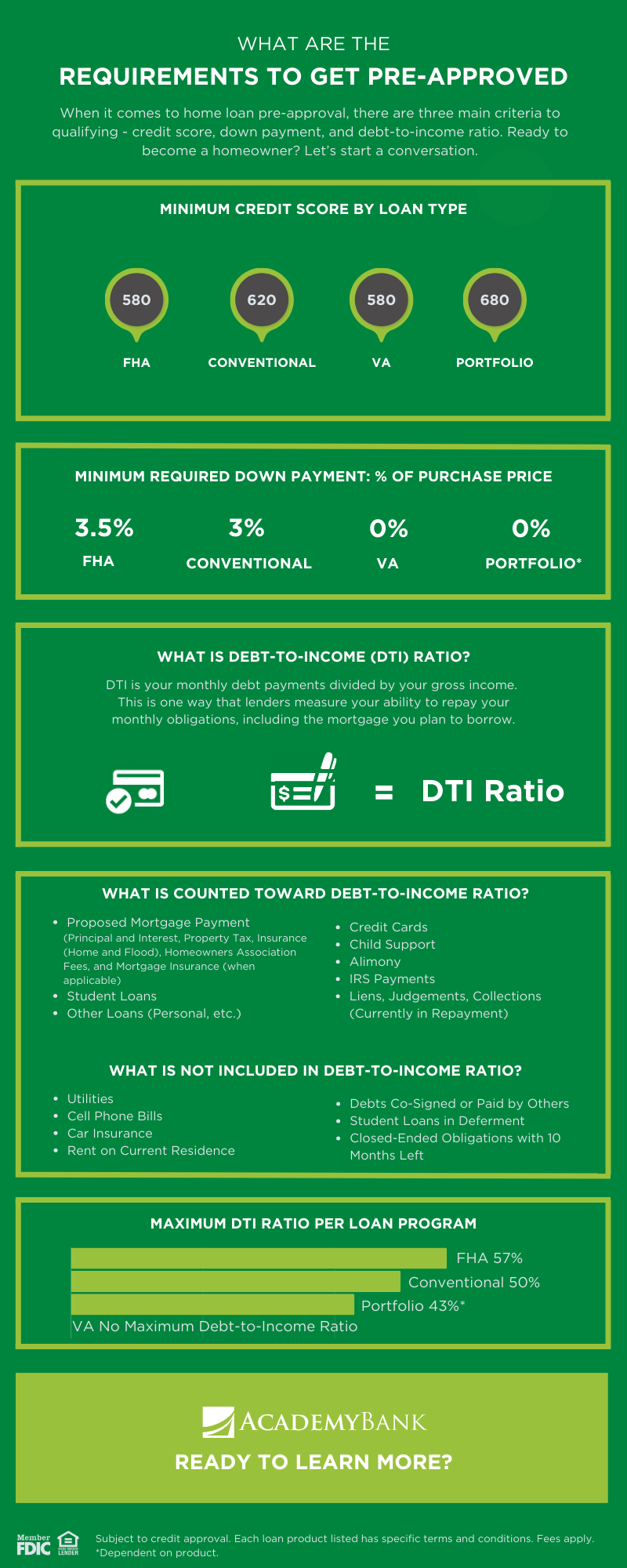

Your credit score is a significant factor in determining your interest rate and loan terms․ Obtain a copy of your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) and review it carefully․ Address any errors or inaccuracies immediately․ A higher credit score generally translates to more favorable loan terms․

3․ Choose a Lender and Apply

Research different lenders and compare their interest rates, fees, and loan programs․ Consider banks, credit unions, and online mortgage lenders․ Once you’ve chosen a lender, complete their pre-approval application, providing all the requested information and documentation accurately․ Be prepared to answer questions about your employment history, residential history, and any other relevant financial details․

4․ Undergo Credit and Income Verification

The lender will verify the information you provided by contacting your employer, checking your bank accounts, and pulling your credit report․ They will also assess your debt-to-income ratio (DTI), which is the percentage of your gross monthly income that goes towards paying debts․ A lower DTI is generally viewed more favorably by lenders․

5․ Receive Your Pre-Approval Letter

If your application is approved, the lender will issue a pre-approval letter․ This letter will specify the loan amount you’re pre-approved for, the interest rate (which may be subject to change), and the expiration date of the pre-approval․ Keep in mind that pre-approval is not a guarantee of final loan approval․ The lender will still need to appraise the property and verify all your information again during the full mortgage application process․

Benefits of Getting Pre-Approved

- Know Your Budget: Determine how much you can realistically afford before you start house hunting․

- Strengthen Your Offer: Show sellers that you are a serious and qualified buyer․

- Faster Closing Process: The pre-approval process streamlines the final mortgage application․

- Peace of Mind: Gain confidence knowing that you are financially prepared to purchase a home․