Predicting the Future: Decoding the Bitcoin Predicted Price

Trying to predict Bitcoin’s future value? Good luck! We dive into the crypto craze, expert opinions, and the wild factors influencing Bitcoin’s price. Buckle up!

Predicting the future of Bitcoin is like gazing into a digital crystal ball, swirling with speculation, analysis, and a healthy dose of uncertainty. The volatile nature of the cryptocurrency market makes definitive price predictions notoriously difficult, yet that doesn’t stop experts and enthusiasts alike from attempting to decipher the trends and forecast the potential future value. Factors ranging from regulatory changes and technological advancements to global economic conditions and investor sentiment all contribute to the complex equation of estimating the bitcoin predicted price. Understanding these influencing factors is crucial for anyone looking to navigate the exciting, yet potentially turbulent, waters of bitcoin predicted price speculation.

Decoding the Price Drivers of Bitcoin

Several key factors consistently influence Bitcoin’s price movements. Understanding these drivers is essential for forming a more informed perspective on potential future values.

- Supply and Demand: The fundamental economic principle of supply and demand plays a significant role. Bitcoin’s limited supply (capped at 21 million coins) inherently creates scarcity, which can drive up prices if demand increases.

- Regulatory Landscape: Government regulations and policy decisions regarding cryptocurrencies can have a dramatic impact. Positive regulations can legitimize Bitcoin and attract institutional investment, while negative regulations can trigger price drops.

- Technological Advancements: Developments in Bitcoin’s underlying technology, such as the implementation of scalability solutions or enhanced security features, can boost investor confidence and drive up prices.

- Market Sentiment: Public perception and investor sentiment, often influenced by news headlines and social media trends, can create short-term price volatility.

- Macroeconomic Factors: Global economic conditions, such as inflation rates, interest rate changes, and geopolitical events, can also influence Bitcoin’s price as investors seek alternative assets.

Expert Opinions and Forecast Models

Numerous analysts and firms employ various methodologies to forecast Bitcoin’s price. These models often incorporate technical analysis, fundamental analysis, and even machine learning algorithms.

Technical Analysis

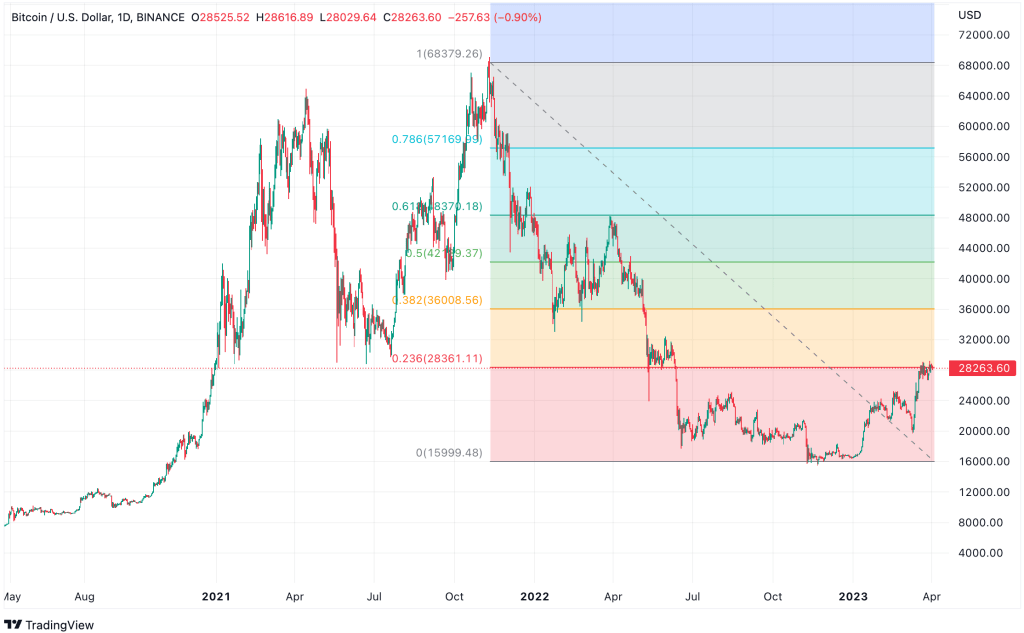

This approach focuses on analyzing historical price charts and trading volumes to identify patterns and trends that may indicate future price movements. It often involves using indicators like moving averages, relative strength index (RSI), and Fibonacci retracements.

Fundamental Analysis

This method involves evaluating Bitcoin’s intrinsic value by considering factors like its adoption rate, transaction volume, network security, and the overall health of the cryptocurrency ecosystem.

Limitations of Predictions

It is important to remember that all forecasts are inherently speculative and subject to significant error. The cryptocurrency market is highly volatile and unpredictable, and unforeseen events can quickly invalidate even the most sophisticated models. Therefore, relying solely on predictions for investment decisions is strongly discouraged.

A Realistic Perspective on Future Value

While specific price predictions vary wildly, a general consensus suggests that Bitcoin has the potential for long-term growth. Its limited supply, increasing adoption, and potential as a store of value continue to attract attention from investors worldwide. The future of Bitcoin hinges on overcoming challenges such as scalability limitations, regulatory uncertainty, and competition from other cryptocurrencies. Considering the landscape, understanding the factors influencing Bitcoin, and being mindful of the limitations of any predictions, will allow you to make sound decisions. Ultimately, whether or not the bitcoin predicted price reaches the heights suggested by some analysts, understanding the driving forces behind its valuation is crucial for any informed participant in the cryptocurrency market.

MAKING INFORMED DECISIONS IN A VOLATILE MARKET

Given the inherent uncertainties, how can investors make informed decisions regarding Bitcoin? The key lies in adopting a diversified and risk-managed approach.

– Diversification: Don’t put all your eggs in one basket. Allocate a portion of your investment portfolio to Bitcoin, but ensure it’s balanced with other assets like stocks, bonds, and real estate.

– Risk Management: Understand your risk tolerance and invest only what you can afford to lose. Bitcoin’s price can fluctuate dramatically, so it’s crucial to have a strategy in place to mitigate potential losses.

– Long-Term Perspective: Bitcoin is a relatively new asset class, and its long-term potential remains uncertain. Adopt a long-term investment horizon and avoid making impulsive decisions based on short-term price swings.

– Do Your Own Research (DYOR): Don’t blindly follow the advice of others. Conduct thorough research on Bitcoin, its underlying technology, and the factors that influence its price. Understand the risks involved before investing.

– Stay Informed: Keep abreast of the latest news and developments in the cryptocurrency market. Regulatory changes, technological advancements, and macroeconomic events can all impact Bitcoin’s price.

POTENTIAL FUTURE SCENARIOS FOR BITCOIN

While precise price targets are elusive, we can consider several potential scenarios for Bitcoin’s future trajectory:

SCENARIO 1: MAINSTREAM ADOPTION

In this scenario, Bitcoin achieves widespread adoption as a medium of exchange and store of value. Institutional investors embrace Bitcoin, and governments adopt favorable regulations. This could lead to significant price appreciation.

SCENARIO 2: REGULATORY CRACKDOWN

In this scenario, governments impose strict regulations on cryptocurrencies, hindering their adoption and innovation. This could lead to a decline in Bitcoin’s price and market capitalization.

SCENARIO 3: TECHNOLOGICAL DISRUPTION

In this scenario, a competing cryptocurrency emerges with superior technology or functionality, challenging Bitcoin’s dominance. This could lead to a shift in market share and a decline in Bitcoin’s relative value.

SCENARIO 4: GRADUAL INTEGRATION

This scenario involves a more gradual and organic integration of Bitcoin into the global financial system. Adoption increases steadily, but the price remains volatile due to ongoing regulatory uncertainty and technological developments.

In conclusion, the future of Bitcoin remains uncertain, and predictions should be viewed with skepticism. The best approach is to stay informed, manage risk effectively, and make investment decisions based on your own research and risk tolerance. The ability to understand market dynamics and adapt to change will be crucial for anyone navigating the world of cryptocurrency investment, regardless of the specific bitcoin predicted price on any given day.