Understanding Bitcoin Mining Profitability

Thinking about Bitcoin mining? Don’t jump in without knowing the real deal! We break down Bitcoin mining profitability, costs, and difficulty. Get the facts!

Understanding bitcoin mining profitability is crucial for anyone considering entering or navigating the complex world of cryptocurrency mining. It’s not as simple as just plugging in a mining rig and watching the satoshis roll in. The calculations surrounding bitcoin mining profitability involve a multifaceted analysis, considering hardware costs, electricity consumption, the current bitcoin price, and the ever-increasing difficulty of the mining algorithm. Success hinges on accurately assessing these variables and adapting strategies to maintain a positive return on investment in a dynamic market.

Understanding the Key Factors

Several core components determine whether your bitcoin mining venture will be profitable. Let’s break down the most important ones:

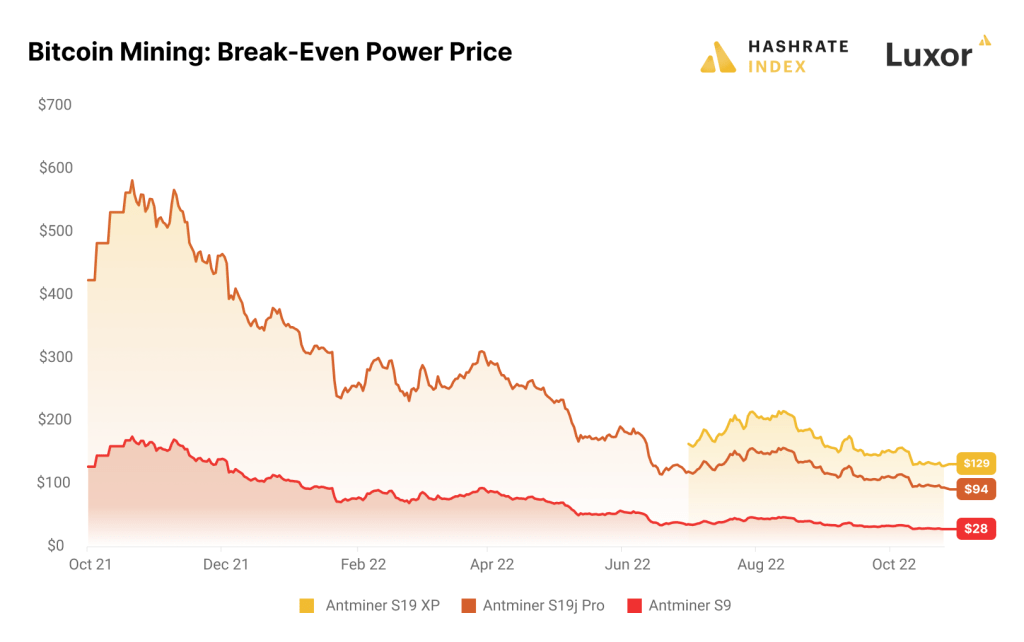

- Hardware Costs: The initial investment in mining hardware (ASICs) represents a significant upfront expense. Different models offer varying hash rates and energy efficiencies.

- Electricity Consumption: Mining rigs consume substantial amounts of electricity. The cost per kilowatt-hour (kWh) in your location directly impacts profitability.

- Bitcoin Price: Fluctuations in the price of Bitcoin directly correlate to the value of mined rewards. Higher prices lead to increased profitability;

- Mining Difficulty: The difficulty of the Bitcoin mining algorithm adjusts periodically to maintain a consistent block creation rate. Higher difficulty means more computing power is required to solve blocks.

- Pool Fees: Joining a mining pool allows miners to combine their resources and increase their chances of earning rewards. However, pools charge fees for their services.

- Maintenance and Cooling: Over time, mining hardware requires maintenance and effective cooling solutions to prevent overheating and ensure optimal performance.

Calculating Potential Profitability

Several online calculators can help estimate potential profitability. These tools typically require you to input your hardware specifications, electricity costs, and pool fees. However, remember that these are just estimates, and actual results may vary.

One crucial aspect to consider is the block reward halving that occurs approximately every four years. This event reduces the reward for mining a new block, directly impacting miner income. Anticipating and preparing for these halvings is critical for long-term sustainability.

Strategies for Maximizing Profitability

Even with fluctuating market conditions, there are steps you can take to improve your chances of success:

Optimize Hardware

- Choose Energy-Efficient ASICs: Invest in the latest generation of ASICs that offer the best hash rate per watt of electricity consumed.

- Regularly Upgrade Hardware: As newer, more efficient models become available, consider upgrading your equipment to stay competitive.

Reduce Electricity Costs

- Relocate to Areas with Cheaper Electricity: Mining operations are often located in regions with low electricity rates.

- Explore Renewable Energy Sources: Utilizing solar, wind, or hydroelectric power can significantly reduce electricity costs.

Join a Reputable Mining Pool

- Compare Pool Fees and Payout Structures: Research different mining pools and choose one that offers competitive fees and a reliable payout system.

- Ensure Pool Stability and Uptime: Select a pool with a proven track record of stability and minimal downtime.

The Future of Bitcoin Mining Profitability

Looking ahead, the long-term bitcoin mining profitability landscape will continue to be shaped by technological advancements, regulatory developments, and the evolving dynamics of the cryptocurrency market. Exploring alternative mining algorithms and focusing on sustainable energy sources will be crucial for miners to remain competitive in the future.

As the difficulty increases and the block reward diminishes, miners will need to innovate and adapt to survive. This could involve exploring alternative revenue streams, such as providing validation services for other blockchain networks or participating in decentralized finance (DeFi) protocols. The ability to pivot and diversify revenue streams could be the key to long-term success in the ever-evolving world of cryptocurrency mining.

THE ENVIRONMENTAL IMPACT AND SUSTAINABLE MINING

The environmental impact of Bitcoin mining has become a significant concern. The energy-intensive nature of the process has drawn criticism for its contribution to carbon emissions. As a result, there’s a growing movement towards sustainable mining practices.

– Utilizing Renewable Energy: Shifting to renewable energy sources like solar, wind, and hydroelectric power is crucial for reducing the carbon footprint of Bitcoin mining.

– Optimizing Cooling Systems: Implementing efficient cooling solutions can minimize energy consumption and reduce environmental impact.

– Carbon Offset Programs: Investing in carbon offset programs can help mitigate the environmental impact of mining operations.

THE ROLE OF REGULATION

Government regulations can significantly impact Bitcoin mining profitability. Some countries have imposed strict regulations or even outright bans on cryptocurrency mining, while others have adopted a more welcoming approach.

– Taxation: Regulations regarding the taxation of mined Bitcoin can affect profitability.

– Environmental Regulations: Environmental regulations can impose restrictions on energy consumption and emissions, potentially increasing operating costs.

– Licensing and Permits: Obtaining the necessary licenses and permits to operate a mining facility can be a complex and costly process.

Ultimately, the future of bitcoin mining profitability depends on a complex interplay of factors. From hardware efficiency and electricity costs to bitcoin price volatility and regulatory changes, miners must navigate a dynamic and challenging landscape. Those who adapt quickly, embrace sustainable practices, and optimize their operations will be best positioned to thrive in the long run.