Understanding Car Loan Interest Rates and Credit Scores

Dreaming of new wheels? Your credit score is the key! Discover how it impacts your car loan interest rate and unlocks the best deals. Drive away smarter!

Securing a car loan often hinges on one crucial factor: your credit score. The car loan interest rate you qualify for is directly tied to your creditworthiness, acting as a key indicator for lenders. A higher credit score typically unlocks access to lower interest rates, saving you significant money over the loan’s lifetime. Conversely, a lower credit score usually results in higher rates, reflecting a perceived greater risk for the lender. Therefore, understanding how your credit score impacts your car loan interest rate is essential for making informed financial decisions.

The Credit Score Spectrum and Its Impact

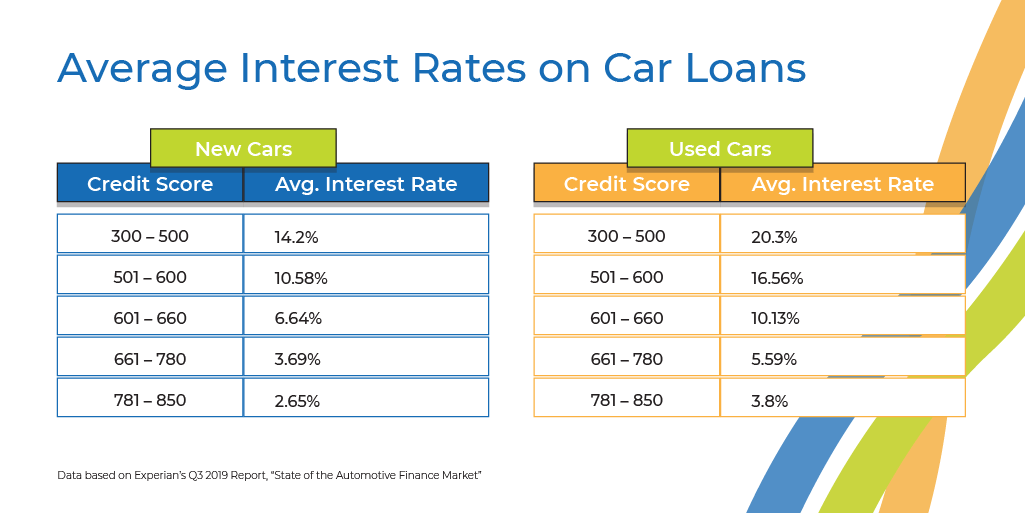

Credit scores are numerical representations of your credit history, typically ranging from 300 to 850. Lenders use these scores to assess your ability to repay debt. Here’s a general overview of how different credit score ranges can affect your car loan options:

- Excellent Credit (750-850): This range typically qualifies you for the lowest interest rates offered by lenders. You’ll likely have access to a wider selection of loan terms and options.

- Good Credit (700-749): You’ll still likely qualify for competitive interest rates, though potentially slightly higher than those with excellent credit. You’ll generally have good loan options available.

- Fair Credit (650-699): Interest rates will be noticeably higher than those with good or excellent credit. You may need to shop around to find the best possible terms.

- Poor Credit (550-649): Expect significantly higher interest rates and potentially limited loan options. You may need to consider secured loans or loans from lenders specializing in borrowers with poor credit.

- Bad Credit (300-549): Securing a car loan with a bad credit score can be very challenging and costly. Interest rates will be extremely high, and you may need a co-signer or be limited to specific lenders.

Factors Beyond Credit Score

While your credit score is a primary determinant of your car loan interest rate, other factors also play a role:

- Loan Term: Shorter loan terms typically come with lower interest rates, but higher monthly payments. Longer loan terms result in lower monthly payments but higher overall interest paid.

- Down Payment: A larger down payment reduces the loan amount, potentially leading to a lower interest rate.

- Vehicle Type: Newer vehicles might qualify for lower rates than older or used vehicles.

- Lender Type: Banks, credit unions, and online lenders may offer different interest rates and terms. Shopping around is crucial.

Comparing Car Loan Interest Rates

To illustrate the impact of credit score on car loan interest rates, consider the following hypothetical example:

| Credit Score Range | Estimated Interest Rate | Example Monthly Payment (on $25,000 loan for 60 months) |

|---|---|---|

| Excellent (750+) | 5.0% | $471.76 |

| Good (700-749) | 7.0% | $495.01 |

| Fair (650-699) | 9.0% | $519.00 |

| Poor (550-649) | 12.0% | $555.63 |

Improving Your Credit Score

If you’re not happy with the car loan interest rate you’re being offered, consider taking steps to improve your credit score before applying. This might involve:

- Paying bills on time

- Reducing credit card balances

- Checking your credit report for errors and disputing any inaccuracies

- Avoiding opening too many new credit accounts at once

Ultimately, understanding the relationship between your credit score and the car loan interest rate is paramount to securing the best possible financing for your vehicle purchase. By proactively managing your credit and shopping around for the most favorable terms, you can save a significant amount of money over the life of your loan. The best way to get a great rate is to focus on your credit and remember the **car loan interest rate by credit score** connection.