Understanding How Much Mortgage You Qualify For

Stop dreaming, start owning! Discover how much mortgage you qualify for and unlock the door to your perfect home. Calculate your borrowing power now!

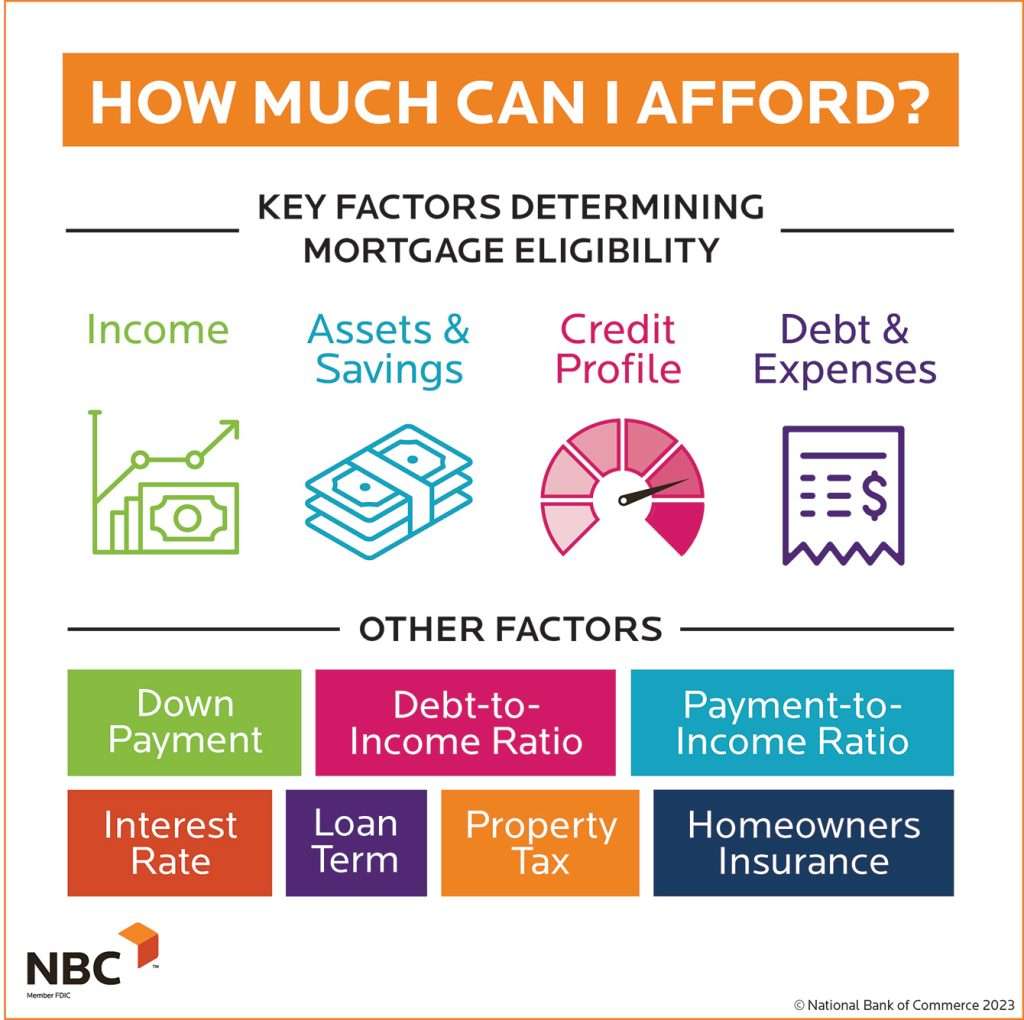

Understanding how much mortgage you qualify for is the crucial first step in the home buying process․ It’s not just about finding your dream home; it’s about ensuring you can realistically afford it without stretching your finances to the breaking point․ Figuring out how much mortgage you qualify for involves a complex interplay of factors, including your income, debt, credit score, and down payment․ By carefully assessing these elements, you can gain a clear picture of your borrowing power and set realistic expectations for your home search․

Key Factors Determining Mortgage Qualification

Several elements significantly influence the mortgage amount you can secure․ Lenders meticulously evaluate these aspects to assess your risk as a borrower․ Let’s delve into each of them:

- Income: Your gross monthly income is a primary factor․ Lenders typically prefer your total housing expenses (including mortgage payment, property taxes, and insurance) to be no more than 28% of your gross monthly income․

- Debt-to-Income Ratio (DTI): This ratio compares your total monthly debt payments (including student loans, car loans, and credit card debt) to your gross monthly income․ Lenders generally prefer a DTI of 43% or lower․ The lower your DTI, the better your chances of getting approved for a larger mortgage․

- Credit Score: A good credit score is essential for securing a favorable interest rate and increasing your borrowing power․ A higher credit score demonstrates responsible financial management and reduces the lender’s risk․

- Down Payment: A larger down payment reduces the loan amount, lowering the lender’s risk and potentially increasing your chances of approval․ It also allows you to avoid paying private mortgage insurance (PMI) if your down payment is at least 20% of the home’s purchase price․

- Assets: Lenders also consider your assets, such as savings accounts, investment accounts, and retirement funds, as a sign of financial stability․ These assets provide a safety net in case of unforeseen financial difficulties․

Beyond the Numbers: Other Considerations

While the above factors are crucial, lenders also consider other aspects of your financial situation and the overall market conditions․

Job Stability and Employment History

Lenders prefer borrowers with a stable employment history, ideally with at least two years in the same industry or field․ Consistent income is a strong indicator of your ability to repay the mortgage․

Current Market Conditions and Interest Rates

Prevailing interest rates significantly impact the affordability of a mortgage․ Higher interest rates reduce the amount you can borrow while keeping your monthly payments manageable․ Economic conditions and market trends influence interest rate fluctuations․

Estimating Your Mortgage Qualification: A Simple Calculation

While a precise calculation requires lender consultation, you can get a rough estimate of how much mortgage you might qualify for using the following formula:

Estimated Mortgage Amount = (Gross Monthly Income x 0․28) ⎻ (Monthly Property Taxes + Monthly Homeowners Insurance + Monthly HOA Fees)

This result can then be further refined by considering your debt-to-income ratio․ Remember that this is just an estimate, and the actual amount you qualify for may vary depending on the lender and your individual circumstances․

Taking the Next Steps

Determining how much mortgage you qualify for is a critical step in the home buying journey․ The process involves a thorough assessment of your finances and the current market․ It’s always best to consult with a mortgage professional to get a personalized assessment of your borrowing power and explore your options․ By understanding these factors and taking the necessary steps, you can confidently navigate the home buying process and achieve your dream of homeownership․