Understanding the Current Cost of Bitcoin

Wondering about the Bitcoin price today? Dive into the wild world of crypto! We break down the factors driving Bitcoin’s value, from scarcity to Elon’s tweets. Get savvy now!

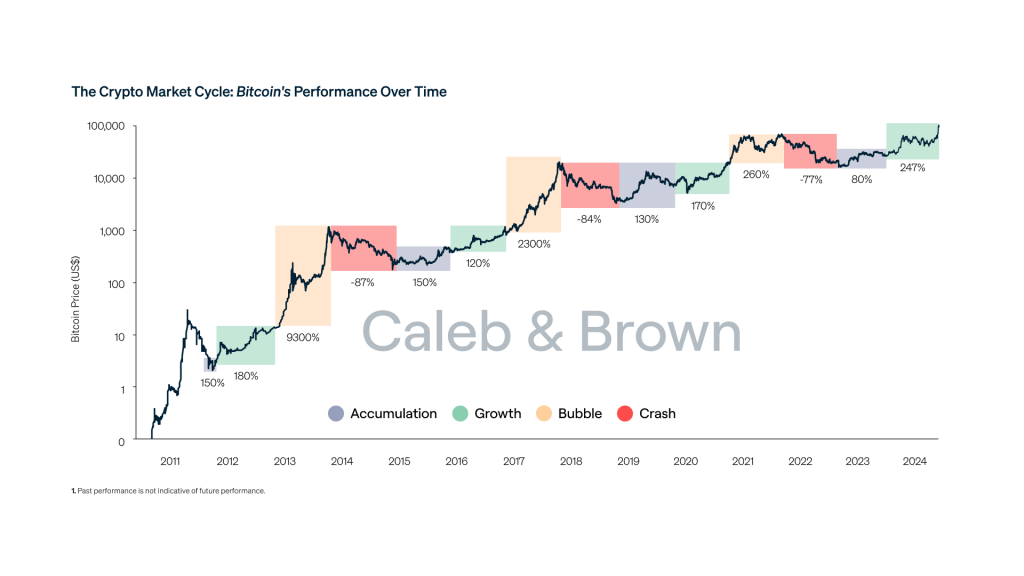

The fascination surrounding the current cost of Bitcoin continues to captivate investors and technologists alike․ Understanding the dynamics influencing its price requires examining a complex interplay of factors, from macroeconomic trends to regulatory developments․ The perceived scarcity of Bitcoin, coupled with growing institutional adoption, fuels speculation and volatility, making pinpointing a stable price a challenging endeavor․ However, by analyzing key indicators and market sentiment, we can gain valuable insights into the forces shaping the current cost of Bitcoin and its potential trajectory․

Factors Influencing Bitcoin’s Price

Several key elements contribute to the fluctuating price of Bitcoin․ These factors can be broadly categorized into supply and demand dynamics, technological advancements, regulatory landscape, and global economic conditions․

- Supply and Demand: Basic economic principles dictate that as demand for Bitcoin increases while its supply remains fixed (capped at 21 million coins), its price tends to rise․

- Technological Advancements: Developments in blockchain technology and the broader cryptocurrency ecosystem can impact Bitcoin’s perceived value and utility․

- Regulatory Landscape: Government regulations and policies regarding cryptocurrencies can significantly influence investor sentiment and market participation․

- Global Economic Conditions: Macroeconomic factors such as inflation, interest rates, and geopolitical events can also affect Bitcoin’s price as investors seek alternative assets․

Understanding Bitcoin Market Sentiment

Market sentiment plays a crucial role in short-term price fluctuations․ News headlines, social media trends, and investor psychology can all contribute to periods of rapid price increases (bull runs) or sharp declines (bear markets)․

Tools for Gauging Sentiment

Various tools and indicators are available to help investors gauge market sentiment:

- Fear & Greed Index: This index measures the overall emotional state of the market, ranging from extreme fear to extreme greed․

- Social Media Analysis: Tracking discussions and trends on social media platforms can provide insights into public perception of Bitcoin․

- News Sentiment Analysis: Analyzing news articles and reports can reveal the overall tone and coverage of Bitcoin-related topics․

Beyond the Hype: Long-Term Value Proposition

While short-term price volatility is a characteristic of Bitcoin, it’s essential to consider its long-term value proposition․ Many argue that Bitcoin’s decentralized nature, limited supply, and potential as a store of value make it a valuable asset in the long run․

The complexities surrounding the current cost of Bitcoin warrant careful consideration․ As we move forward, continuous monitoring of market trends and technological advancements is critical for understanding its role in the evolving financial landscape․ This understanding ultimately helps to evaluate your investment decisions․

COMPARING BITCOIN TO TRADITIONAL ASSETS

Bitcoin is often compared to traditional assets like gold, stocks, and real estate․ Understanding the similarities and differences can help investors make informed decisions․

Asset

Volatility

Liquidity

Store of Value

Regulation

Bitcoin

High

High

Potential

Varying

Gold

Moderate

High

Yes

Moderate

Stocks

Moderate

High

Variable

High

Real Estate

Low

Low

Yes

High

As the table illustrates, Bitcoin presents a unique profile compared to traditional assets․ Its high volatility and varying regulatory landscape present both opportunities and risks․ Gold is often touted as a safe haven, while stocks offer growth potential․ Real estate, despite being illiquid, is considered a stable investment․

FUTURE OUTLOOK FOR BITCOIN’S PRICE

Predicting the future price of Bitcoin with certainty is impossible․ However, various factors suggest continued growth and adoption in the coming years․ Institutional investment, increased regulatory clarity, and technological advancements are likely to drive further demand․ However, potential challenges include scalability issues, security vulnerabilities, and regulatory crackdowns․

POTENTIAL SCENARIOS

– Bullish Scenario: Widespread adoption, institutional investment, and favorable regulatory environment drive the price significantly higher․

– Bearish Scenario: Regulatory crackdown, security breaches, or economic downturns lead to a significant price decline․

– Neutral Scenario: Price fluctuates within a defined range, influenced by a mix of positive and negative factors․

Ultimately, the future of the current cost of Bitcoin depends on a complex interplay of technological, economic, and regulatory forces․ Prudent investors should conduct thorough research, understand the risks involved, and diversify their portfolios accordingly․ Considering the information provided throughout this article is vital for making informed decisions about investing in Bitcoin or any other cryptocurrency․