Wells Fargo Car Loan Rates: A Comprehensive Guide

Decoding Wells Fargo car loan rates so you don’t overpay! Get the inside scoop and drive away happy. Your dream car awaits!

Securing a car loan can feel like navigating a complex maze, especially when trying to understand the nuances of interest rates offered by different lenders․ Wells Fargo, a major player in the financial industry, provides auto loans to a wide range of borrowers․ Understanding Wells Fargo car loan rates is crucial for making an informed decision, ensuring you get the best possible terms for your individual circumstances․ This guide aims to demystify the process, offering a fresh perspective on how to approach Wells Fargo car loan rates and maximize your chances of securing a favorable deal․

Understanding the Factors Influencing Car Loan Rates

Several factors influence the car loan rates offered by Wells Fargo, and understanding these will help you gauge what to expect․ These include:

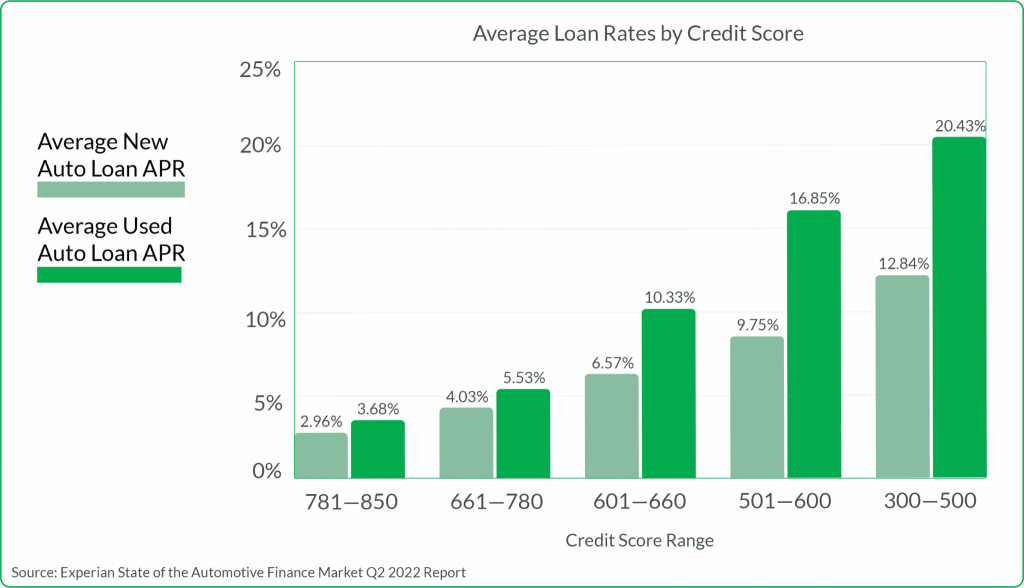

- Credit Score: Your credit score is a primary determinant․ A higher credit score generally translates to lower interest rates․

- Loan Term: The length of the loan term impacts the interest rate․ Shorter loan terms usually have lower rates but higher monthly payments, while longer terms have higher rates but lower monthly payments․

- Loan Amount: The amount you borrow can also influence the rate․ Larger loan amounts might sometimes qualify for slightly lower rates․

- Type of Vehicle: The type of vehicle you’re financing (new vs․ used) also plays a role․ Used cars often have higher interest rates due to increased risk․

- Market Conditions: Broader economic factors and prevailing interest rates can affect the rates offered by Wells Fargo․

Beyond the Headline Rate: What to Consider

While the advertised interest rate is important, it’s crucial to look beyond the headline and consider the entire cost of the loan․ This includes:

- APR (Annual Percentage Rate): The APR includes the interest rate plus any fees associated with the loan․ It provides a more accurate picture of the true cost of borrowing․

- Fees: Be aware of any application fees, origination fees, or prepayment penalties․

- Loan Term Impact: A lower interest rate on a longer loan term might still result in paying significantly more interest over the life of the loan․

Comparing Loan Scenarios

Let’s illustrate the impact of loan term on the total cost․ Assume you’re borrowing $20,000:

| Loan Term | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| 36 Months | 6․00% | $608․44 | $1,903․84 |

| 60 Months | 6․50% | $389․13 | $3,347․80 |

| 72 Months | 7․00% | $330․56 | $3,799․92 |

As you can see, even a slight increase in the interest rate over a longer term can significantly increase the total interest paid․

Tips for Securing the Best Wells Fargo Car Loan Rates

Before applying for a Wells Fargo car loan, here are some proactive steps you can take to improve your chances of getting the best possible rate:

- Improve Your Credit Score: Pay bills on time, reduce your credit card balances, and avoid opening new credit accounts before applying for the loan․

- Shop Around: Don’t just settle for the first offer․ Get quotes from multiple lenders, including credit unions and online lenders․

- Consider a Co-signer: If you have a limited credit history or a lower credit score, a co-signer with good credit can help you qualify for a better rate․

- Negotiate: Don’t be afraid to negotiate the interest rate with the lender․ Present competing offers to see if they are willing to match or beat them․

- Get Pre-Approved: Getting pre-approved allows you to shop for a car with confidence, knowing how much you can borrow and what your interest rate will be․

Ultimately, understanding the factors that influence car loan rates, comparing different loan scenarios, and taking steps to improve your creditworthiness are essential for securing the best possible terms․ By being proactive and informed, you can successfully navigate the car loan process and drive away with confidence․ It’s about making smart financial decisions, and hopefully, this guide has shed some light on how to approach the complexities of auto financing․