WHAT IS A MORTGAGE PRE-APPROVAL?

Stop dreaming, start owning! Learn how a mortgage pre-approval gives you a serious edge in the crazy housing market. Get approved & land your dream home now!

Navigating the world of homeownership can feel overwhelming, especially when encountering terms like mortgage pre-approval. This vital step in the home buying process essentially gives you a head start, demonstrating to sellers that you are a serious and qualified buyer. A mortgage pre-approval is a lender’s preliminary assessment of how much you can borrow to purchase a home. It’s not a guarantee of a loan, but rather an estimate based on your financial information, giving you a clear understanding of your budget.

Understanding the Pre-Approval Process

The pre-approval process involves providing a lender with detailed information about your financial situation. This typically includes:

- Income Verification: Pay stubs, W-2s, and tax returns.

- Credit History: The lender will pull your credit report to assess your creditworthiness.

- Debt Assessment: Information on your existing debts, such as car loans, student loans, and credit card balances.

- Asset Verification: Bank statements to show your savings and investments.

Once the lender reviews your information, they will issue a pre-approval letter, which states the maximum loan amount you are likely to qualify for. This letter is typically valid for a period of 60 to 90 days.

Benefits of Getting Pre-Approved

Obtaining a mortgage pre-approval offers several advantages when you are ready to buy a home:

- Shows You’re a Serious Buyer: Sellers are more likely to consider offers from pre-approved buyers.

- Sets a Realistic Budget: Knowing your pre-approved amount helps you focus on homes you can afford.

- Speeds Up the Loan Process: Much of the paperwork is already completed, streamlining the final approval.

- Strengthens Your Negotiation Position: Pre-approval demonstrates financial strength, which can give you an edge in negotiations.

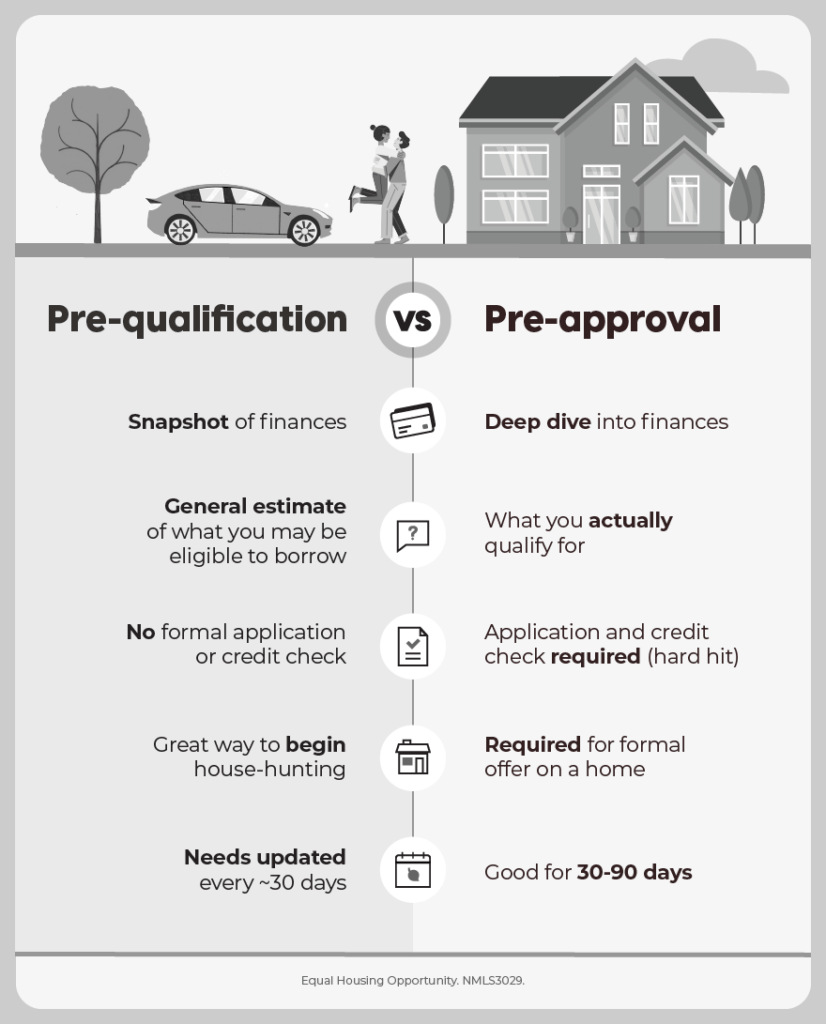

Pre-Approval vs. Pre-Qualification

It’s important to distinguish between pre-approval and pre-qualification. Pre-qualification is a less rigorous process based on self-reported information, while pre-approval involves a thorough review of your financial documents. Therefore, a pre-approval carries more weight with sellers.

Key Differences:

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Verification of Information | Based on self-reported information | Requires documented proof |

| Commitment from Lender | Informal estimate | Conditional commitment, pending appraisal and final underwriting |

| Strength of Offer | Less impactful | More impactful |

What to Do After Getting Pre-Approved

After receiving your pre-approval, don’t make any major financial changes that could impact your credit score or debt-to-income ratio. Avoid opening new credit accounts, making large purchases on credit, or changing jobs. Keep all of your financial documents readily available. A mortgage pre-approval provides you with a great start to the house buying process.

Finally, remember that a mortgage pre-approval is not a guarantee of a loan. The final loan approval will depend on the appraisal of the property and the completion of the underwriting process.

WHAT IS A MORTGAGE PRE-APPROVAL?

Navigating the world of homeownership can feel overwhelming, especially when encountering terms like mortgage pre-approval. This vital step in the home buying process essentially gives you a head start, demonstrating to sellers that you are a serious and qualified buyer. A mortgage pre-approval is a lender’s preliminary assessment of how much you can borrow to purchase a home. It’s not a guarantee of a loan, but rather an estimate based on your financial information, giving you a clear understanding of your budget.

UNDERSTANDING THE PRE-APPROVAL PROCESS

The pre-approval process involves providing a lender with detailed information about your financial situation. This typically includes:

– Income Verification: Pay stubs, W-2s, and tax returns.

– Credit History: The lender will pull your credit report to assess your creditworthiness.

– Debt Assessment: Information on your existing debts, such as car loans, student loans, and credit card balances.

– Asset Verification: Bank statements to show your savings and investments.

Once the lender reviews your information, they will issue a pre-approval letter, which states the maximum loan amount you are likely to qualify for. This letter is typically valid for a period of 60 to 90 days.

BENEFITS OF GETTING PRE-APPROVED

Obtaining a mortgage pre-approval offers several advantages when you are ready to buy a home:

– Shows You’re a Serious Buyer: Sellers are more likely to consider offers from pre-approved buyers.

– Sets a Realistic Budget: Knowing your pre-approved amount helps you focus on homes you can afford.

– Speeds Up the Loan Process: Much of the paperwork is already completed, streamlining the final approval.

– Strengthens Your Negotiation Position: Pre-approval demonstrates financial strength, which can give you an edge in negotiations.

PRE-APPROVAL VS. PRE-QUALIFICATION

It’s important to distinguish between pre-approval and pre-qualification. Pre-qualification is a less rigorous process based on self-reported information, while pre-approval involves a thorough review of your financial documents. Therefore, a pre-approval carries more weight with sellers.

KEY DIFFERENCES:

Feature

Pre-Qualification

Pre-Approval

Verification of Information

Based on self-reported information

Requires documented proof

Commitment from Lender

Informal estimate

Conditional commitment, pending appraisal and final underwriting

Strength of Offer

Less impactful

More impactful

WHAT TO DO AFTER GETTING PRE-APPROVED

After receiving your pre-approval, don’t make any major financial changes that could impact your credit score or debt-to-income ratio. Avoid opening new credit accounts, making large purchases on credit, or changing jobs. Keep all of your financial documents readily available. A mortgage pre-approval provides you with a great start to the house buying process.

Finally, remember that a mortgage pre-approval is not a guarantee of a loan. The final loan approval will depend on the appraisal of the property and the completion of the underwriting process.

MAINTAINING YOUR PRE-APPROVAL

The journey doesn’t end once you receive that coveted pre-approval letter. It’s crucial to maintain your financial standing during your home search. Lenders will often re-verify your information just before finalizing the loan, ensuring nothing has drastically changed since the initial pre-approval. This means continuing to demonstrate responsible financial behavior.

TIPS FOR MAINTAINING YOUR PRE-APPROVAL:

– Avoid Taking on New Debt: Resist the urge to finance new furniture or appliances before closing.

– Keep Your Credit Utilization Low: Try to keep your credit card balances well below your credit limits.

– Don’t Change Jobs: Stability in employment is a key factor lenders consider.

– Communicate with Your Lender: Inform your lender immediately of any significant financial changes, however minor they may seem.

WHEN TO RE-APPLY FOR PRE-APPROVAL

As mentioned earlier, pre-approval letters typically have an expiration date. If your home search extends beyond this period, you’ll need to re-apply. This process involves updating your financial information and undergoing another review by the lender. It’s also wise to re-apply if there have been significant changes in your financial situation, such as a promotion, a job loss, or a major debt payoff. Keeping your pre-approval current ensures that you’re always presenting the most accurate picture of your financial health to potential sellers.

Understanding what a mortgage pre-approval is, how to obtain one, and how to maintain it is a powerful tool in the competitive real estate market. Taking the time to get pre-approved demonstrates your seriousness, clarifies your budget, and ultimately increases your chances of successfully purchasing your dream home.