What Can I Afford Mortgage Calculator: A Guide to Understanding Your Borrowing Power

Stop dreaming, start planning! Use our mortgage calculator to see what you can *really* afford. Find your perfect home, stress-free! Calculate your mortgage now!

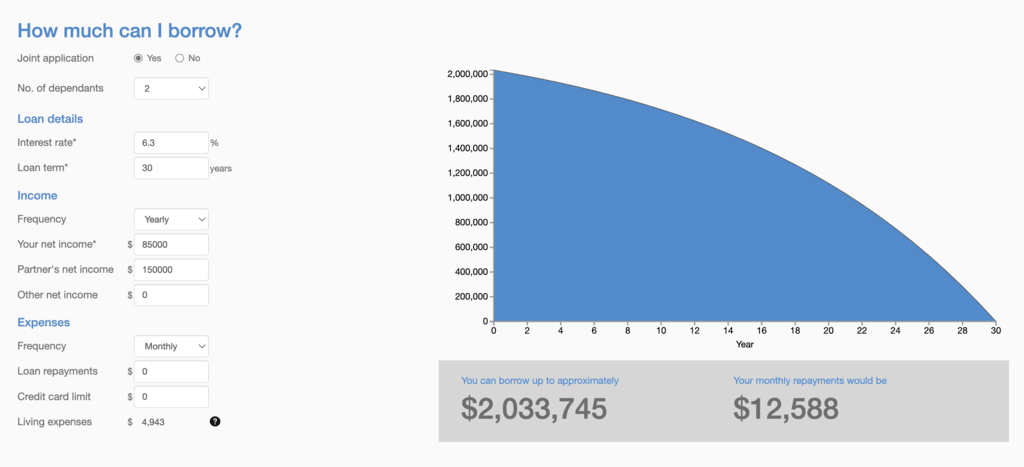

Dreaming of owning your own home? Figuring out what you can realistically afford is the first‚ and arguably most important‚ step. Using a what can I afford mortgage calculator allows you to input your financial details and get a clearer picture of your potential borrowing power. Understanding your affordability means you’ll avoid the heartache of falling in love with properties outside your budget‚ and it empowers you to start your home search with confidence. This tool helps you make informed decisions and take control of your financial future by showing you the maximum mortgage amount you can comfortably manage.

Decoding the Mortgage Calculator: Key Input Factors

A what can I afford mortgage calculator isn’t a magic wand‚ but a powerful tool that uses your financial information to estimate your borrowing capacity. Let’s break down the key factors that influence the result:

- Gross Monthly Income: This is your total income before taxes and other deductions. The higher your income‚ the more you can generally afford.

- Monthly Debt Payments: This includes credit card payments‚ student loans‚ car loans‚ and any other recurring debts. High debt payments reduce your affordability.

- Down Payment Savings: The larger your down payment‚ the less you need to borrow‚ and the lower your monthly mortgage payments will be.

- Estimated Interest Rate: Mortgage interest rates fluctuate constantly. Research current rates to get an accurate estimate.

- Property Taxes: These are annual taxes levied by your local government‚ divided into monthly installments.

- Homeowner’s Insurance: This protects your home from damage or loss. Premiums are typically paid monthly.

- HOA Fees (if applicable): If you’re buying in a homeowners association‚ you’ll have monthly fees to cover maintenance and amenities.

Beyond the Numbers: Factors Affecting Your Actual Affordability

While a mortgage calculator provides a valuable estimate‚ it’s crucial to remember that it’s not the final word. Several other factors can influence what you can *actually* afford:

- Credit Score: A higher credit score typically translates to lower interest rates‚ making your mortgage more affordable.

- Job Security: Lenders prefer borrowers with stable employment histories.

- Savings for Unexpected Expenses: Homeownership comes with unexpected costs (repairs‚ maintenance). Having a healthy emergency fund is essential.

- Lifestyle: Consider your current spending habits and whether you’re willing to make adjustments to accommodate mortgage payments.

Stress Testing Your Finances

Before committing to a mortgage‚ it’s wise to “stress test” your finances. What happens if interest rates rise? What if you lose your job? Can you still comfortably afford your mortgage payments? Consider scenarios where income is reduced or expenses increase to ensure you’re prepared for unforeseen circumstances.

The Final Word on Affordability

Ultimately‚ determining what you can afford requires a holistic approach. Use a mortgage calculator as a starting point‚ but don’t rely on it exclusively. Carefully assess your financial situation‚ consider your lifestyle‚ and consult with a financial advisor or mortgage professional to get personalized guidance. Remember‚ buying a home is a significant financial decision‚ and due diligence is key. So‚ after considering all these factors‚ hopefully‚ you have a clearer understanding of using the what can I afford mortgage calculator effectively.